Ethereum’s Important Moment

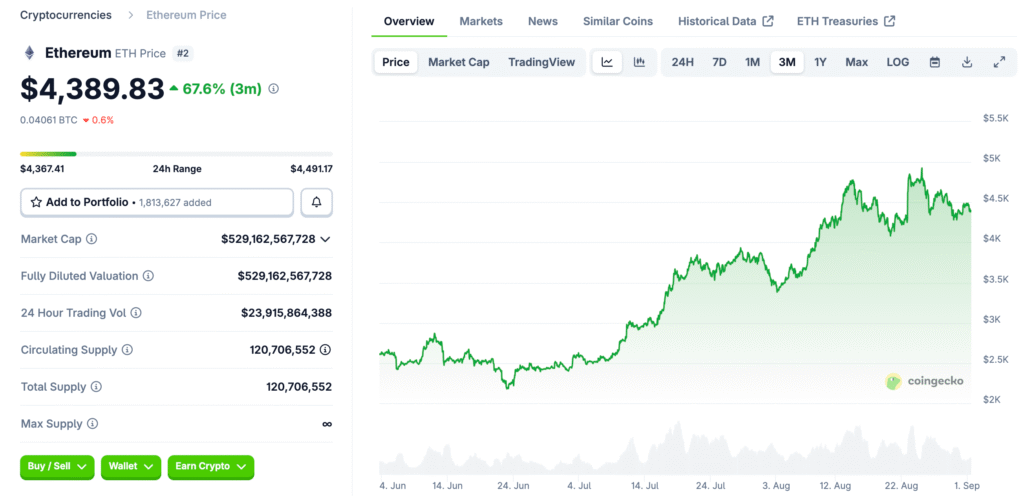

The Ethereum market is once more at a crucial point. After weeks of steadily building up their holdings, big investors, called “whales,” have changed their minds and are now selling huge amounts of ETH. People are worried that the price might drop because of this sudden change, especially since the market is already feeling weak.

Ethereum’s price went up a little bit recently, but the question is whether it can hold its ground against the renewed selling pressure. This article will look at how this whale activity affects the market and the important support levels that could decide Ethereum’s short-term future.

What the Whale Sell-Off Means

Ali Martinez, a well-known crypto analyst, says that Ethereum whales have sold more than 430,000 ETH in the last two weeks. This is a big change from how they had been buying it up. In dollars, this means that a lot of value, $1.80 billion, is coming back to the market. This huge exodus is very different from what these whales did in July and August, when they bought a lot of ETH as its price fell from over $4,800 to under $4,100. After their buying spree, the price went up to a new all-time high of $4,950 before the recent drop.

The Two-Way Effect of Whale Deals

There are two main ways that whale sell-offs can have a big, immediate effect on the market. First, they put pressure on direct selling. The sheer number of assets hitting the market can make it hard for existing buy orders to keep up, which can cause the price to drop quickly. Second, smaller investors often see what these big players do as a sign. When a whale sells, it can cause retail investors to feel fear, uncertainty, and doubt (FUD). This can lead to a “snowball effect” of panic selling that makes the price drop even more. This dynamic shows how much power a few big holders can have over the market.

An OG Bitcoin Swapping for ETH

Even though the market is generally going down, not all big investors are selling their stocks. A certain person in the crypto community, who goes by the name “Bitcoin OG,” has not been discouraged. This whale has been trading a lot of Bitcoin for Ethereum all the time. The most recent trade was worth $109 million. This investor has bought about $3.4 billion worth of ETH and sold a lot of BTC. This behavior shows that the person has a long-term bullish view on Ethereum that isn’t affected by short-term market changes or what other whales do.

The Fight for the $4,000 Support

Ethereum’s price fell to $4,250 as a result of the renewed selling pressure, but it then rose again. But there is still a very real chance of a bigger correction. Analyst Martinez says that the most important support line for ETH’s current market structure is the $4,000 mark.

A support level is a price point where a downtrend is likely to stop because of a lot of demand. If Ethereum’s price drops below this important level, it could start a bigger sell-off because traders lose faith and a new psychological support level is set.

Recommended Article: Ethereum’s Bull Market Status Hangs in the Balance

The Next Stop if Support Doesn’t Work

If Ethereum can’t keep the $4,000 support line, its price could drop to the next big level at $3,800. When a major support level breaks, it can set off a chain reaction that leads to more selling and liquidations. This shows how important these technical indicators are for traders who use them to help them make decisions. The way the market is acting right now is a test of Ethereum’s strength and a clear reminder that its price is affected by the psychology of its biggest holders as well as its own fundamentals.

Market Volatility and Liquidity

Whale activity can have a big effect on an asset’s liquidity just because of what it is. When a whale sells a lot of a cryptocurrency, it can cause a “liquidity crunch,” which means there aren’t enough buyers to handle the sell orders without a big drop in price. This can make the market very unstable and make it hard for other traders to make their trades without experiencing slippage, which is when the price at which the trade is executed is different from the price they expected. The recent sale of whales has shown how weak the Ethereum market is.

Why investors should keep an eye on whales

For small investors, keeping an eye on whale activity is an important part of navigating the unstable crypto landscape. It’s not a good idea to blindly follow a whale’s every move, but their trades can give you useful information about how the market feels and what might happen in the future. Some whales are selling while others are buying, which gives us a complicated but important picture of the current market. This difference in strategy among the biggest players shows how uncertain the situation is and how different the long-term outlooks for the asset are.

What’s Next for the Ethereum Market?

As the market processes the recent whale sell-offs and the possibility of a deeper correction, the short-term outlook for Ethereum stays cautious. The $4,000 support level is very important for bulls, so everyone will be watching it closely. Whether or not Ethereum can stay at this level will have a big impact on where it goes next. The current volatility is a great way to learn about how the market works and how much power big holders can have over even the biggest cryptocurrencies.