Metaplanet Strengthens Bitcoin Treasury Position

This week, Metaplanet said it had bought 136 more BTC. The purchase cost about $15.2 million, or $111,666 per bitcoin on average. The company’s move shows that it is still bullish.

With this buy, Metaplanet now owns 20,136 BTC. At an average price of $103,196, the whole portfolio cost about $2.08 billion. The business is now one of the biggest holders of bitcoin in the world.

Ranking Among the World’s Biggest Corporations

Metaplanet is now the sixth-largest company in the world that owns bitcoin. It comes after Strategy, Mara, XXI, the Bitcoin Standard Treasury Company, and Bullish. Michael Saylor’s Strategy is at the top of the list with 636,505 BTC.

Metaplanet is now one of the most important institutional players in this ranking. Having such a large reserve makes it more visible around the world. It also shows that people believe in the long-term value of Bitcoin.

CEO Simon Gerovich Highlights Confidence

Simon Gerovich, the CEO of Metaplanet, confirmed the purchase on X. He said that the company still plans to buy more bitcoin over time. His announcement made the company even more sure of its belief in digital assets.

Gerovich’s plan has been to make disciplined purchases. Metaplanet wants to make sure it can stay financially stable in the long term by slowly building up its reserves. The most recent purchase shows that this vision is still strong.

Recommended Article: Corporate Bitcoin Reserves Show Slower Growth in 2025

Stock Market Reaction to Bitcoin Purchases

After the news, Metaplanet’s stock fell 1.2% in Japan. The company’s shares that trade in the U.S. also fell, closing at $4.86. Short-term investors were careful with their reactions to the news.

Even with these drops, the stock is still up 101% this year. But it has gone down 30% in the last month. Investors are still worried about the market’s ups and downs.

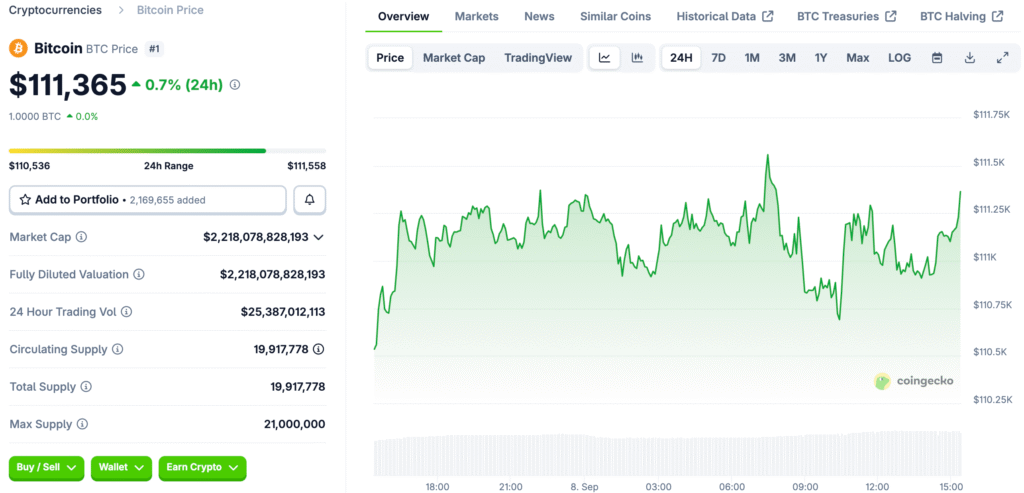

Bitcoin Price Maintains Upward Momentum

In the last 24 hours, Bitcoin went up by 0.5%. According to The Block, it was worth $111,146 on Sunday night. Steady demand from institutions keeps the market strong.

Metaplanet’s purchase fits with the trend of more and more businesses using it. Bitcoin is still a good way for companies that want to diversify to protect themselves. This growing momentum shows how appealing it is to treasury managers.

Strategic Implications of Accumulation

Metaplanet has strategic power because it holds more than 20,000 BTC. It makes the company look like a strong institutional supporter of digital assets. This job makes it look better to investors around the world.

Accumulation also shows that people trust Bitcoin as a safe asset. Metaplanet protects itself from fiat depreciation by keeping large amounts of it. The strategy is similar to what other big organizations are doing.

Bitcoin Corporate Demand Fuels Price Stability

Other companies may be affected by what Metaplanet does. Big purchases show that bitcoin is a real treasury asset. These kinds of moves often lead to more institutions using them.

Bitcoin demand may go up as more businesses use similar strategies. This trend could help keep prices stable over the long term. Corporate treasuries are still a big reason why adoption is growing.