The Shift in Ethereum Investor Behavior

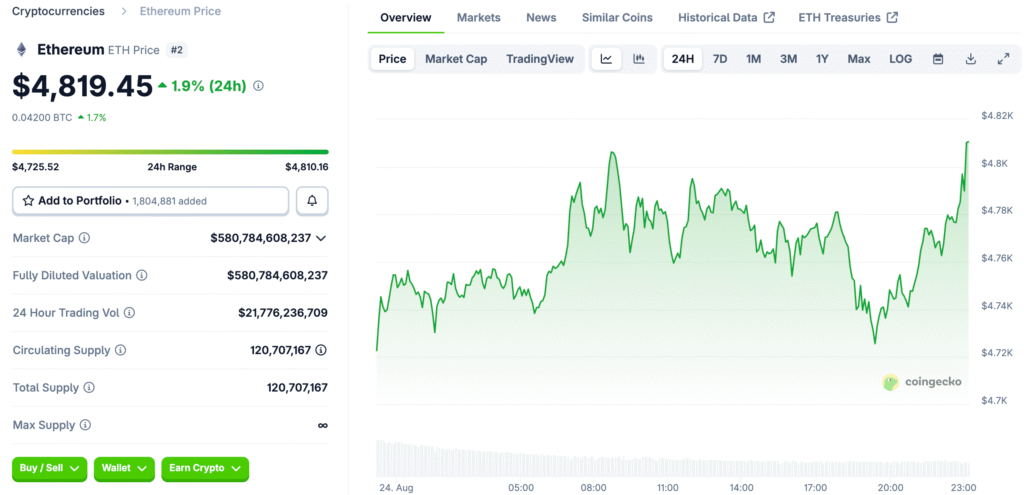

The cryptocurrency market is witnessing a fundamental shift in investor behavior, with a significant amount of capital and focus moving towards Ethereum. This movement is not merely a short-term trend but a reflection of a maturing ecosystem where investors are increasingly prioritizing long-term value and autonomy. As an unmistakable energy flows through the veins of Ethereum, investors are engaging in a mass exodus from exchanges, a bold act that whispers of renewed trust in this digital powerhouse.

These withdrawals from centralized platforms not only influence the immediate price trends of ETH but also foster a burgeoning appetite for self-custody, revealing a shift in investor behavior away from traditional, centralized financial systems. This pivot towards decentralized finance and self-sovereignty is a key driver of Ethereum’s current momentum.

Escalating Institutional Demand and ETF Inflows

The prevailing optimism surrounding Ethereum draws much of its strength from a surging wave of institutional interest. The demand for Ethereum-based Exchange Traded Funds, or ETFs, has become a powerful stabilizing force, cushioning the market against potential profit-taking from retail investors. Over the past month, these ETFs have seen a staggering $3 billion in net inflows, a testament to the growing enthusiasm for ETH among large-scale financial players.

This institutional demand signifies that Ethereum is no longer viewed as a mere speculative asset but as a legitimate and multifaceted investment opportunity. This consistent influx of institutional capital acts as a buffer, providing a solid floor for the price and promising a more stable growth trajectory for the asset.

The Strategic Significance of Exchange Withdrawals

Recent on-chain data paints a striking picture of this shift, with approximately 200,000 ETH, valued at nearly $1 billion, vanishing from exchanges within a 48-hour window. Such massive withdrawals are not happenstance; they reflect a calculated maneuver by investors looking to shield their assets from immediate market pressure and the vulnerabilities associated with centralized exchanges.

This pivot towards self-custody highlights a growing faith in Ethereum’s stability while simultaneously challenging the status quo of traditional financial systems. It uncovers a strategic migration where liquidity is being removed from centralized exchanges, indicating a heightened awareness regarding the safeguarding of assets and a fresh desire for financial empowerment.

CME Gaps and Their Predictive Value

For traders and analysts, a key tool for understanding market dynamics is the CME gap. These are price disparities that are seen in futures contracts on the Chicago Mercantile Exchange. Ethereum recently filled its weekly CME gap before undergoing a minor price correction. This action is often seen as a sign of a larger momentum still in play.

However, wise investors know that vigilance is key. Analysts have warned that should ETH trading slip below critical support thresholds, substantial liquidations in the derivatives markets could threaten hard-earned gains. This reliance on both technical indicators and on-chain data is a hallmark of a maturing market, where investors are using a wider range of tools to inform their decisions.

Read More: Decoding an Ethereum Chart: Why a ‘Crash’ Signal Might Mean the Opposite

The Changing Landscape of Crypto Dominance

The current market is seeing a significant rotation of capital, with Bitcoin’s dominance dwindling from over 65% to approximately 59%. This shift signals that capital is flowing toward resilient alternatives like Ethereum. Historically, such movements have often led to dynamic altcoin movements, and many experts believe we are on the brink of such a significant shift.

While the market is increasingly becoming more diversified, it is important to note that a grand “altseason” may not be immediate. The Altseason Index, which measures the strength of the altcoin market relative to Bitcoin, currently sits at 42 out of 100, underscoring the challenges Ethereum must navigate to fully leverage its recent momentum.

Ethereum’s Diverse Value Proposition and Future

Unlike Bitcoin, Ethereum offers a diverse range of value propositions that extend beyond a simple store of value. It serves as the foundation for a vast ecosystem of decentralized applications, from staking techniques and smart contracts to burgeoning DeFi innovations. These diverse use cases set Ethereum apart from Bitcoin, paving distinct avenues for growth in today’s market.

With analysts adopting a cautiously optimistic stance, the path forward for Ethereum is a complex web of external elements. If ETH manages to maintain its upward momentum while aligning closely with Bitcoin’s trajectory, a more pronounced altseason may be on the horizon. The indicators point toward a time of short-term consolidation, challenging investors to prepare for potential volatility.

The Next Chapter for Ethereum

The cryptocurrency ecosystem is in constant flux, with Ethereum standing as a beacon of transformative change. The recent investor behaviors characterized by significant withdrawals and escalating institutional interest paint a promising picture for ETH’s future. As we traverse the nuanced pathways toward altseason, remaining attuned to market intricacies, from ETF movements to CME gap investigations, will empower smarter investment decisions.

Ethereum is thus more than just a profit-seeking tool; it symbolizes a wider cultural embrace of decentralized finance, inviting us to monitor ongoing developments in the digital asset arena closely. The unfolding of Ethereum’s journey could very well mirror the revolutionary technology that powers it.