Ethereum’s Price Reversal Awaiting a Daily Close Above $4,540

Ethereum has recently made a triple bottom near $4,230. This pattern is often seen as a strong sign that sellers are losing steam. Every time prices try to go down, they bounce back strongly, which keeps bullish traders hopeful that prices will go up in the near future.

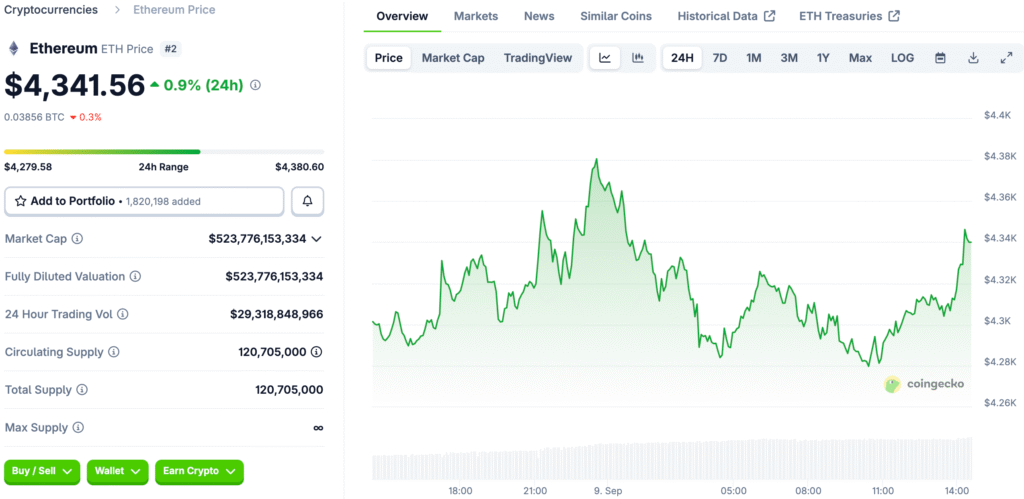

ETH is still just below the $4,540 resistance band that has stopped rallies in the past few weeks. Right now, it is around $4,305. If the daily close is above this area, it would mean that the reversal structure is valid, which could push the token past $5,000.

Stablecoin Liquidity Fuels Bullish Momentum

Ethereum now has an unprecedented $172.2 billion worth of stablecoins, which is more than half of all stablecoins in circulation on all chains. These inflows are like immediate liquidity reserves, and they are often capital that can be quickly moved into ETH or other decentralized finance systems.

Layer-2 networks are still growing, and they now hold more than 8.8% of the circulating stablecoin supply. This shows that the networks are becoming more efficient. In the past, when stablecoin liquidity rose, ETH prices also rose, giving traders more leverage and increasing the number of derivative trades.

ETF Demand Increases Institutional Exposure

Institutional investors still have a big impact on the direction of Ethereum, with spot ETFs led by BlackRock and Fidelity getting a lot of money. These products are sending billions of dollars into Ethereum, which makes it even more credible as a core part of digital portfolios.

Analysts on Wall Street now call Ethereum digital infrastructure instead of just a speculative token. Tom Lee’s $8 billion bet on ETH, with estimates as high as $62,000, shows how traditional finance is starting to use valuation models for crypto.

Recommended Article: Ethereum Revenue Falls 44 Percent Despite ETH Price Record

On-Chain Signals Back Up Bullish Thesis

Ethereum’s network revenue has gone up by 30% in a week, making it the highest-earning blockchain again, ahead of Solana and Tron. Ethereum shows both utility growth and an increase in transaction demand across its base and Layer-2 networks, with daily fees of $16.3 million.

Exchange balances keep going down because more than 36,000 ETH were moved to cold storage in just 24 hours. When exchange reserves go down, it usually means that investors are getting ready for long-term growth. This makes the supply smaller and makes bullish market structures stronger.

Ethereum’s Downward Triangle Signals a Sharp Breakout

Ethereum has been stuck in a downward triangle with resistance at $4,540 and support near $4,250. Technical indicators show that things are neutral right now, but if momentum picks up, there could be a sharp breakout.

Fibonacci projections show that clearing the resistance zone opens up paths to $4,865 and $6,000, which are backed up by longer-term accumulation signals. Experts say that the medium-term range could go up to $6,750, while bullish cycle projections still aim for $10,000 in 2026.

Macro Environment Adds Fuel to Rally

Because the U.S. economy’s job market is getting weaker, people think the Federal Reserve will lower interest rates later this year. In the past, a weaker dollar has been good for risk assets. Ethereum is both a settlement layer for stablecoins and a speculative hedge.

Washington’s push for rules on stablecoins makes Ethereum even more legitimate as the backbone of tokenized dollars. Geopolitical instability is still a wild card, but overall macro conditions and supportive monetary policy point to Ethereum’s upward trend.

Competing Narratives Challenge Retail Focus

Institutions are increasing their investments in Ethereum, while retail traders are moving into speculative alternatives that promise huge returns. Tokens like Remittix and Mutuum Finance get a lot of attention because they make big predictions, but their higher risks make them less popular.

Ethereum’s long-standing role as the backbone of decentralized finance means that it will keep its credibility with institutions. Retail changes show short-term changes, but Ethereum is still the best choice for portfolios that want long-term exposure in a changing market.

Ethereum’s Path to $6,200 Awaits a Key Breakout

At its current price of about $4,305, Ethereum traders have a big choice to make. If it breaks through the $4,540 resistance level, it could open the way to $5,800 and then $6,200.

If it doesn’t go up, it could go back down to $3,940, but ETF demand and stablecoin liquidity are strong counterweights. Overall, Ethereum is a good buy on dips, thanks to both institutional confidence and strong structural fundamentals.