Ethereum’s Price Action Steadies as Volume Surges

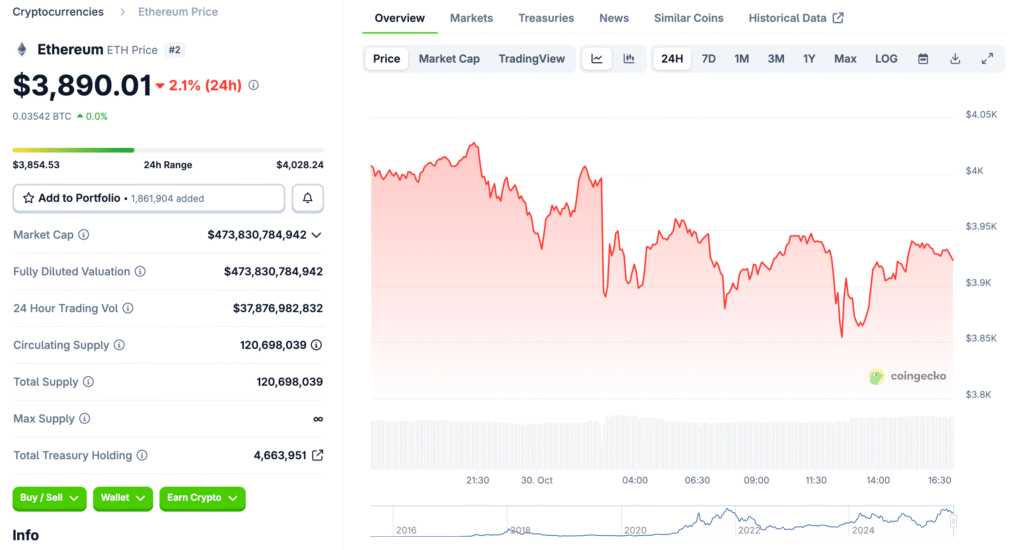

Ethereum’s momentum remains a focal point for investors as it trades near $3,900, showing resilience amid broader market uncertainty. Trading volume recently surged 33%, indicating strong accumulation by buyers. Despite a slight 0.44% daily decline, Ethereum’s long-term trajectory remains upward. Analysts note that ETF-related outflows, totaling $312 million, are relatively small compared to total managed assets of $14.6 billion — signaling continued institutional confidence.

Key Technical Levels Ahead of U.S. Inflation Data

ETH is currently priced at $3,852.55, maintaining stability above its critical $3,500 support level. The 200-day EMA has acted as a reliable bounce zone, keeping Ethereum within its bullish channel since April. The RSI sits around 46.5, showing neutral-to-bullish conditions. Analysts highlight that a sustained move beyond $4,300 could open the path toward the key psychological $5,000 mark, especially if U.S. inflation data favors risk assets.

Institutional Catalysts Fuel Ethereum’s Long-Term Outlook

Institutional interest continues to grow, with potential ETH ETF approvals poised to inject massive liquidity into the ecosystem. Industry giants like PayPal and State Street are already integrating Ethereum-based solutions. Upcoming upgrades such as Pectra and Fusaka promise enhancements like Verkle Trees and danksharding — both aimed at lowering transaction costs and boosting scalability. Forecasts for 2025 range between $3,142.70 and $9,428.11, averaging $6,285.41, underscoring Ethereum’s growth potential.

Recommended Article: Tom Lee’s $281M Ethereum Bet Sparks Speculation on ETH’s Next Move

As ETH Stalls, Meme Coins Like Maxi Doge Draw Aggressive Interest

While Ethereum remains a dominant force in decentralized finance, meme coins are stealing short-term attention. Maxi Doge, for example, has raised over $3.7 million and is entering its final presale stage with rapid community growth. Its fair-launch structure and staking incentives up to 83% APY have drawn interest from speculative traders seeking faster gains.

Maxi Doge’s Strategic Edge Over Legacy Meme Coins

Unlike traditional meme tokens, Maxi Doge blends humor-driven branding with real token utility. Over 6% of its supply is already staked, suggesting that holders see long-term potential. This mix of staking yield and community engagement has made Maxi Doge a standout amid meme coin mania.

Could Maxi Doge Outperform Ethereum in Q4?

Ethereum remains the institutional cornerstone of crypto, but Maxi Doge’s speed and viral reach make it a speculative challenger. While ETH’s upside depends on macroeconomic and ETF catalysts, Maxi Doge’s growth hinges on retail energy. If trends persist, it could outperform Ethereum in Q4 — at least in percentage gains.

Conclusion: Ethereum Retains Its Crown Amid Rising Competition

Ethereum’s fundamentals — Layer-2 expansion, institutional backing, and technological upgrades — ensure its place at the heart of blockchain innovation. Meme coins like Maxi Doge may deliver quick returns, but Ethereum’s structural strength continues to attract serious capital. Whether ETH reaches $5K this quarter or next, it remains the most credible long-term play in the market.