A Market Overview of Key Cryptocurrencies

The cryptocurrency market is an ever-evolving ecosystem where new projects and established players coexist. For investors, the key to success is often identifying and positioning themselves in projects that offer a strong value proposition. This overview will examine a diverse mix of projects, from the highly speculative presale-stage Little Pepe (LILPEPE) to well-established cryptocurrencies like Hedera (HBAR), Stellar (XLM), Cronos (CRO), and Algorand (ALGO).

Each of these tokens is being watched for its distinct characteristics and potential for growth in the year ahead. The ability to understand the different strengths and weaknesses of these projects is crucial for any investor looking to build a diversified and resilient portfolio.

Little Pepe A Presale Powerhouse and a Layer 2 Meme Token

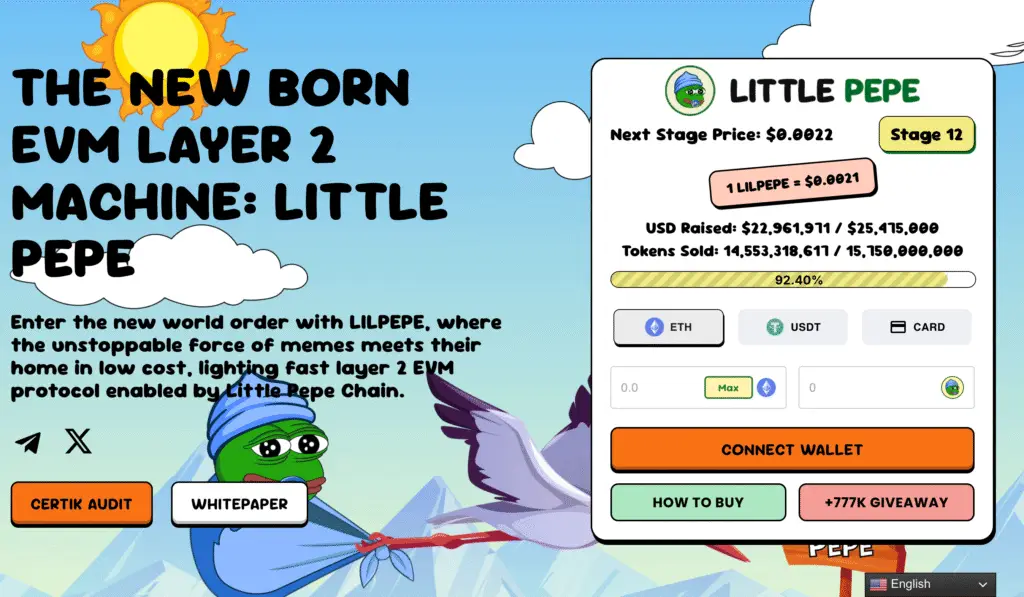

As a presale project, Little Pepe (LILPEPE) is arguably the most speculative asset on this list, but it also carries the potential for significant returns. The token is currently priced at $0.002 in Stage 11 of its presale. What sets Little Pepe apart is its unique combination of meme culture and advanced technology. It isn’t just a simple meme token; it is built on what its creators describe as the first Ethereum-compatible Layer 2 blockchain dedicated exclusively to memes.

This technological foundation provides several key advantages, including lightning-speed transaction finality and remarkably low fees. The project has also integrated anti-sniper bot protection to ensure a fair launch and has created its own Meme Launchpad to foster the growth of new meme tokens within its ecosystem. With over $22.3 million already raised in its presale, the project has achieved a significant milestone that demonstrates strong investor confidence.

Hedera’s Enterprise-Grade Technology

Moving from a new presale to an established network, Hedera (HBAR) stands out for its enterprise-grade technology. Currently trading at around $0.23, Hedera is built on its unique hashgraph technology, which offers a different approach to consensus than traditional blockchains. The project is backed by a prestigious governing council that includes major global firms, a key factor that its developers believe will support its growth in institutional use cases.

Hedera’s network is designed for fast and secure transactions, which makes it an attractive platform for large-scale enterprise applications and real-world utility. Its focus on security, stability, and governance positions it as a serious contender for institutional adoption, which could be a major driver for its value in the coming years.

Recommended Article: Little Pepe Takes on Meme Coin Giants: Comparing a Newcomer to SHIB and PEPE

Stellar’s Focus on Cross-Border Payments

Another established player with a clear use case is Stellar (XLM). Currently trading at approximately $0.42, Stellar is a project focused on the niche of cross-border payments. The project’s team has highlighted its strategic partnerships and its focus on an innovative smart contract platform called Soroban.

Stellar’s network is designed to be fast and low-cost, making it an ideal solution for facilitating global financial transactions. By connecting financial institutions and payment providers, Stellar aims to make money as easy to transfer as information. Its clear use case and dedicated focus on solving a real-world problem give it a strong value proposition.

Cronos as a DeFi and Media-Layer Player

Cronos (CRO) is a native token of the Crypto ecosystem, a major player in the cryptocurrency industry. The token trades at around $0.15 and is used to power a wide range of applications, including decentralized finance (DeFi), NFT platforms, and payment solutions. The project’s team emphasizes its integration with the crypto exchange as a key driver of utility and growth.

This deep integration provides a massive user base and a direct path to liquidity, which is a significant advantage over many other projects. Cronos’s position as a core component of one of the largest crypto ecosystems gives it a unique value proposition as a layer for both media and finance applications.

Algorand as an Efficient Layer 1 Blockchain

Finally, Algorand (ALGO) is a Layer 1 blockchain known for its speed, security, and scalability. The project is focused on being enterprise-ready and has a reputation for high throughput and consistent performance. Algorand’s technology makes it suitable for a variety of use cases, including payment processing, DeFi, and the tokenization of real-world assets.

The developers state that its consistent usage and strong fundamental technology can help cushion it against market volatility, making it a more stable and reliable investment in the long term. Its focus on efficiency and scalability makes it a strong competitor in the Layer 1 space.

Little Pepe and Established Blockchains

Each of these cryptocurrencies offers a different value proposition to investors. Little Pepe is a new presale project with high-risk, high-reward potential, focused on combining meme culture with a dedicated Layer 2 blockchain. In contrast, Hedera, Stellar, Cronos, and Algorand are all established projects with a focus on real-world utility and adoption.

Their future performance will depend on their ability to execute on their respective roadmaps, gain wider market adoption, and navigate the ever-changing regulatory landscape. For a diversified portfolio, an investor might consider a mix of these projects to balance risk and potential return, from the explosive upside of a new presale to the steady growth of a well-established network.