The Start of DOGE Treasuries in Business

The opening of new DOGE treasuries shows that the market’s focus has changed for all investors. It is no longer just speculation driven by retail; it is now moving toward structured and corporate holdings. This is a very important step forward for the whole Dogecoin community and its future growth.

Alex Spiro, Elon Musk’s personal lawyer, is in charge of a new $200 million public fund that will buy up Dogecoin as an asset for its balance sheet. This is similar to what other companies have done in the past when they added Bitcoin or Ethereum to their corporate treasuries. This new method is giving the token a lot of new credibility and a lot of new attention.

DOGE Treasuries Become a Useful Tool

Other big businesses have been trying out similar plans for a while now. Neptune Digital Assets, a Vancouver-based company, said it bought one million DOGE through derivatives for a lot of money. Bit Origin Ltd., which is listed on the Nasdaq, has also raised a lot of money to build a balance sheet with a lot of DOGE.

All of these steps show how DOGE treasuries are becoming a very useful tool for institutions. There are a number of important on-chain movements that have happened at the same time as the market impact. A whale recently moved a huge amount of DOGE into Binance wallets, which made the price go down in the short term.

Rules and the Future of DOGE as an Investment

A lot will depend on how clear the rules are for Dogecoin to become a real asset in the future. Regulation will now be very important in deciding whether DOGE treasuries can bring in a lot of long-term capital. All of the regulators and the public are keeping a very close eye on these new changes.

In May 2025, Nasdaq asked to list a 21Shares Dogecoin ETF, which is set up as a new trust that keeps track of prices in a roundabout way. These filings are now showing that ETFs could be a way to get regulated exposure, but everyone involved still needs to get approval. This is a very important step toward more people using it and investing in it.

Recommended Article: Dogecoin’s Rise as an Institutional Crypto Asset

Why Investors Think This New Trend Could Work

More and more institutions are interested in cryptocurrencies besides just Bitcoin and Ethereum. In 2025, 184 public companies said they were buying crypto, which added up to a huge $132 billion. Most of that money went to Bitcoin and Ethereum, but the rise of DOGE treasuries shows that companies are also interested in meme tokens.

A public DOGE fund would let investors get exposure through stock markets without having to deal with the problems that come with holding tokens directly. This could make it easier for a lot of people to get involved, especially for organizations that have to follow a lot of rules. This is a very important step for the future of the whole meme token market.

The Problems and Risks of an Overvalued Asset

Despite all of the positive news, investors should always remember that Dogecoin is an inflationary asset with no fixed supply cap. Everyone involved needs to think about this very important and very serious risk. The SEC has pointed out this specific risk in many of its filings about proposed ETFs.

Treasuries can give the asset some legitimacy and open up new ways for people to buy it, but it is still subject to meme-driven price changes, whale activity, and changes in sentiment. These things can have a huge and very quick effect on the price. The token’s future is still very uncertain, and it is a very risky investment.

Important On-Chain Data Participation by Institutions

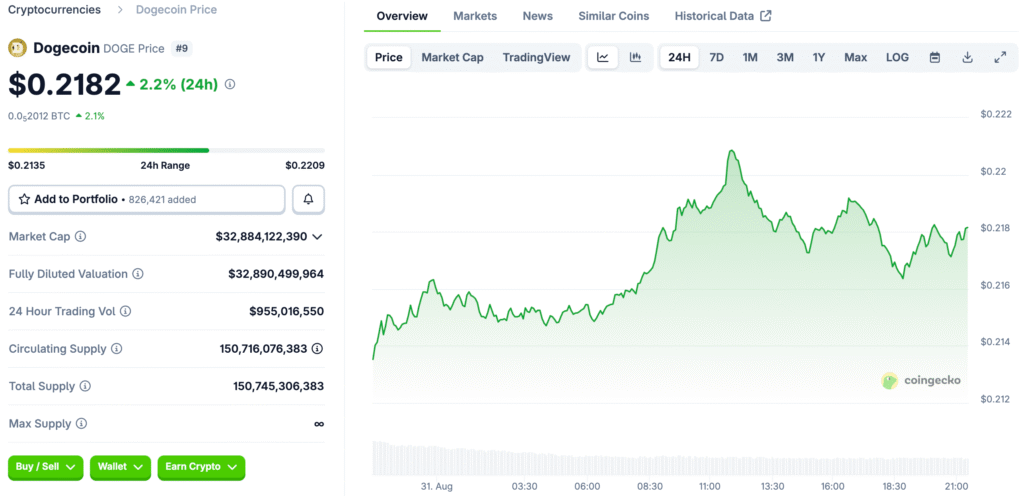

On-chain data is now showing that institutional participation is a big part of the market. The token has seen a huge amount of trading in just one day, which means that DOGE treasuries and other big players are having a bigger and bigger impact on liquidity. This is a very important step forward for the whole ecosystem.

The open interest in futures did go down by about 8%, though, which means that whales were less able to use leverage as they moved their positions. This shows that the market is still in a very unstable and unpredictable time. The on-chain data gives us a very interesting and important look at how the market works.

The Future of Dogecoin in the World of Cryptocurrencies

A few important things will determine what happens to Dogecoin in the future of cryptocurrency. If DOGE treasuries keep growing and get approved by regulators, these things could easily cause the coin’s next big price change. This is a very exciting and important time for everyone in the community.

Investors should keep an eye on treasury allocations, on-chain flows, and ETF developments. If a public DOGE fund is successful, it could change the way we think about meme tokens in a big way. This is an important step toward the long-term growth of the meme coin category.