Analyzing the Bullish Case for Cardano

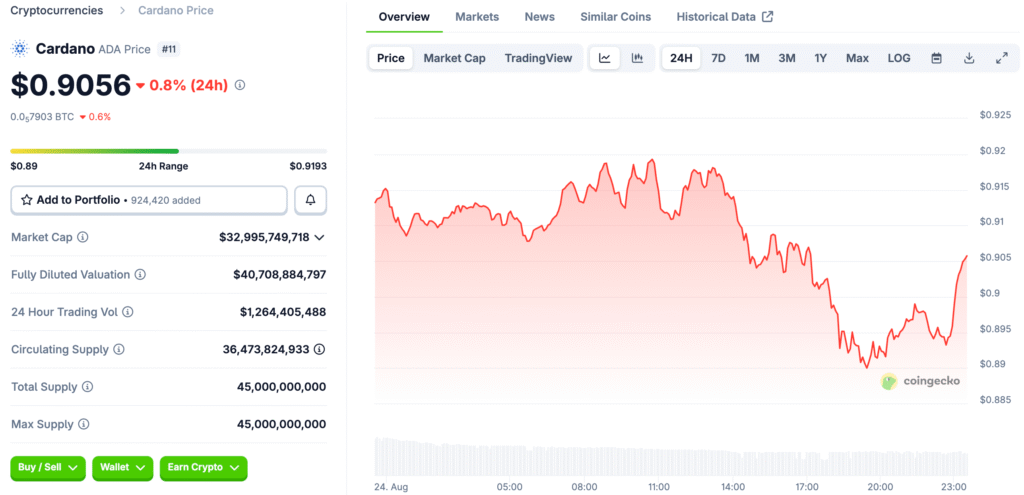

Cardano, or ADA, has been one of the most closely watched altcoins in recent months, and for good reason. A growing number of experts are highlighting its potential for a major breakout, driven by a compelling mix of technical indicators and strong institutional fundamentals. The bullish case for Cardano is not built on speculation alone; it is rooted in a methodical analysis of its price action and on-chain metrics.

The token’s recent performance has been compared to its historical 2020-2021 bull run, where it delivered life-changing returns by soaring from a mere $0.15 to a peak of over $3. This historical pattern is now serving as a powerful roadmap for analysts who believe that ADA is on the cusp of repeating its most successful performance.

A Bull Flag Pattern Signals an ADA Rally

Cardano’s recent price action has formed a bull flag pattern on short-term charts, a powerful technical indicator that signals the potential for a strong upward move. According to an analyst, a breakout above the key level of $1 could signal a move toward price targets of $1.80, with a more ambitious target of $2.12. This is further supported by the token’s breakout through a symmetrical triangle formation on the weekly chart.

These patterns indicate a period of accumulation and consolidation, where the market is coiling before a decisive move. On-chain metrics, such as the Relative Strength Index, or RSI, have also shown a steady increase in momentum, rising from 41 in mid-June to 59 as of late August. This increase in momentum, combined with the clear technical patterns, provides a compelling case for a future rally.

Read More: Cardano’s Next Chapter: A Trader Predicts a Monumental Rally to $6.50

A Surge in Futures Volume and Investor Activity

The bullish sentiment around Cardano is further reinforced by a significant surge in trading activity. In August, ADA’s futures trading volume reached a five-month high of $7 billion, reflecting a heightened level of engagement from both institutional and retail investors.

This surge in volume is a key indicator of strong interest and aligns with the last significant ADA price rally, which occurred in March 2025 when prices were also above the $1 mark. The increase in futures volume suggests that sophisticated investors are taking a position in anticipation of a major price movement. This is a crucial metric to watch, as it can often precede a sharp upward move in the underlying asset’s price.

The Impact of a Potential Cardano ETF Approval

The possibility of an Exchange Traded Fund, or ETF, approval for Cardano has further fueled optimism and is a major fundamental driver for the asset. As of late August, the odds of regulatory approval for a Cardano ETF stood at 81%, a significant jump from 59% in early August. This development has spurred increased institutional interest, with the Total Value Locked, or TVL, in Cardano’s decentralized finance protocols rising to $423.6 million, a 56% increase since July 1.

Historical data suggests that such growth in TVL has coincided with significant price movements, as seen in late 2024 when a 271% TVL increase was followed by a 300% ADA price rally. A successful ETF approval would open the floodgates for a new wave of institutional capital to flow into the ecosystem.

Institutional and Retail Interest in BONK and PENGU

While Cardano is a major focus, other altcoins are also drawing significant attention. The Solana-based meme coin BONK has attracted institutional interest, with a drinks company recently announcing plans to acquire up to $115 million worth of the token by year-end. This corporate backing, along with a $25 million treasury boost from a partnership with a Nasdaq-listed company, signals renewed confidence in the token.

PENGU, another emerging meme coin, has demonstrated strong performance, with a price surge of over 151% in the last 30 days. While PENGU may lack the institutional backing of BONK or ADA, its growing popularity and social media traction have contributed to increased retail participation. These two tokens highlight the diverse nature of the current altcoin market.

Exploring New Avenues for Asymmetrical Returns

In contrast to the momentum in established projects like Cardano and BONK, some analysts have highlighted the potential for newer tokens with smaller market caps to deliver exponential returns. Projects like Token6900 have been cited as alternatives that could outperform legacy altcoins in the current market phase.

These projects, still in early accumulation stages, offer asymmetrical upside potential and are being positioned as breakout candidates in the next rotation phase of the altcoin cycle. For investors with a higher risk tolerance, these smaller, emerging tokens represent a new avenue for capturing significant gains, and they are a key part of the broader market dynamic.

Cardano’s Position in a Shifting Market

The current altcoin landscape is a mix of established projects with strong technical and institutional fundamentals and newer tokens with high growth potential. Cardano is particularly well-positioned for a major breakout, fueled by bullish technical indicators, a surge in trading volume, and the increasing odds of an ETF approval. Its price action is closely mirroring a historical pattern that led to a massive rally, and its on-chain metrics are reinforcing the bullish case.

The activity in other tokens like BONK and PENGU also demonstrates a broader trend of capital rotation into projects with compelling narratives and strong fundamentals. Investors are advised to balance their portfolios to capture both stability and speculative upside, as the market enters a new phase of growth.