DCA Strategy Demonstrates Strong Long-Term Returns for ADA

The cryptocurrency market is known for its volatility, making strategic investment approaches a key to long-term success. A recent analysis of a Dollar-Cost Averaging (DCA) simulation on the Pintu app has vividly demonstrated this principle, highlighting the strong performance of Cardano (ADA) over a one-year period. For an investor who committed to a consistent monthly investment of Rp1 million from August 2024 to August 2025, the results were impressive.

The total capital invested amounted to Rp12 million, but as of August 8, 2025, the value of that investment had grown to an impressive Rp15,671,232. This represents a significant return of over +30.59%, showcasing the power of a disciplined investment strategy. This return is a clear testament to the effectiveness of DCA, which helps investors mitigate risk by spreading their purchases over time, thereby smoothing out the impact of price fluctuations and enabling them to capitalise on long-term price trends without the stress of market timing.

Cardano’s Current Price and Robust Market Overview

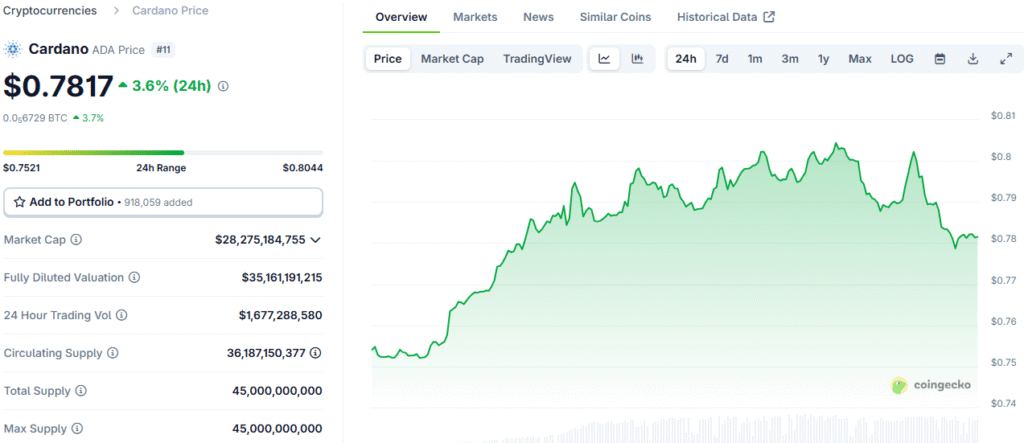

The DCA simulation’s positive performance is linked to Cardano’s strong market behaviour. On August 8, 2025, Cardano (ADA) recorded a 5.99% increase in the last 24 hours, highlighting its resilience amidst volatile crypto market conditions. The asset’s market capitalisation is Rp463.55 trillion, making it one of the largest digital assets in the market.

Its circulating supply stands at 36.18 billion ADA out of a maximum of 45 billion ADA, and the last 24-hour trading volume reached Rp26.02 trillion, indicating high investor interest and liquidity. These metrics suggest a healthy and active market, laying a solid foundation for Cardano ecosystem growth.

The DCA Method: A Disciplined Approach to Investment

The Dollar-Cost Averaging (DCA) method is a strategy used by investors to navigate the unpredictable nature of the crypto market. It involves investing a fixed amount of money at regular intervals, regardless of the asset’s price, to avoid common mistakes like panic-selling or FOMO-buying. This disciplined approach helps investors acquire more tokens when prices are low and fewer when prices are high, resulting in a lower average cost per token over time.

DCA is ideal for long-term financial goals and those believing in the growth potential of crypto assets like Cardano. Although it doesn’t guarantee consistent profits, the Pintu simulation shows it can help investors build wealth steadily while managing market volatility risks.

Leveraging the Pintu App’s DCA Feature

The Pintu app offers a convenient Routine Saving Simulation (DCA) feature for investors looking to implement a DCA strategy for Cardano. This feature simplifies the investment process by allowing users to automatically purchase crypto assets on a set schedule. Users can easily determine their desired investment amount and frequency, and the app monitors their routine savings results.

This feature empowers investors to be disciplined without the hassle of manual purchases, ensuring they stick to their long-term financial goals even in volatile market conditions. The app’s seamless integration makes it accessible to a wide range of investors, from seasoned enthusiasts to beginners.

The DCA Advantage: Minimising Risk in a Volatile Market

The recent DCA simulation on the Pintu app offers a compelling case for how this investment strategy can minimise risk. The crypto market’s highly dynamic nature means that prices can change dramatically in a short period. An investor who tries to time the market may buy at a local top, leading to a significant loss of capital. However, an investor who uses the DCA method avoids this risk by spreading their capital over time.

For example, in a volatile period, a DCA investor might buy a small amount of ADA at a high price, but they would also buy more at lower prices during the dip. This balances out their average cost, making them less vulnerable to short-term price swings. The DCA strategy for Cardano, as shown by the simulation, demonstrates how this method can help investors weather market volatility while still benefiting from the long-term upward trend of a promising digital asset. It is a patient and prudent approach that prioritises consistency and long-term growth over short-term speculation.

The Broader Context of Cardano’s Market Health

Cardano’s positive performance, as evidenced by the DCA simulation, is a reflection of its broader market health and the confidence of its community. The cryptocurrency’s high market capitalisation and significant trading volume are strong indicators of a vibrant and active ecosystem. With an outstanding supply of 36.18 billion ADA out of a maximum of 45 billion, the tokenomics are well-defined, providing a clear path for supply and demand dynamics.

This stability, combined with the DCA method’s ability to mitigate volatility, makes Cardano an attractive asset for a diverse range of investors. The DCA simulation’s success, in the face of what the article describes as a “highly dynamic nature” of crypto price movements, serves as a powerful testament to both the resilience of Cardano and the efficacy of this investment strategy. It highlights that even amidst market uncertainty, a disciplined approach can yield substantial returns.

Pintu Simulation Endorses DCA for Cardano’s Future

The endorsement of the DCA strategy through the Pintu simulation, combined with Cardano’s strong market fundamentals, paints a promising picture for ADA’s future. The convergence of a disciplined investment method with a resilient and growing digital asset offers a compelling case for optimism. As Cardano continues to navigate the complexities of the cryptocurrency market, the potential for sustained growth, supported by a loyal community and a robust ecosystem, is undeniable.

The positive performance of the DCA simulation serves as a vivid testament to the power of a long-term, patient approach to crypto investment. For investors and enthusiasts alike, Cardano’s journey represents a compelling narrative of resilience, collaboration, and strategic innovation, a narrative that is bound to attract a new wave of interest and excitement in the competitive cryptocurrency landscape. Ultimately, the DCA method for Cardano provides a clear and effective way to participate in its growth, making it a valuable tool for anyone with long-term financial goals in the crypto space.

Read More: Cardano ADA Rally Potential Surges with Key Upgrades