Ethereum Decline Tests Critical Psychological Support

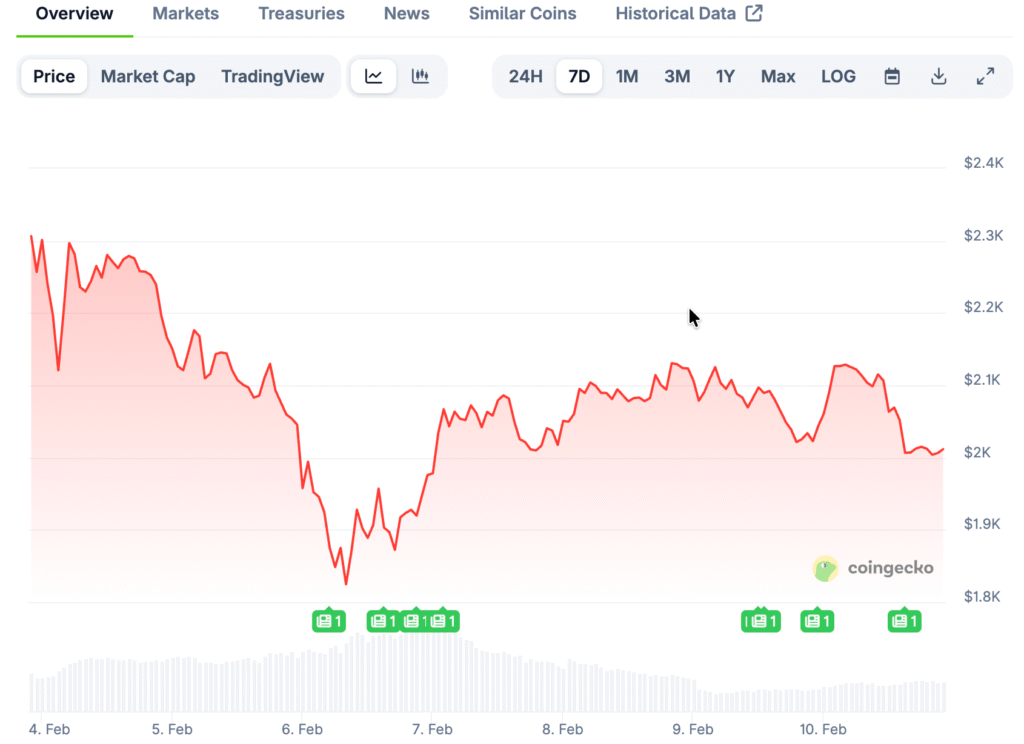

Ethereum dropped about 3% to about $2,028, which is close to the $2,000 level that traders watch closely because it is a psychological level. The drop shows that things are still unstable, even though major financial institutions are making positive long-term predictions. More and more, people in the market see this level as a key battleground that will shape short-term sentiment.

If the price stays below $2,000 for a long time, it could put more pressure on selling as automated strategies respond to the slowing momentum. On the other hand, holding the level may attract bargain hunters looking for lower prices. These kinds of technical inflection zones often affect the direction of the market in the short term.

Institutional Forecasts Project Strong Long-Term Upside

Standard Chartered had 1 of the most aggressive predictions, saying that Ethereum could be worth $7,500 by the end of 2026. Analysts also gave longer-term forecasts that showed prices going up to $15,000 in 2027 and maybe even $40,000 by the end of the decade. These goals depend a lot on more people using the network and improvements to the infrastructure.

The bank said that Ethereum’s leadership in decentralized finance and stablecoin activity were 2 of the main reasons for its growth. Institutional accumulation has made people even more sure that the asset will be important in the long term. Supporters say that technological progress could make higher valuations reasonable.

Citi And Investors Reinforce Bullish Narrative

Citigroup also joined the optimistic camp, predicting prices to be around $5,440 in about 1 year because more investors are interested. Analysts said that steady inflows into exchange-traded funds and purchases of corporate treasuries were signs that institutional participation was growing. These flows can help keep liquidity stable when things get rough.

In general, traditional financial institutions now put their predictions for 2026 in the $6,500 to $7,500 range. This kind of agreement shows that established market players are becoming more open to digital assets. Institutional support often has an effect on the confidence of other investors.

Recommended Article: Ethereum Could Reach $40,000 by 2030 Says Standard Chartered

Technical Indicators Suggest Bears Maintain Control

Even though the outlooks are positive, chart patterns show that sellers are currently in charge of short-term price action across all major trading pairs. Analysts said that $1,760 was the first downside target, which would mean a drop of about 33% from recent levels. A bearish pin bar below resistance near $2,100 added to the signs of negative momentum.

If selling continues, technicians say prices could drop to $1,400, which is where they were in April 2025. Before long-lasting recoveries happen, historical retests happen a lot. So traders are still being careful.

Extreme Scenario Points to a $1,000 Floor

Some analysts won’t rule out a drop back to the psychologically important $1,000 mark if the downturn lasts for a long time. This level is the same as a 100% Fibonacci extension that comes from the downtrend that happened after peaks near $5,000. If this happens, most of the gains made since late 2022 would be lost.

In November 2025, similar bearish patterns showed up when death cross signals pointed to drops into the $1,370–$1,500 range. When things are uncertain, people often look to technical history to help them figure out what to expect. Still, bad outcomes are still possible but not certain.

Buterin Strategy Raises Investor Sensitivity

Co-founder Vitalik Buterin recently took out 16,384 ETH to help long-term ecosystem projects, which led to speculation about the company’s financial strategy. On-chain data showed that only about 3,000 ETH had been sold, but the news made some investors nervous. People think that insider trading is going on, and markets often react strongly to it.

People in the industry said that the foundation might be entering a time of careful financial discipline. Even small signs can change people’s minds when traders are already being extra careful. Perception is often what makes things unstable.

Stabilization Signals Possible Accumulation Phase

Strategists like Joel Kruger have noticed that the crypto markets are starting to calm down after a chaotic selloff that sent fear indicators to their highest levels. Forced liquidations seem to be slowing down, which is letting prices move toward a more stable trading environment. Sometimes, consolidation phases happen before trends change.

Kruger also said that deeper corrections often draw in medium- and long-term investors who want to buy when prices are low. Quiet accumulation under surface panic could eventually help institutions reach their price goals. Whether that support happens or not depends on the bigger picture of the economy.