Dogecoin’s New Digital Asset Treasury

A brand-new digital asset treasury for Dogecoin is meant to make the cryptocurrency more important in the financial world. Alex Spiro, a lawyer with close ties to Elon Musk, is in charge of the project, which aims to attract and manage large amounts of money. This new fund is a big step toward giving Dogecoin a more legitimate place in the crowded digital asset market.

This new project, which is part of the business side of the Dogecoin Foundation, is an effort to run like other crypto treasury companies that are already in business. The goal is to make managing Dogecoin’s assets more organized and professional for everyone involved. This is a very important step as more and more businesses think about using crypto on their balance sheets.

Dogecoin’s Big Challenge

One of Dogecoin’s biggest problems will be finding a balance between its well-known community-driven charm and the needs of traditional investors. As Dogecoin moves toward a more formal financial structure, the funny and meme-driven nature that made it popular may be in danger. This change is putting to the test its ability to keep its relaxed and welcoming atmosphere.

The Dogecoin community has grown because it is a fun and laid-back group, which has made them feel very close to each other. But the project needs to find a way to keep its original spirit while also trying to gain credibility in institutions. This is a hard job because traditional investors usually care more about stability and credibility than having a fun culture.

How the Market Reacted to Dogecoin’s Moves in the Institutional Space

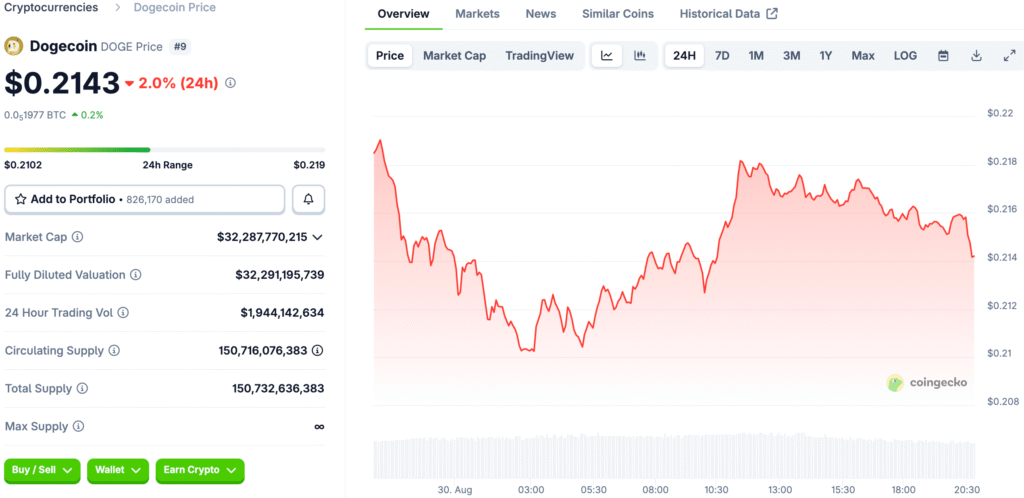

Even though the new digital asset treasury was announced, the market’s first reaction was not very strong, and the price went down a little. DOGE fell by 2% in the last 24 hours, showing how volatile meme tokens are and how strong that volatility is. Speculative trading or general social media buzz can easily cause this volatility.

But Elon Musk has been a part of the Dogecoin story for a long time, which means that a big rally could happen at any time. Managing price changes and market liquidity will be very important for Dogecoin as it goes through this change. The possibility of a huge influx of new money could eventually make the market more stable.

Recommended Article: Dogecoin Price Action and Breakout Potential Analysis

Dogecoin’s Strategy to Control Volatility

Dogecoin needs to take strategic steps to bring in new, very stable capital in order to effectively control its volatility. The new digital asset treasury is a strong first step in this direction because it wants to attract big investors. This new money can help with liquidity and calm down some of the big price changes.

The project also needs to come up with new ways to encourage people to hold on to their investments for a long time and to stop a lot of the short-term speculative trading. This will help it build a stronger and more trustworthy group of investors. It needs to attract new capital in order to stay a serious financial asset in the long run.

What We Can Learn From Bitcoin’s Treasury Management

As Dogecoin moves closer to being used by businesses, it can learn a lot from how Bitcoin manages its treasury. Setting clear rules for governance is important for setting long-term goals and making sure that everyone is accountable and open. A clear investment policy can also help you set the right limits and make decisions in the future.

Also, being ready for legal and regulatory issues is very important for getting around the complicated world of digital assets. Using effective risk management tools like dollar-cost averaging can help deal with some of the extreme changes in value. Finally, clear reporting and regular audits can help new investors trust you a lot.

What Dogecoin Will Do in Finance in the Future

This new change is a big turning point for Dogecoin and its future as a major cryptocurrency. Setting up a separate treasury is a great new way to manage and grow the token’s ecosystem. This is a very important step in turning it from a simple meme coin into a more valuable financial asset.

The token’s future may not be as much about pure speculation as it is about its basic role in the digital economy. This project could also open up new ways to use it and new partnerships that would make it even more useful. This is a very good and exciting new thing for all Dogecoin holders.

Dogecoin’s Move to an Institutional Asset

In order for Dogecoin to become an institutional asset, it needs to keep making very smart moves toward a long-term goal. It needs to find a balance between its unique charm and strong community and a more serious and professional approach to money. The project needs to keep making useful things and find new ways to get more people to use them.

This will need a clear and very strict plan that can meet the needs of both its community and the new institutional investors. A very important step is to successfully set up this new digital asset treasury. Dogecoin has a bright future, but it needs to keep changing and growing.