ADA Price Action Approaches Key Resistance

Cardano has been going up steadily since its lows in June and is now hitting resistance near $0.97. Traders think this is a key point that could determine what ADA does next in the larger market.

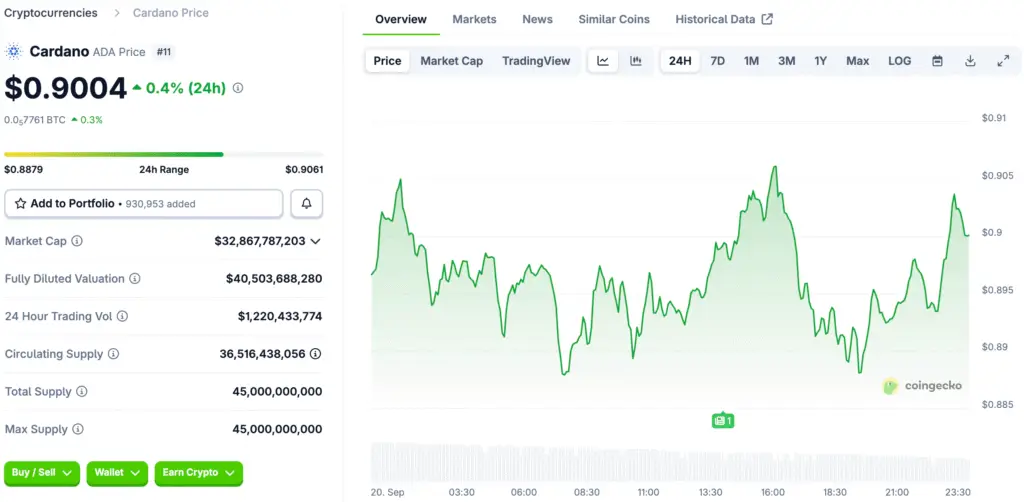

ADA has been making higher lows since it hit a low of about $0.72. Current trading near $0.905 shows that momentum is back and is testing important resistance zones that can confirm bullish continuation patterns.

Technical Chart Reveals Strong Recovery Trend

The ADA/USDT chart shows that the price is slowly rising again, with a lot of green candles every week. Support has been held between $0.80 and $0.82, bringing in buyers over and over again. This has set up a strong base for possible growth in the last three months of 2025.

The first target would be $1.03 if it breaks above $0.97, and the second target would be $1.15. These levels would be the highest trading range for ADA since early 2025, which would mean that investors are getting stronger again.

Market Sentiment Supports Positive Outlook

Cardano’s gains are in line with the market’s recovery. People felt better about altcoins because Bitcoin stayed above important levels. It’s a good sign that traders are moving into large-cap cryptocurrencies, which makes ADA’s bullish setup even stronger.

Investors are also confident because Cardano’s staking activity and DeFi adoption are steadily growing. These changes to the ecosystem make it more useful, which means that the fundamentals of demand will support price action that goes up.

Recommended Article: Cardano Price Rises on Bank Integration and ETF Approval

ADA Ecosystem Expands Amid Recovery

Cardano is still trying to add decentralized finance to its platform. The network’s capacity grows with ongoing partnerships and protocol upgrades. This is good for decentralized applications, lending markets, and DeFi protocols. When the whole crypto market is doing well, these things draw in investors.

People who hold onto their coins for a long time can expect steady returns from the growing staking ecosystem. If buying momentum keeps up in global crypto markets, supply issues may make bullish effects stronger as more ADA is locked up.

Potential Upside Targets for ADA Price

ADA could keep going up toward $1.03 and $1.15 in the next few weeks if the resistance at $0.97 breaks. These targets are based on resistance levels that have been around for a few months. If demand picks up again, it could be good for ADA investors in the long run.

If prices stay above $1.00, it would mean that the structure has changed in a way that is good for the market. Individual traders and big institutional investors who are keeping a close eye on large-cap altcoins could both make more money if these kinds of changes happen.

Downside Risks if Resistance Holds Firm

If ADA can’t get past $0.97, it will probably have to go back into consolidation phases. The next safety net will be support near $0.85–$0.82. But if it drops below $0.80, it could hurt the bullish mood a lot.

Bearish rejection could lead to retesting summer lows and wiping out recent gains. Traders are paying attention to risk management strategies at these levels and waiting for confirmation before adding to their positions.

Cardano Targets $0.97 as Traders Watch for Breakout or Consolidation

Traders are still using the $0.97 level as the next point of interest. If the breakout works, it could mean that new bullish cycles are starting. If it doesn’t work, consolidation ranges might last until late 2025.

Investors are hopeful because ADA’s ecosystem is growing and other altcoins are starting to recover. Because it has a lot of things going for it, Cardano is one of the most important cryptocurrencies to keep an eye on in the near future.