ONDO Price Consolidates After Platform Expansion

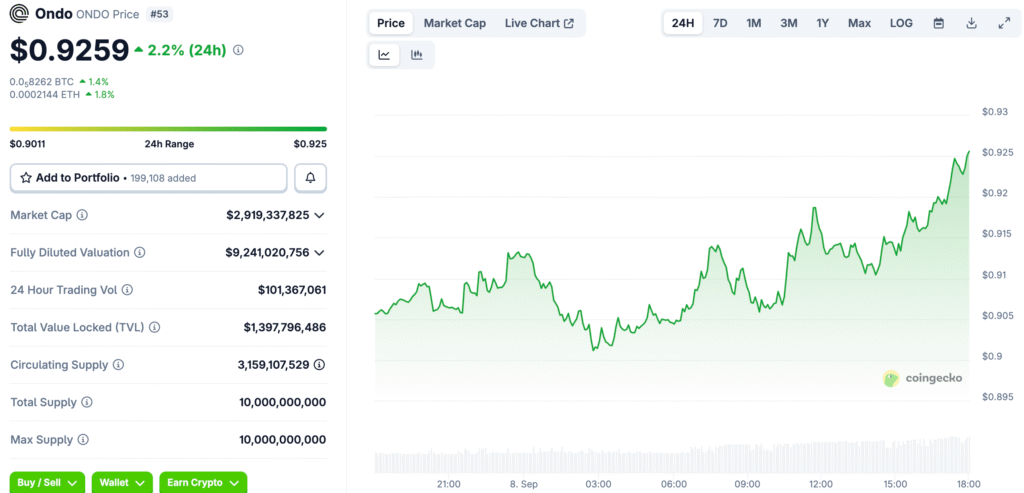

This week, ONDO has been trading between $0.90 and $0.91. A lot of people are interested in the launch of Ondo Finance’s Global Markets platform. There are now more than 100 tokenized U.S. stocks and ETFs on Ethereum.

This change makes Ondo a key link between DeFi and regular finance. Broker-dealer backing that is in line with regulations adds even more credibility. The move addresses worries that institutions won’t use it for a long time.

Technical Indicators Show Mixed Sentiment

The RSI for ONDO is 45.94. This neutral level suggests that things are getting stronger, but it also hints at a possible change. Traders are keeping a close eye out for a change.

The token is trading below its 20-day and 50-day SMAs. This shows that it is weak in the short term, even though it is holding near its 7-day SMA. The signals are still mixed.

Momentum Indicators Reflect Bearish Pressure

The MACD for ONDO is -0.0160, and the histogram is negative. This means that bearish momentum is likely to stay in the short term. The stochastic oscillator backs this up with readings that show the market is oversold.

Even though the market is going down, oversold levels often come before bounces. If people want to buy again, ONDO could go up again. There is still a good balance between risk and opportunity in the technicals.

Recommended Article: ONDO Token Builds Momentum Near Crucial Support Zones

Ondo’s Technical Signals Point to a Rebound

ONDO is trading close to the bottom of its Bollinger Bands. The %B position of 0.3495 shows that the price is lower than it has been in the past. This kind of positioning often comes before corrective rebounds.

Basic catalysts like the launch of tokenization support bullish scenarios. If the mood of the market gets better, ONDO could move back up toward the upper bands. Traders are still cautiously hopeful.

Important Support and Resistance Levels for ONDO

The first level of support is $0.86. This level is in line with the lower Bollinger Band and is the first test for bullish defense. Below this, $0.84 has stronger historical support.

Resistance to going up starts at $1.03. This area lines up with the upper Bollinger Band, which is close to $1.00. At $1.17, just above the yearly high, there is a lot of resistance.

Traders’ Risk Reward Scenarios

Aggressive traders think there is a chance near $0.91. A stop-loss order below $0.84 sets a clear risk. Resistance levels as high as $1.17 offer a good risk-to-reward ratio.

Investors who are more cautious might want to wait for confirmation. If the price breaks above $1.03, it would show that the bulls are strong. A retest of $0.86 could give you a chance to buy at a lower price.

ONDO’s Next Move Awaits a Breakout From Key Levels

After expanding its platform, ONDO is at a key point. Technical indicators say that there will be volatility in the future, with factors that could cause it to go either way. The $0.86 and $1.03 levels will set the direction for the next few days.

If people start using tokenized assets more, demand could go up faster. The fact that there are both oversold signals and strong fundamentals makes me cautiously optimistic. Traders are still keeping an eye on the next breakout attempt.