DeFi Dev Corp Deepens Commitment to Solana

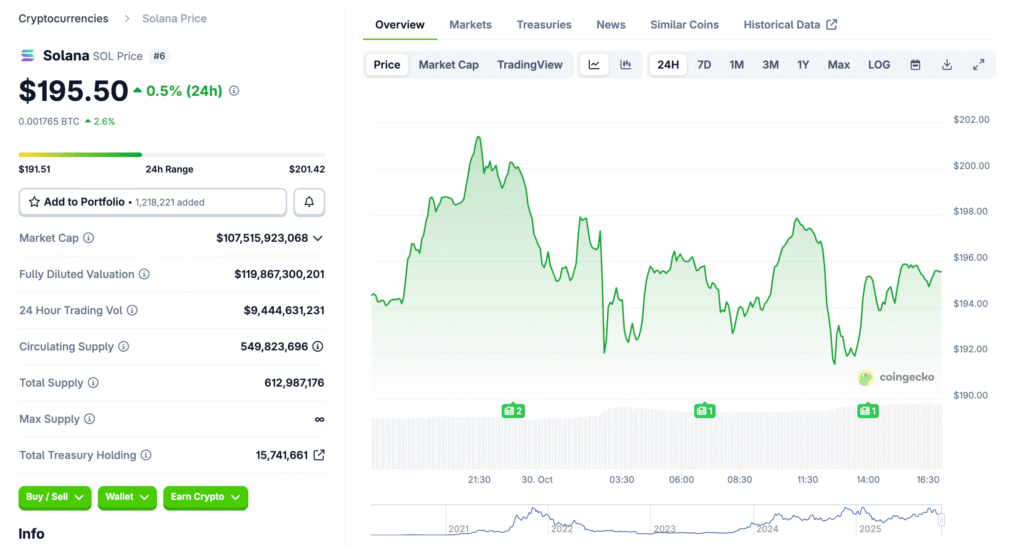

DeFi Development Corp (Nasdaq: DFDV) has expanded its Solana exposure through a fresh acquisition of 86,307 SOL tokens at an average cost of $110.91. This purchase lifts its total Solana holdings to over 2.19 million tokens, now valued around $426 million. The move highlights the company’s continued conviction in Solana’s long-term growth and staking economics.

Strengthening Treasury Strategy and Yield Generation

The firm confirmed that all newly acquired tokens will be staked across multiple validators, including its own infrastructure. Staking allows DeFi Dev Corp to generate yield while contributing to Solana’s network security. This aligns with its ongoing strategy of combining accumulation and validator operations to sustain on-chain income streams. The resulting yield supports both corporate treasury returns and operational expansion.

Institutional Exposure to Solana’s Ecosystem Expands

Through consistent accumulation, DeFi Dev Corp has emerged as one of the largest institutional holders of Solana. The company’s Solana-per-share ratio (SPS) now stands at $14.67, reflecting the growing valuation of its blockchain treasury assets. Analysts view this as a signal of deep institutional confidence in Solana’s ecosystem resilience and scalability.

Recommended Article: Solana Eyes $210 Rally as Analysts Predict Strong Q4 Momentum

Solana’s Growing Role in Institutional DeFi

Solana’s appeal to enterprises lies in its low fees, high throughput, and maturing DeFi infrastructure. DeFi Dev Corp’s ongoing commitment underscores how institutional adoption is gradually diversifying beyond Ethereum. As staking yields remain competitive and transaction volumes climb, Solana continues to cement its position among the top programmable blockchains.

Multi-Validator Staking Enhances Network Decentralization

By distributing its stake across several validators, DeFi Dev Corp contributes to Solana’s decentralization and consensus stability. This approach mitigates centralization risks and demonstrates best practices for corporate blockchain participation. The company also noted that validator diversification helps optimize staking returns and reduce operational exposure.

Financial Transparency Reinforces Investor Confidence

DeFi Dev Corp regularly discloses its on-chain holdings and validator activities to maintain transparency with shareholders. These disclosures have strengthened investor trust and align with the broader trend of verifiable, auditable blockchain operations. Such openness differentiates the company from traditional financial institutions engaging in digital asset management.

Long-Term Strategy Anchored in Blockchain Utility

Executives reiterated that Solana’s utility, ecosystem momentum, and staking efficiency make it a core asset within the company’s balance sheet strategy. Future acquisitions will likely follow similar disciplined entry points and network participation models. The firm’s focus remains on sustainable yield generation and support for blockchain scalability initiatives.

Outlook: Institutional Confidence in Solana Remains High

DeFi Dev Corp’s latest purchase reinforces institutional belief in Solana’s potential to dominate high-performance DeFi. Analysts expect other corporate treasuries to adopt similar strategies as staking frameworks mature. With expanding validator participation and transparent disclosures, Solana’s ecosystem continues to attract long-term capital focused on growth and stability.