Ethereum Recovery Boosts Market Confidence

Ethereum’s recovery reignited investor optimism, drawing attention from traders across major global crypto markets. After stabilizing near $4,100, ETH climbed steadily, showing resilience despite recent market volatility.Technical signals improved as prices consolidated near resistance zones, reflecting growing buying pressure.This pattern highlights Ethereum’s ability to maintain momentum while weaker positions exit during uncertainty.

ETH’s rebound closely mirrored Bitcoin, underlining the tight connection between both leading digital assets. Analysts noted ETH’s strength above key averages, reinforcing bullish narratives shared on trading platforms.This stability encouraged traders anticipating gains once $4,240 and $4,280 resistance levels are breached. Such technical alignments often precede rallies, attracting momentum-focused participants seeking favorable setups.

Resistance Levels Determine Next Breakout

Crucial resistance levels will decide Ethereum’s breakout potential in upcoming sessions as traders watch closely. ETH faces stiff resistance around $4,240, marking a key retracement zone from previous movements. A confirmed close above this level may spark stronger momentum and bring $4,320 into focus. Such a breakout would likely attract institutional inflows, amplifying ETH’s strength during positive phases.

Beyond $4,280, analysts eye $4,320 as the next barrier potentially accelerating bullish continuation.

Clearing these layers may trigger short covering, boosting upward momentum within leveraged markets.

Momentum indicators are improving, suggesting buying activity could overpower remaining bearish supply.

Investors are positioning strategically, anticipating solid risk-reward opportunities if breakouts gain traction.

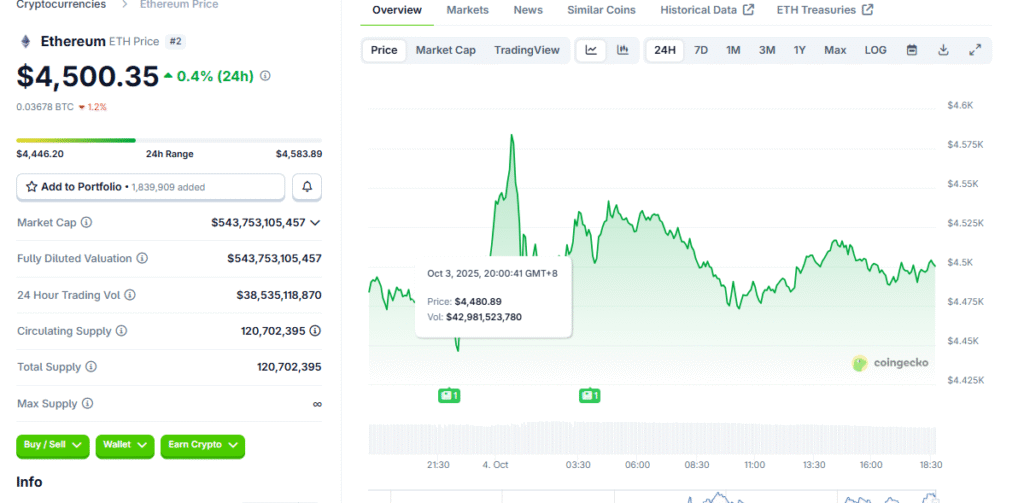

Recommended Article: Ethereum Tests $4,500 As Whales Accumulate And Spot Inflows Return

Consolidation Above Support Strengthens Bulls

ETH has consolidated firmly near $4,100, reinforcing its base and reducing immediate downside threats.

This phase allows traders to accumulate positions patiently, preparing for potential follow-through soon.

Stability around support signals growing confidence among participants expecting upward moves during October’s rally. Such constructive structure usually precedes larger breakouts as selling pressure gets absorbed gradually.

Short-term averages remain positive, supporting ETH’s resilience against sudden corrective declines nearby. Traders emphasize holding this level because failure could negate bullish setups seen across charts. Institutional investors watch support zones carefully when planning medium-term entries aligned with trends. If ETH defends this base effectively, trader confidence in sustained rallies could grow stronger.

Whale Accumulation Strengthens Momentum

Whales continue accumulating Ethereum, signaling renewed confidence in the asset’s near-term performance. On-chain data shows rising balances among influential holders, mirroring patterns before major rallies. Such activity usually reflects strategic positioning ahead of expected market moves with deep insights.This trend supports a bullish case since whales typically influence overall momentum significantly.

Persistent accumulation tightens supply, amplifying price reactions when bullish momentum gains strength. Reduced liquidity often accelerates upward moves, rewarding early participants and catching late buyers. Traders view this behavior as confirmation of Ethereum’s improving fundamentals and technical setups. Whale activity thus acts as both catalyst and validation during evolving bullish phases.

Derivatives Markets Show Bullish Interest

ETH derivatives are signaling growing bullish sentiment, reinforcing expectations for continued upward momentum. Open interest has increased steadily, showing traders are preparing for breakout scenarios.

The rise in long positions indicates stronger conviction among leveraged participants anticipating rallies.

Historically, such derivatives behavior has preceded significant market expansions.

Funding rates remain balanced, showing healthy conditions without extreme speculative pressure building. Balanced funding suggests organic spot demand drives movements rather than unstable leveraged trades. These stable conditions support sustained rallies as positions stay manageable without distortions.Derivatives trends therefore confirm Ethereum’s bullish structure approaching critical resistance levels.

Technical Indicators Support Breakout Case

Multiple indicators confirm Ethereum’s strengthening momentum, backing a possible breakout above $4,500 resistance. MACD shows bullish crossover signals with expanding histograms indicating rising buying interest. RSI readings remain above neutral, showing steady participation without overbought risk developing. Trendlines across different timeframes align, pointing toward structured upward continuation.

Moving averages are stacking positively, reinforcing bullish sentiment among traders and algorithms.

Historically, similar alignments preceded sharp upside expansions during strong market phases.

Volume profiles reveal increasing participation, validating recent moves and lowering false breakout risks.

These converging signals create a strong bullish narrative as Ethereum approaches resistance.

Pullback Risks Still Exist

Despite optimism, traders remain aware that rejection near resistance could trigger quick pullbacks.

Resistance failures often cause fast corrections, shaking out leveraged traders and retesting supports.

Targets lie near $4,095 and $4,020 where past consolidations might stabilize price briefly.

Deeper drops toward $3,920 remain possible if overall market sentiment turns negative quickly.

Risk control is crucial during these setups, protecting capital against sudden volatility spikes.

Stop-loss placements below support help manage exposure while keeping upside potential intact.

Experienced traders adjust strategies dynamically based on shifting conditions, not fixed predictions.

This balanced approach allows capturing upside while managing risks effectively.

Ethereum Eyes Breakout Heading Into October

Ethereum’s structure, signals, and market behavior increasingly support the case for a decisive breakout.

Whale accumulation, healthy derivatives activity, and solid support strengthen the bullish argument.

A strong close above $4,280 could send ETH quickly toward $4,450 or even $4,500 targets.

Such a move might trigger renewed institutional attention and broader media coverage.

Investors should monitor macroeconomic influences shaping crypto sentiment, including Fed policy and ETF flows. However, ETH’s current resilience places it in a leading position for Q4 rallies.

This alignment of factors highlights Ethereum as a crucial asset approaching a pivotal moment.

October could mark the beginning of another defining chapter for ETH’s price trajectory.