SEC Approves First Dogecoin ETF with New Leadership

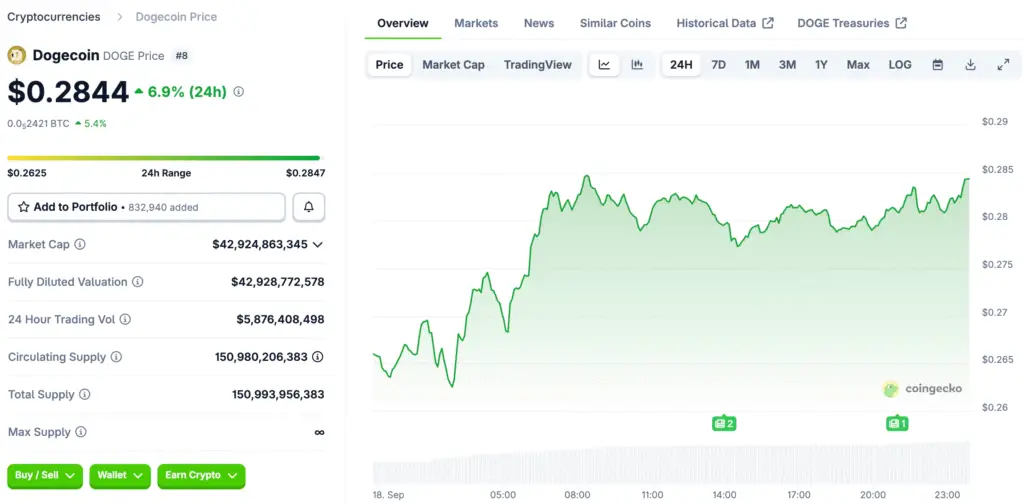

The US Securities and Exchange Commission has approved the Rex Osprey Doge ETF, marking the first memecoin-backed ETF to be approved. The decision follows a leadership change, with new chair Paul Atkins expressing a more positive view of cryptocurrencies.

The SEC’s ease of listing crypto ETFs is expected to lead to more of them in the coming months. Dogecoin now falls under the Bitcoin and Ethereum ETF categories, providing more exposure options for investors.

How Dogecoin Went From Meme to Market ETF Asset

Originally a joke cryptocurrency in 2013, Dogecoin has grown to become the sixth largest non-stablecoin asset by market value in all industry rankings. Dogecoin’s status has changed now that it is part of an ETF structure. This has led to discussions about the legitimacy and risks of memecoins entering mainstream markets.

Analysts are worried. Bryan Armour of Morningstar said that memecoin ETFs make collectibles like baseball cards seem normal, which makes capital markets less serious. Even though some people are skeptical, investors are still excited. The high demand shows how popular Dogecoin’s online culture and market presence are in the community.

Institutional Players Rex and Osprey Drive Launch Efforts

Rex Financial, which manages $8 billion, worked with Osprey Funds, a crypto expert, to list the Dogecoin ETF on the Cboe. This partnership goes beyond traditional leveraged ETFs by adding memecoin exposure while still following US investment rules.

Both companies are also launching their first XRP ETF along with a Dogecoin product. This gives investors more options for getting exposure to different cryptocurrencies. Greg King, the CEO of Rex, said that investors want easy-to-use trading tools that support popular digital assets like Dogecoin directly.

Recommended Article: CleanCore Grows Dogecoin Treasury With 100M DOGE Buy

Analysts Warn Of Investor Confusion And Risk Normalization

Experts say that the Dogecoin ETF could confuse investors by making it seem like it has real economic value, when memecoins often don’t have any real use cases. Armour warned that giving ETFs legitimacy could unfairly compare Dogecoin to gold or S&P 500-linked funds.

Todd Rosenbluth from TMX VettaFi said that development is a slippery slope and that more approvals could lead to reckless speculation in unknown assets. Some people are unsure if regulatory support makes assets that are mostly based on hype instead of usefulness or economic fundamentals seem more real.

Supporters Highlight Market Demand and Investor Enthusiasm

Dogecoin’s large market cap and popularity have attracted support from supporters, including Nate Geraci. Geraci believes the SEC’s changing stance demonstrates understanding of investor demand and the need for regulated frameworks.

Supporters argue that ETFs offer safer exposure than unregulated ones, as they allow investors to buy and sell Dogecoin in existing market conditions. Approval of ETFs is seen as a practical choice that protects a wider range of participants.

Wider Effects on the Growth of Cryptocurrency ETFs

The approval of more cryptocurrency ETFs, including those for memecoins, altcoins, and non-fungible tokens like Pudgy Penguins, is expected to change the ETF landscape by adding unusual exposures.

Analysts predict a flood of new products, with 90-100 applications still waiting. Despite concerns about lowering standards for ETFs, the expansion is a sign of a shift towards a more flexible framework that can handle new digital asset classes that investors desire.

Dogecoin ETF Fees and Market Launch Details Announced

The Dogecoin ETF will charge a 1.5% fee, which is higher than the fees for regular funds. This is because of the risks and newness of memecoin exposure. The XRP ETF, which is also starting at the same time, has a lower fee of 0.75%, which gives brokerage account investors more options for cryptocurrencies.

Both funds are listed on Cboe, which is a growing list of cryptocurrency ETFs. BlackRock and Fidelity are already in charge of Bitcoin and Ethereum. New companies add to the competition by giving retail and institutional investors who want to take risks or follow a theme in the crypto market more options.

The Market Weighs the Dogecoin ETF’s Future

Some people say that the approval is a historic step, while others call it a dangerous precedent that will lead to ETFs becoming fads and collectibles. Some investors see the product as a risky new thing, while others see it as a legitimate evolution of financial markets that can handle digital communities.

The SEC’s regulatory path will determine what happens in the future. More memecoin ETFs could come out soon, which could change how people think about digital assets. For now, the Dogecoin ETF is a turning point that has sparked debate around the world about innovation, risk, and legitimacy in the investment world.