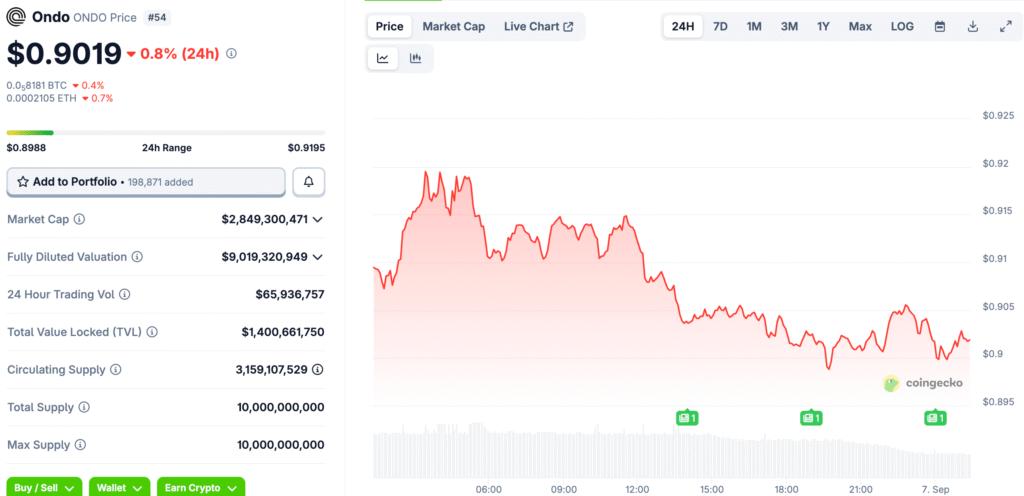

ONDO Holds Above Key Support

ONDO is trading above the support levels of $0.84 to $0.88. These levels are in line with major moving averages, which shows that the market is very stable from a technical point of view. People who want to buy are still defending this range.

Consolidation shows that things are stable even when prices are going down. The amount of trading stays the same. This backs up possible breakout scenarios if the overall momentum picks up soon.

Technical Analysis Suggests Breakout Potential

The $0.84–$0.88 range is the same as the 50-day and 100-day moving averages. This confluence gives the support more weight. Experts say it’s very important.

If ONDO closes above $0.90, people may start to cover their shorts. Patterns from the past suggest a possible rise to $0.98 or $1.00. Traders keep a close eye on things.

Institutional Partnerships Drive Adoption

Mastercard and Ondo Finance are now working together. In collaboration, they created tokenized treasuries on blockchain networks. This was a big step forward for adoption.

Partnerships between JPMorgan and Chainlink give more credibility. These partnerships prove that ONDO is important for tokenizing real-world assets. Institutions see its potential as a base.

Recommended Article: Ondo Finance Token Price Jumps On Asset Launch

Regulatory Progress Strengthens Legitimacy

Ondo bought Oasis Pro, a broker-dealer that is registered with the SEC. This made it possible for compliant tokenized securities offerings to get licenses. Institutional investors were happy about the big step forward.

Regulation makes careful people feel better. Working within compliance frameworks makes people feel more secure. This makes ONDO even more appealing as a real RWA tokenization leader.

21 Shares ONDO ETF Proposal Sparks Price Rally

In July 2025, 21Shares filed for an ONDO ETF. The proposal got people excited, which caused prices to go up for a short time. Investors think that ETF approval will change everything.

An ETF would give you more ways to get cash. Traditional investors could get to ONDO directly through trusted structures. Approval would speed up the participation of institutions by a lot.

Regulatory Risk Poses a New Challenge for Altcoin ETFs

SEC approvals are still not always the same, even though things are getting better. Previous applications for altcoin ETFs were either turned down or took a long time to process. ONDO might face the same kind of uncertainty in the future.

Investors should think about the risks very carefully. Regulatory issues could make it take longer for more people to start using it. But institutional momentum could make up for short-term problems.

ONDO Positioned as a Strategic Buy

The support range has good places to enter. Long-term optimism is high for ONDO because it has strong partnerships and the potential for ETFs. Technicals show that it is strong.

Tokenized assets are a quickly growing field. ONDO is at the top of its field. Long-term investors might see dips as chances.