Galaxy Digital Accelerates Solana Accumulation Strategy

Galaxy Digital bought $306 million worth of Solana in just one day, continuing its aggressive buying spree across many exchanges. Fireblocks took care of the tokens, which shows how Galaxy is becoming more involved in Solana’s strategies for getting institutions to use it and managing its treasury.

During a five-day buying spree, Galaxy bought 6.5 million SOL for a total of about $1.55 billion. There were a lot of purchases in a short amount of time, with tens of thousands of tokens bought for millions of dollars each. This shows that people are becoming more sure of Solana’s future.

Forward Industries Fuels Strategic Treasury Partnership

Galaxy worked with Multicoin Capital and Jump Crypto to take part in Forward Industries’ $1.65 billion private placement round. Forward Industries changed its focus to building the largest Solana treasury holdings, which is in line with a trend among companies that are using digital treasury strategies.

The partnership shows that more public companies want Solana as a treasury asset. Galaxy’s role shows that institutions trust the network’s stability. The pivot of Forward Industries has had a big effect on how well its stock has done.

Forward Industries Stock Rallies After Solana Pivot

After telling shareholders about its Solana pivot strategy, Forward Industries’ stock rose 16% in five days. Despite lower sales and a lower net margin earlier this year, the stock is now up more than 600% this year.

The switch to Solana treasury holdings ended years of poor performance. Investors were very interested in the company’s new direction. The move shows how strong crypto stories are in traditional stock markets.

Recommended Article: Solana Positioned As Leader In Crypto Payroll Solutions

Solana Treasury Companies Grow Their Market Presence

After buying $117 million worth of SOL in eight days, DeFi Development Corp. said its Solana treasury now holds more than two million tokens. Mert Mumtaz, the CEO, said that the Solana treasury companies raised between $3 billion and $4 billion, which shows how quickly institutions are growing.

These projects show that Solana is becoming more important as a treasury asset. Interest from institutions keeps the momentum going. These big allocations make Solana’s market position stronger in both decentralized finance projects and treasury strategies.

Solana Adoption Surges Across Multiple Use Cases

Recently, the total value locked on Solana went over $12 billion, making it the second most valuable decentralized finance ecosystem by locked liquidity, after Ethereum. This milestone shows that Solana is becoming more popular with developers, users, and institutions that want low fees and fast transaction speeds.

Galaxy Digital itself was the first company on Nasdaq to have its stock tokenized on Solana. This shows that traditional finance and blockchain innovation are becoming more connected. This trend speeds up adoption in all markets. Institutional validation strengthens Solana’s growing role in the world of finance.

Market Performance Strengthens Investor Confidence Significantly

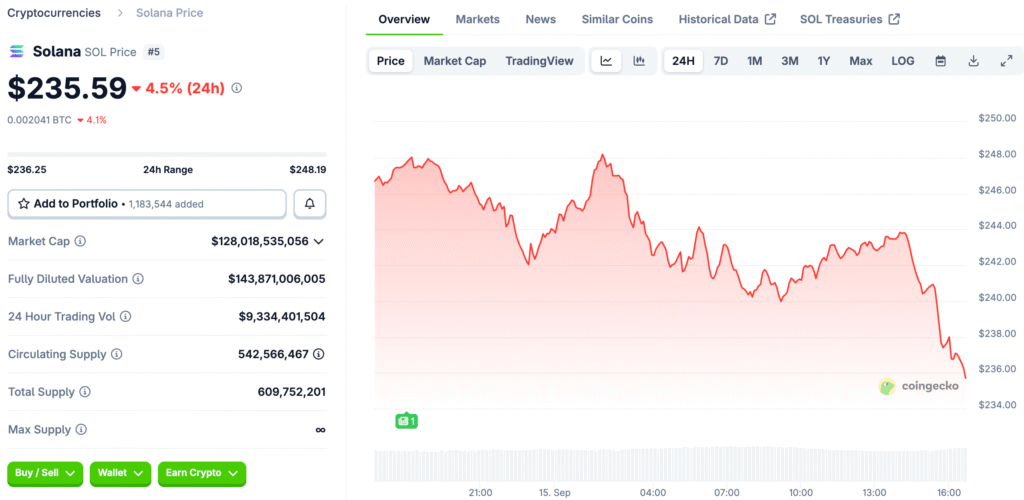

According to CoinGecko, Solana went up 17% in the last week and almost 30% in the last 30 days. This kind of growth is in line with the increasing investments from institutional investors and treasury companies that are aggressively increasing their exposure to Solana.

Market watchers say that Solana is more resilient than its peers and that this is due to its growing use and treasury strategies. The buying pressure that keeps going shows that people are hopeful in all markets. Institutional activity is still the main thing that supports stories of long-term growth.

What I Think About Galaxy’s Plan to Expand Solana

The $1.55 billion purchase by Galaxy Digital shows that more and more institutions believe in Solana’s usefulness, scalability, and long-term value. Partnerships with Multicoin Capital and Jump Crypto make Solana an even more legitimate treasury asset for people in the global financial community.

With more people using it and treasury companies getting involved, Solana is becoming even more of a top blockchain ecosystem. The rise in Forward Industries’ stock price makes the message even stronger. Institutional moves show that Solana will be a big player in the treasury market in the future.