Death Cross Signals Trend Reversal

Dogecoin recently flashed a bearish death cross pattern as its fifty day moving average dipped beneath the two hundred day moving average. This formation historically marks the end of bullish momentum phases in many assets.

Technical analysts interpret this signal as confirmation of trend weakening rather than temporary volatility. Momentum based strategies typically shift toward defensive positioning once these crossovers appear.

Whales Increase Distribution Activity

Large Dogecoin holders accelerated distribution behavior after weeks of sideways consolidation. Significant token quantities flowed out from whale clusters indicating reduced long term conviction across major supply holders.

Institutional scale selling can amplify market pressure because fewer deep liquidity pockets remain supportive. When large wallets exit positions, retail sentiment usually declines faster.

Selling Pressure Intensifies Volatility

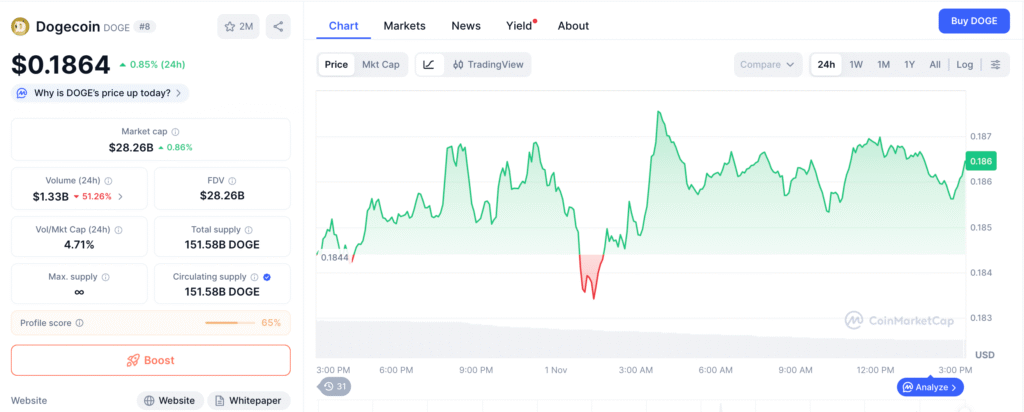

As whales distributed tokens aggressively, Dogecoin’s price rapidly slipped beneath the psychological twenty cent support barrier. This breach introduces heightened downside probability because previous support turned into new resistance.

Analysts warn this decline could trigger automated liquidation flows across leveraged traders. Those liquidations can create cascading drops and prolong bearish direction.

Short Term Targets Trend Lower

Market models identify potential retest zones near seventeen and sixteen cents depending on momentum strength. These lower levels represent possible stabilization points if sellers lose intensity.

However traders must watch short interval chart structures carefully. If fresh selling arrives unexpectedly, rapid spikes downward remain highly plausible.

Recommended Article: Analyst Predicts November Surge as Dogecoin Enters Bullish Window for Breakout

Retail Confidence Weakens Rapidly

Retail traders typically rely on whale activity to validate directional confidence. Seeing whales exit aggressively usually discourages speculative buyers from re entering volatile conditions.

Confidence dips become self reinforcing because lack of participation lowers volume. That makes each minor sell event look larger than it would during high liquidity periods.

Potential Recovery Requires Strong Break

Any bullish recovery would require Dogecoin to reclaim near twenty cent levels quickly. Reclaiming support would invalidate part of the bearish breakdown and realign short term trend momentum.

Until then, rally attempts risk forming only temporary bounces. No long duration uptrend typically forms until multiple resistance zones break convincingly.

Emotion Driven Reactions Distort Analysis

Bear markets create emotional fear responses among retail traders which often accelerates selloff behavior. When traders capitulate early, they sometimes reinforce short volume reaction loops.

Calm evaluation becomes more effective than reactionary selling. Understanding data rather than emotion helps avoid surrendering opportunity prematurely before forecasts stabilize.