Ethereum Unstaking Queue Hits Record High

Ethereum’s unstaking queue recently went over $12 billion, which is the most it has ever been. There are currently more than 2.6 million ETH waiting to be withdrawn. Validators, who are in charge of keeping the blockchain safe, are the ones who are leaving the most.

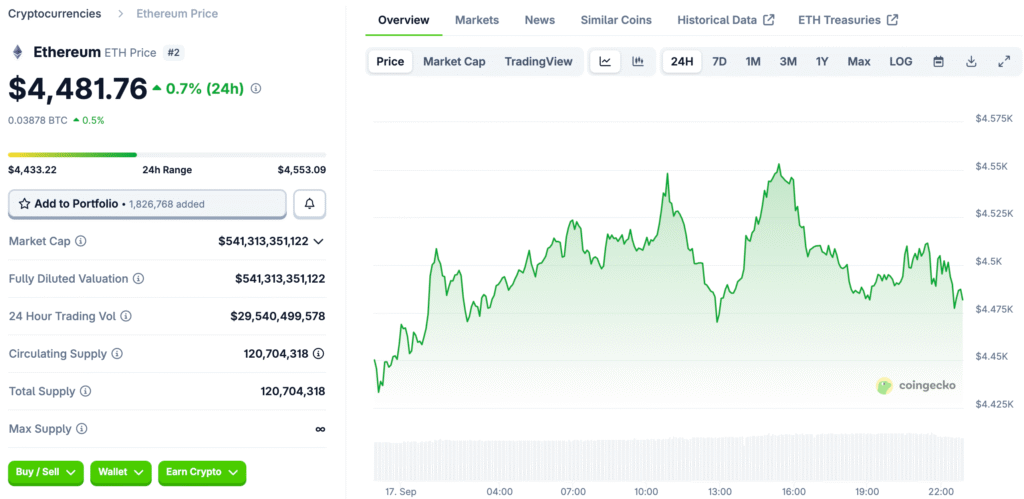

This change suggests that a lot of investors may be trying to lock in their gains. Ether has gone up by almost 100% in the last year. These kinds of gains give both retail and institutional investors a lot of reasons to take profits.

Extended Wait Times Raise Market Concerns

The exit queue has grown to 44 days, which shows how many people want to leave. These long wait times show that the system is very congested. This backlog makes it hard to know how it will affect the stability of the Ethereum market.

Not every validator wants to sell, but a lot of withdrawals could still make it easier to sell. Crypto influencers have said that the market could be unstable. People are getting more worried that sell-offs will hurt ETH prices in the short term.

Ethereum Staking Inflows Surge Amid Bullish Sentiment

The queue to leave has gotten longer, but the stake inflows have slowed down. The admission queue is at its lowest point in the last four weeks. People are staking less, which means that investors are being careful.

At the time of the publication, there were a little over 512,000 ETH waiting to be staked. This number is a lot lower than it was at the beginning of the month, when it was close to 960,000. People could conclude that confidence in staking is going lower because of the economy.

Recommended Article: Ethereum Price Outlook Brightens After Fed Rate Cut Boost

Profit-Taking Dominates Market Narrative

The record-high exit queue shows that profit-taking is a major reason. Some people who own Ethereum want to cash in on their gains because the value has doubled every year. A lot of investors think that now is a good time to sell because of the current price levels.

Some experts think this might be a short-term cycle instead of a long-term change. Taking profits is a normal thing to do when the market is going up. Still, traders are keeping an eye on price changes because the exit queue is so long.

Institutional Demand Counteracts Selling Pressure

Even though people are worried about a mass sell-off, institutional demand is keeping things stable. Since July, strategic reserves and ETFs have added 116% to their holdings. They now own more than 11.7 million ETH together.

This large amount of accumulation shows that institutional investors still believe in Ethereum’s long-term value. ETFs and corporate treasuries help balance out possible selling pressure from retail investors by taking in the circulating supply. They also use restaking as a way to find yield opportunities.

Approval of ETFs Makes People More Bullish

People are getting more and more excited about Ethereum staking ETFs. Analysts in the industry think that approvals could happen as soon as October 2025. If this approval goes through, it will probably help institutions adopt it and support staking inflows.

Investors may be taking ETH out of their accounts now so they can later put it into staking ETF products. This reshuffling shows that they are strategically repositioning rather than leaving the market completely. The SEC’s deadline in 2026 makes it more likely that the request will be approved.

Ethereum Price Outlook Remains Mixed

Ethereum’s future is mostly uncertain. The long exit queue, on the other hand, signals that there is a chance of short-term selling pressure. On the other side, institutional buying and confidence about ETFs are two factors that are excellent for the market.

Ethereum might start to go up again if people stop taking profits and ETFs get the green light. Strong backing from institutions means that it will stay strong even when circumstances are unstable in the short term. As they navigate through the present ETH market, traders need to keep both risk and opportunity in mind.