Anticipation Builds Around First Dogecoin ETF

As excitement builds for the launch of the first United States Dogecoin ETF, which will be listed under the ticker $DOGE, Dogecoin is making headlines. This is a big step forward that gets investors excited because it gives them indirect access to Dogecoin through regulated market structures.

As deadlines for regulatory decisions get closer, investors are getting ready for possible price spikes. Speculative energy is still gaining ground quickly. Many people think that ETFs will change the game. They give institutional investors a reason to trust Dogecoin, which will greatly increase its liquidity, demand, and adoption around the world.

Institutional Interest Boosts DOGE’s Momentum

Nate Geraci, president of ETF Store, said that crypto ETFs will be very active, especially Dogecoin, which is in a good position as approval nears. This optimism shows that most people in the industry think that Dogecoin’s path could change a lot if institutions can use it and it becomes more legitimate.

The SEC is still very important to Dogecoin’s future, and decisions on ETF applications are coming soon. As the chances keep going up, excitement grows. Polymarket data shows a 91% chance of approval, which boosts confidence. These kinds of expectations make Dogecoin even more popular with both retail and institutional investors.

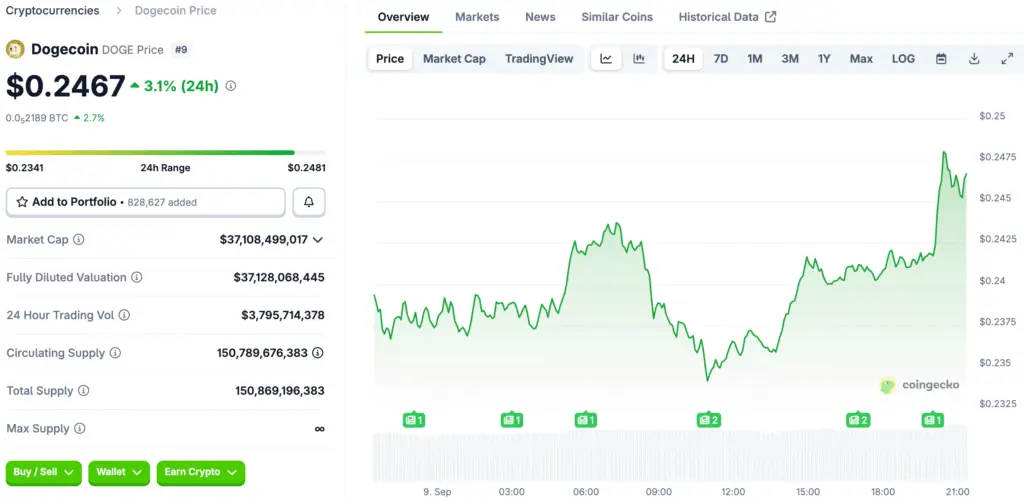

Dogecoin’s Price Aims for $0.50 After a Confirmed Breakout

Dogecoin charts show strong bullish technical structures, especially ascending triangle formations that show a higher chance of a breakout as time goes on. If a candlestick closes decisively above $0.27, it would confirm continuation patterns, with targets that go well beyond immediate resistance levels.

The $0.50 level is a short-term goal that could lead to a 110% rise from current prices, thanks to increased speculative energy. Chart patterns suggest that momentum could continue, backed by excited traders and positive feelings about announcements related to ETFs.

Recommended Article: Dogecoin Leads Altcoin Rally With XRP, Tron, and Solana Gaining

Long-Term Predictions Aim for Higher Goals

Technical formations point to longer-term targets at $1.40 and possibly $3.65, with classic cup-and-handle structures backing them up. These kinds of projections show that Dogecoin has the potential to rise a lot if more people start using it through institutions and more investors trust it.

Analysts have different ideas about what will happen, but long-term views show that growth will be big. In this cycle, Dogecoin still has the potential to reach new all-time highs. XForceGlobal said that a $10 price is still possible as long as Elliott Wave structures line up with bullish liquidity conditions that favor DOGE.

Institutional Adoption Changes Perception of Memecoins

Including Dogecoin in ETF talks changes how people see it from a speculative meme token to a well-known financial product in traditional markets. This change makes it easier for more people to use Dogecoin, making it both a cultural phenomenon and an asset class that can be bought and sold by institutions.

Institutional demand creates stable liquidity, which helps lower the risks of volatility. More people taking part leads to better integration across a number of financial ecosystems. If ETFs are approved, Dogecoin’s role in larger crypto portfolios could change a lot, making it an established digital asset.

How the Market Reacts to Approvals

Dogecoin’s growth is expected to accelerate due to the potential ETF approval, which could boost trading volumes as investors seek early entry. The market’s reaction will depend on the size of institutional inflows, with high buying pressure potentially altering Dogecoin’s price over extended periods.

Price changes around ETF confirmations could set new baselines, pushing Dogecoin towards all-time highs and stronger areas for institutional buying.

Risks Remain Despite Bullish Projections

Even though people are hopeful, there are still risks that come from regulatory decisions and the state of the economy as a whole that could lower growth expectations for Dogecoin. If a rejection or delay in approval happens, it could cause corrections, which would make the volatility that often comes with speculative cryptocurrency movements even worse.

Investors also need to think about bigger trends in liquidity and the Federal Reserve’s monetary policy, which still have an effect on how the cryptocurrency market behaves. Even with ETF approval, growth will only continue if more people use them, more stores sell them, and the overall strength of the larger crypto ecosystems.

Dogecoin’s Path to Mainstream Finance

As the chances of ETF approval rise and technical patterns show strong breakout potential, Dogecoin’s future looks better and better. The chance that institutions will use it changes its role in the market in a big way, moving Dogecoin from a meme token to a part of mainstream finance.

It looks like a $0.50 rally in the near future is possible, with long-term targets of $1.40, $3.65, and maybe even higher. Investors are now waiting for official approval, which could be a turning point for Dogecoin on its way to long-term financial success.