CleanCore Expands DOGE Treasury Rapidly

In just three days, CleanCore Solutions almost doubled its Dogecoin holdings, getting more than five hundred million DOGE. The first purchase came with 285 million tokens. The quick accumulation shows how quickly the company is carrying out its strategy, which shows how determined it is to become a major player in the meme coin ecosystem.

CleanCore, which is listed on the Nasdaq, said it plans to buy up to one billion DOGE in the next 30 days. Corporate accumulation shows that more and more institutions are treating meme coins as treasury assets. Market observers highlight acceleration as a signal of confidence in DOGE’s future potential as a reserve asset.

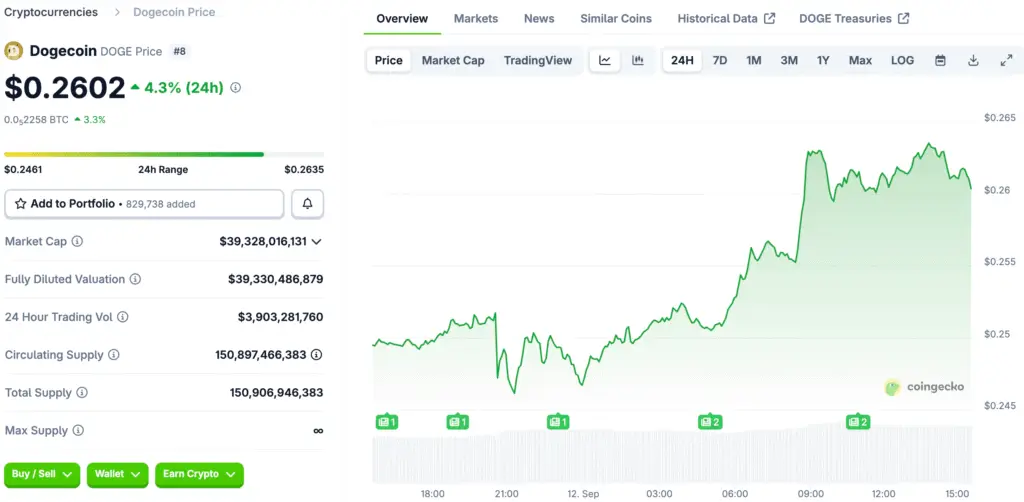

Market Reacts to Treasury Announcement

After the treasury expansion, CleanCore’s stock rose 14% in after-hours trading before falling back. The market cap is close to $55 million. The stock market’s reaction shows that investors are excited about the company’s risky treasury strategy, even though it comes with a lot of risk because of its exposure to Dogecoin.

Analysts say that there is a link between treasury moves and stock prices. Investors see DOGE’s strategy as a new way to diversify their portfolios, which makes it more visible and relevant in the digital asset economy. Even though there are risks, momentum shows that institutions are becoming more willing to use meme coin accumulation as a forward-looking financial strategy.

Corporate Vision Emphasizes Dogecoin Utility

Marco Margiotta, the Chief Investment Officer, said that the goal is to make Dogecoin the best reserve asset that can be used for a wider range of payments and remittances around the world. The strategy fits with the House of Doge collaboration and the corporate arm that was set up by the Dogecoin Foundation. The long-term goal is to get five percent of the total circulating supply.

The company focuses on staking products, tokenization projects, and remittance apps that use the Dogecoin infrastructure. CleanCore wants to move DOGE beyond meme status by making it more useful. The goal of the strategy is to make DOGE the main currency for decentralized payment networks, which will make it more legitimate in the larger global blockchain economy.

Recommended Article: Dogecoin Price Surges With ETF Launch And Bullish Momentum

Custody Strengthens Institutional Credibility

Robinhood’s Bitstamp system ensures institutional-quality security for DOGE’s treasury, enhancing investor confidence and safety. CleanCore’s approach, characterized by clear custody, sets it apart from other treasury models in changing regulatory environments.

This transparency lowers concerns about mismanagement and demonstrates a commitment to responsible practices. The company’s institutional-grade arrangements support DOGE’s growth as an asset that can serve as a treasury reserve, boosting stakeholder confidence in their strategies.

First DOGE ETF Getting Ready to Hit the Market

The launch of the first spot Dogecoin ETF is expected to occur within a week, thanks to the REX-Osprey partnership. ETFs offer regulated exposure, potentially increasing demand and liquidity. Bloomberg analysts suggest that ETFs may mix spot holdings with derivatives to provide investors with more options while maintaining spot exposure.

The introduction of ETFs could make Dogecoin more legitimate in institutions’ eyes, making it easier for both retail and professional investors to invest. This is significant for meme coins, as it demonstrates their relevance in mainstream finance and aligns with global market narratives.

Institutional Treasuries Make Meme Coins Real

CleanCore is among the institutions collecting meme coins, a trend that extends beyond Bitcoin holding. This shift makes DOGE a more legitimate and strategic treasury asset. As more institutions show interest, meme coins can become real reserve assets. The fact that a Nasdaq-listed company is buying meme tokens supports their popularity in institutional settings.

Corporate participation accelerates adoption, strengthening the foundations for long-term value growth. The industry trend suggests that meme coin treasuries may last, potentially affecting the widespread use of meme coins by banks worldwide.

Dogecoin’s Future Hinges on a Balance of Hype and Utility

The quick rise of CleanCore and the launch of the ETF are both important events that will affect the future of Dogecoin. Treasury growth shows that institutions believe in the market, while ETFs make it easier for more people to invest. When these things happen together, they make it more likely that DOGE will be accepted in financial markets.

There are still problems, like unstable markets and unclear rules. But institutional strategies and ETF approvals make the case for continued relevance stronger. The future of Dogecoin will depend on finding a balance between meme appeal and utility growth. This will be helped by companies like CleanCore using DOGE in their global financial plans.