Chainlink Price Rebounds as Buying Pressure Builds

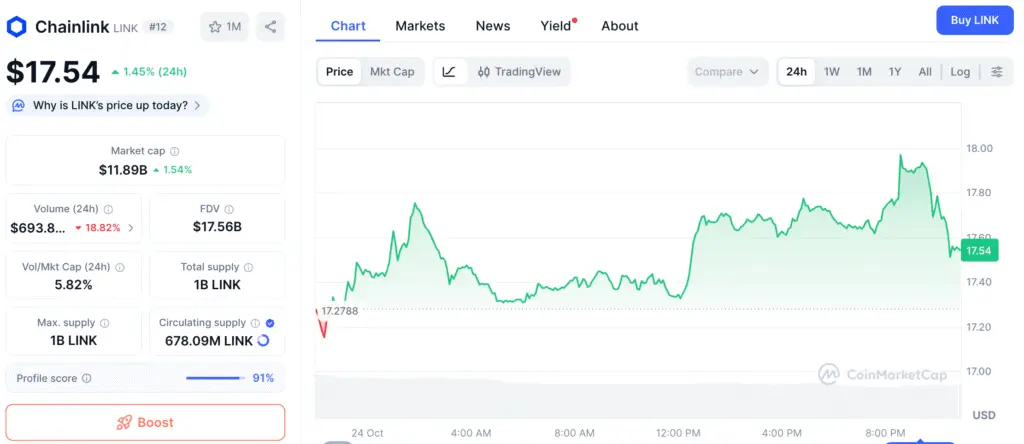

After a week of ups and downs that temporarily brought prices below $17, Chainlink (LINK) is becoming stronger again. The coin has subsequently risen by more than 1.6% and is now trading at around $17.72 as the market steadily becomes more positive.

Analysts think that the correction may have been the bottom for a short time. Chainlink might be getting ready for a long-term rebound in the next few weeks as institutional investors purchase more and major technical indicators show buy signals.

Whale Accumulation Signals Institutional Confidence

On-chain data shows that big investors are aggressively accumulating. Lookonchain says that two whale wallets took out a total of 128,000 LINK worth more than $2.2 million from centralized exchanges in only a few hours.

This is part of a larger pattern of accumulation, with exchanges taking in more than 1.4 million LINK in the last few weeks. These withdrawals lower the pressure on sellers and usually mean that long-term holders are getting ready for higher prices.

Chainlink Reserve Strengthens Network Stability

The Chainlink Reserve, which was established to help the ecosystem last for a long time, saw its twelfth straight inflow this week, which boosted investor confidence. The reserve now has 586,641 LINK, which is worth around $10.4 million. It got 63,481 LINK.

ChainLinkGod (Zach Rynes) said that 90% of the new money came from USDC through Uniswap exchanges, while the other 10% came from user fees paid in LINK. These recurring purchases, which are based on real network income, show that Chainlink is moving toward a model that can support itself.

Recommended Article: New Wallet Accumulation Is Reshaping Chainlink Volatility and Stablecoin Adoption

Technical Indicators: Strong Buy Signals Flash

Chart experts have found many bullish technical patterns forming for LINK. There was a TD Sequential buy signal on the 4-hour chart, which means that the recent slump may be running out of steam.

Also, at the $17 level, a possible inverse head-and-shoulders pattern has formed. This is a classic reversal pattern that typically comes before breakthroughs. If momentum picks up, a verified move over $19.80 might go to $24 and higher.

Ali Charts Notes LINK Pattern Resembling Past Pre-Rally Accumulations

Ali (@ali_charts), a crypto trader, said that LINK’s structure is similar to earlier accumulation stages that resulted in big price increases. Gordon, an analyst, agreed with this and said, “Any $LINK bought for less than $20 is some of the easiest money you’ll find.” We’ll talk about this again when it goes above $100.

Key resistance is still around $19.80–$20, which is in line with a downward trendline from early September. If LINK breaks out of this zone, it might bring in fresh buyers and push the price up to $24 in the immediate future.

Risk Factors: What Could Invalidate the Bullish Setup

Even if people are getting more hopeful, experts say that if the stock closes below $16.80 every day, the positive perspective might be wrong. If this happens, the token might drop to $15 support, where buyers are likely to come in again.

Short-term volatility may continue as traders respond to things that affect the market as a whole, such as inflation statistics, ETF updates, and Bitcoin’s price changes. Long-term indications, on the other hand, still point to accumulation rather than dispersion.

Chainlink Poised for Recovery and Expansion

Chainlink seems to be entering a new phase of recovery as whale accumulation speeds up, institutional inflows rise, and technical setups come together. The strong ecosystem acceptance and sustained reserve financing make the optimistic argument even stronger.

Analysts think that LINK might have a short-term rise toward $24–$25 if it stays above $17 and breaks through the $20 hurdle. If Chainlink keeps going up, it might be one of the best cryptocurrencies by 2026.