Solana Faces Technical Headwinds

Solana is trading close to $202 inside a rising wedge pattern, which shows that buyers are losing momentum. Resistance starts to show up around 216, while support is moving up near rising lows. Experts say that possible breakdowns could make selling pressure worse. Market watchers keep an eye on Fibonacci retracements that could go to levels of 191, 177, or even 167.

Structure shows that buyers are losing faith. Two possible scenarios remain: immediate breakdown below the wedge or failed retest near resistance preceding decline. Analysts say that a rising wedge usually comes before a correction. Investors carefully consider the possible outcomes and question Solana’s short-term direction as the crypto markets around the world become more volatile.

Levels of Retracement Make Investors Worried

Fibonacci projections suggest that if Solana fails, it will need to find support levels around $191 at first. If prices drop further, they could hit historical demand zones between $157 and $144, causing investors to be more worried. This could weaken the bullish case made during rallies.

Analysts predict a wedge breakdown that could lead to sector corrections, as investors shift their strategies to protect themselves and diversify. People are currently feeling cautious due to weakening structures and capital flowing to other opportunities. They are more focused on growth-driven projects, unlike Solana’s current technical pressure and unclear momentum signals.

Mutuum Finance Presale Momentum Surges

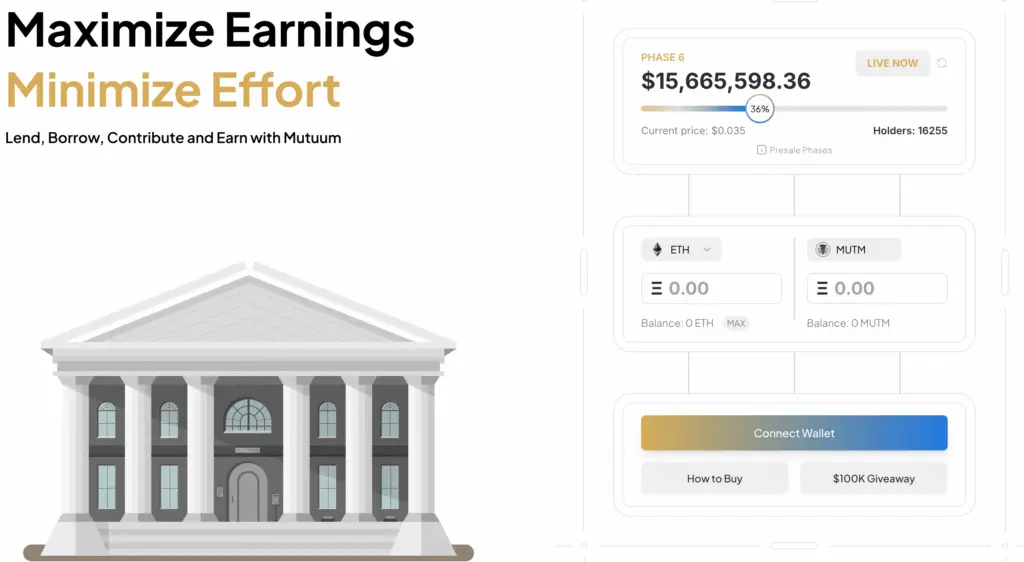

Mutuum Finance is now in the sixth phase of an eleven-stage presale. Tokens that cost three point five cents have gone up by two hundred fifty percent since phase one. The project raised more than fifteen million dollars and got more than sixteen thousand people around the world to hold it.

The next stage of pricing is set for four cents, which makes it more urgent. The planned launch at six cents could give early investors a return of up to five hundred fifty percent. Leaderboard rewards give the top fifty holders extra tokens as a reward. As investors focus on projects that show real presale traction and clear growth roadmaps, community involvement grows.

Recommended Article: Mutuum Finance Draws Investor Attention After 300 Percent Surge

Mutuum Finance Introduces Two New Lending Systems

Mutuum Finance introduces two lending systems: peer-to-contract and peer-to-peer. Peer-to-Contract pools stable assets into smart contracts, automatically changing interest rates. Peer-to-peer allows participants to negotiate independently, making it more flexible.

Both systems require more collateral than the system has, protecting its integrity. Risk management features limit borrowing and deposits based on asset value. Stablecoins have higher thresholds, while riskier tokens have lower ones. The design balances protection and capital utilization, appealing to DeFi investors seeking flexible and safe lending frameworks.

Security and Community Incentives Build Trust

Mutuum Finance received a 95-percent security score from the CertiK audit, indicating no issues. The protocol’s trustworthiness is further enhanced by a bug bounty program offering tiered rewards of up to $50,000. Transparency during the presale stage boosts investor confidence.

A $100,000 giveaway with ten winners each, requiring wallet verification and a $50 minimum investment, further boosts investor confidence. These initiatives enhance Mutuum Finance’s reputation among retail and institutional investors, bolstering its security guarantees.

Whales Look for New Chances

As Solana faces unclear technical signals, whales are spreading out more and more. People are interested in Mutuum Finance because of its presale momentum, structured lending design, and verified security credentials. The project strategically positions itself with liquidity controls, which makes it more resilient. Market stories show that whales are changing their minds quickly, which shows that sentiment is changing quickly.

People who take part in institutional-style events put the most value on chances that offer both growth and safety. Mutuum Finance is appealing because it offers both. While involvement shows confidence and speeds up awareness. Transition shows how dynamic cryptocurrency allocations are, with capital flows quickly moving toward projects that combine innovation with measurable progress in a big way.

Mutuum Finance’s Momentum vs. Solana’s Risks

While Mutuum Finance moves forward with presale milestones, Solana is at risk of making mistakes. Diverging paths show how people’s feelings about the market are changing. Investors keep a close eye on the risks of established altcoins and the speculative promise of new contenders that offer innovation and early adoption benefits.

The future of Solana and Mutuum depends on their ability to keep the presale momentum going and stay above important support levels. These developments show how the dynamics of crypto investment are changing. Traditional leaders are under more scrutiny, and new projects are capturing the imagination of traders around the world.