Ethereum ETFs Post Fourth Straight Week of Gains

Ethereum spot ETFs saw $638 million in inflows from September 8 to September 12. This was the fourth week in a row that they had good results. Fidelity’s FETH had the most inflows, with $381 million, and BlackRock’s ETHA came in second, showing that institutions are very interested in Ethereum.

Other funds, like Grayscale’s ETHE and Bitwise’s ETHW, also saw small inflows. This shows that investors are interested in a wide range of regulated products. It’s important to note that no Ethereum ETF had net outflows, which shows that the market is still optimistic and demand is still high. More and more people are confident in Ethereum’s long-term role.

Fidelity FETH Secures Leadership With Billions Under Management

Fidelity’s FETH now has $3.73 billion in assets, making it one of the best Ethereum ETFs since it started, thanks to steady institutional investments. Its performance shows that Fidelity is becoming more and more known as a reliable way for both institutional and retail investors to get into the Ethereum ecosystem.

The $381 million that comes in every week shows that investors trust Fidelity’s management and that Ethereum is becoming more useful outside of speculative markets. Strong allocations make Ethereum look like a core investment asset even more. This trend makes institutions more credible and helps the trend spread more quickly around the world.

BlackRock ETHA Keeps Strong Market Share

During the same week, BlackRock’s ETHA gained $165 million, keeping its lead with $17.25 billion in assets under management. This is almost three percent of Ethereum’s total market capitalization, which makes BlackRock one of the most important players in the Ethereum market.

Institutional investors see BlackRock’s involvement as proof that Ethereum is a legitimate currency in regulated finance. The ETF’s size makes it much easier to trade. This makes it easier for big capital flows that want to get into crypto without the risks that come with exchanges.

Recommended Article: Ethereum Privacy Stewards Balance Regulation And Innovation

Market Data Highlights Ethereum ETF Growth Momentum

By September 12, Ethereum spot ETFs had brought in a total of $13.36 billion in net inflows, bringing their total net assets to $30.35 billion. There is still a lot of trading going on. Last week, there were $2.55 billion worth of Ethereum ETF transactions in just one day across several funds.

Grayscale is still in charge of more than $8 billion in its products, which shows how popular Ethereum has been with institutional investors for a long time. These numbers show that Ethereum ETFs are becoming more popular in the mainstream financial world. They add to Bitcoin ETFs while also being important on their own in regulated markets.

Institutional Interest Boosts Ethereum’s Long-Term Narrative

Institutional inflows show that Ethereum has grown into a well-known financial asset, with regulated ETFs giving people safe access to DeFi and staking opportunities. Fidelity and BlackRock are the first to adopt, showing that traditional finance trusts that Ethereum will continue to be important in the future of finance.

ETFs lower the risks of holding assets for institutions that aren’t familiar with wallets or exchanges, making it easier for people to use them. More investors are willing to buy these kinds of products as regulations become more accepting of them. This change is part of a bigger trend around the world toward bringing crypto into traditional markets.

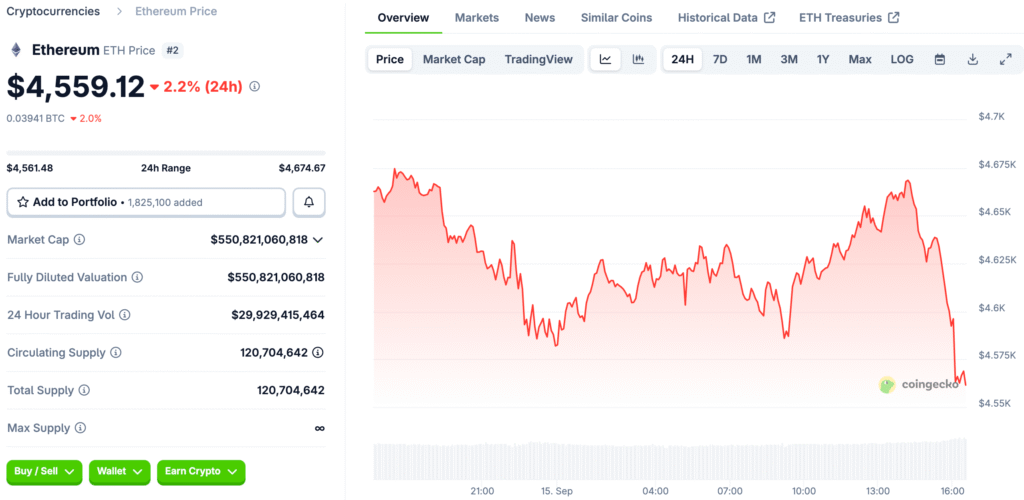

Ethereum Maintains Strong Market Presence Despite Volatility

Ethereum is still a key part of decentralized finance, NFTs, and smart contracts, which supports its case as a long-term investment. When ETFs buy stocks, they take them off the market, which lowers selling pressure and may help keep prices stable over the long term.

The fact that there are no net outflows makes people more sure that Ethereum will hold up in uncertain market conditions. If the overall mood in the crypto world stays positive, momentum may continue. Institutional accumulation shows that investors are still very interested in Ethereum over a range of investment time frames.

Ethereum’s Momentum Builds with ETF Success

Ethereum ETFs show how regulated investment products are becoming more important in digital asset markets, which builds trust among both institutions and individual investors. Ethereum is becoming a more important investment asset for institutions, alongside Bitcoin, with weekly inflows of $638 million.

As frameworks around the world get better, Ethereum ETF inflows could keep going up, pushing assets past the current $30 billion mark. The demand from institutions shows that Ethereum is moving toward becoming widely used. This change makes it more important as both a technological and financial foundation.