Fitell Shares Plunge After Crypto Treasury Pivot

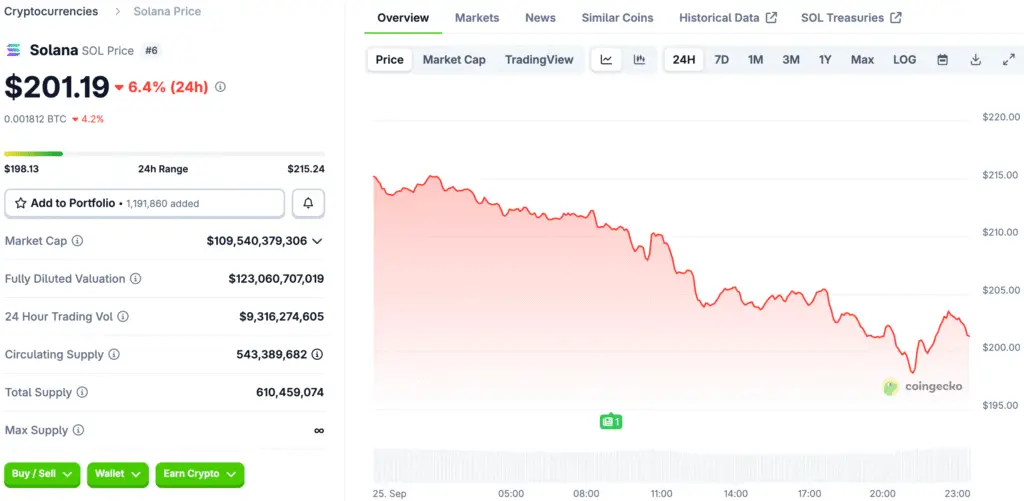

Australian fitness company Fitell has announced a 21% drop in its stock after buying $10 million worth of Solana as part of a treasury strategy. The move has sparked discussions among shareholders and analysts, who are concerned that the switch from fitness equipment to crypto exposure could negatively impact the business’s stability and long-term fundamentals.

The company’s first significant effort to collect digital assets has raised concerns about the wisdom of investing in unstable cryptocurrencies. The sharp drop in shares reflects growing skepticism about traditional companies diversifying their risky treasury holdings.

Solana Treasury Gamble Leads to Bigger Selloff

Fitell’s announcement follows other Nasdaq-listed companies’ sharp declines in share prices following the purchase of Solana. Medical device company Helius Medical Technologies’ stock fell 34% after buying Solana for $175 million, indicating increasing risk in such deals.

CEA Industries and BitMine Immersion also experienced significant selling after switching to crypto treasury allocations. Strategy Inc., with the most Bitcoin in its treasury, also lost money after buying more Bitcoin, but not as much as companies focusing on Solana. Investors are becoming more cautious about companies investing in risky assets without clear plans for risk management.

Management Defends Treasury Diversification Strategy

Fitell’s leaders believe buying Solana is a wise move to expand their holdings and capitalize on staking opportunities. CEO Sam Lu emphasizes the importance of institutional support and believes long-term Solana exposure could bring value to shareholders.

70% of the $100 million convertible note profit was used to buy digital assets. Management hired industry experts to create profitable models and explore DeFi opportunities in the new Solana ecosystem. David Swaney and Cailen Sullivan, experienced in treasury management and crypto risk assessment, believe integrating crypto is crucial for Fitell’s competitiveness in global financial markets.

Recommended Article: Dogecoin, Solana and Ethereum Lead $1.7B Crypto Liquidations

Shareholders Express Concern Over Risk Exposure

Fitell’s stock has experienced a 96% drop this year, raising concerns among shareholders about the company’s current direction. Analysts previously deemed the company overvalued and underperforming, and the recent drop in share prices supports this view.

Shareholders fear that Solana’s volatility could worsen losses, affecting trust in Fitell’s treasury management. Critics argue that diversification should focus on assets with predictable cash flow, rather than cryptocurrencies that are hard to predict. This raises questions about Fitell’s strategy as a sign of desperation rather than a vision for the future.

Solana Treasuries Expand Despite Market Skepticism

Solana-based treasuries are rapidly growing, with several companies investing in the ecosystem. Briera Holdings, now Solmate, received $300 million to build infrastructure around the Solana ecosystem and treasury operations.

Neurotech company Helius Medical Technologies launched a $500 million fundraising campaign for its Solana digital asset treasury project. These actions have brought the total number of tokens in Solana’s treasury holdings to 17.04 million, representing almost 3% of the total supply. Adoption momentum indicates companies’ interest in Solana, despite short-term stock market effects.

Analysts Warn of Treasury Strategy Pitfalls

Corporate treasuries must strike a balance between innovation and risk to maintain shareholder confidence. Adding volatile assets like cryptocurrencies to portfolios requires hedging strategies, liquidity buffers, and risk frameworks. Companies without these protections risk losing investors and stock price drops.

Crypto supporters argue for long-term adoption trends and staking yield opportunities in ecosystems like Solana. Early involvement can help companies advance in decentralized finance. However, the market’s reaction indicates that short-term volatility is more important than long-term value arguments, highlighting the need for a balanced approach.

Fitell’s Long-Term Outlook Remains Uncertain

Fitell’s future strategy depends on the success of Solana’s price and its ability to manage treasury risks. If Solana increases in value and generates significant staking revenue, Fitell’s investment could be a wise financial move. However, volatility could worsen losses and damage investor trust, making it harder for Fitell to regain shareholders’ trust.

The company’s involvement in Solana treasuries sets a precedent, but it needs careful communication and careful management. Investors are divided between those seeking new treasury management and those concerned about financial instability. Until performance improves, uncertainty will likely be more important than hope in Fitell’s crypto treasury experiment.

Fitell’s Example Shows Solana Adoption Still Faces Shareholder Resistance

Fitell’s case demonstrates that traditional companies can learn from the success of digital assets in their treasury strategies. Large-scale allocations without proper risk disclosures or phased implementation plans can lead to market backlash.

Careful communication and gradual exposure can reduce volatility and gain shareholder trust. Other companies should consider the pros and cons of diversifying their crypto treasury before implementing similar plans. Ultimately, connecting finance with crypto requires finding a balance between innovation and risk.