Binance Coin Shows Resilience After Volatile Week

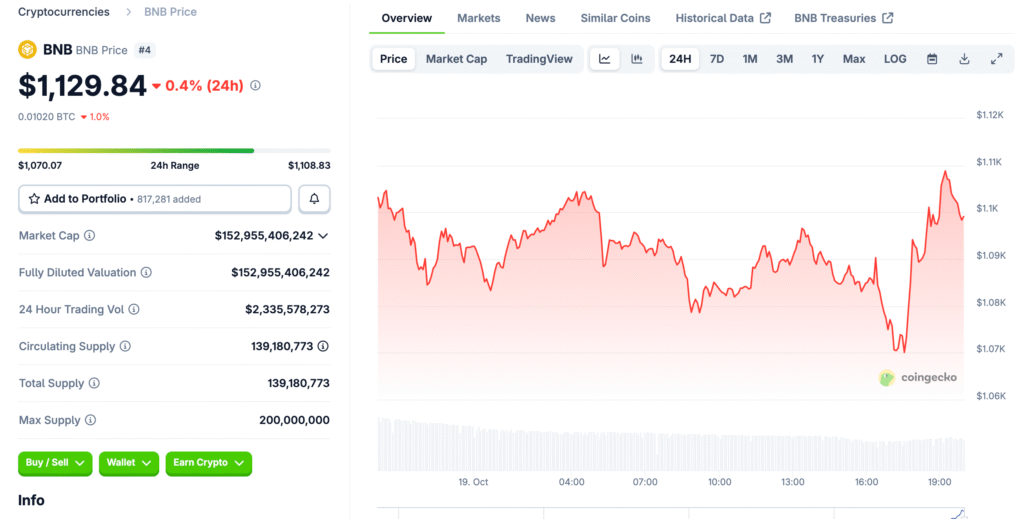

Binance Coin (BNB) has demonstrated remarkable resilience after a week marked by volatility across major crypto assets. The token briefly dipped below $1,100 before recovering strongly toward $1,150, closing the week as a standout performer. Despite a 12.4% weekly drop, BNB remains up more than 50% year-to-date, reflecting the enduring strength of the Binance ecosystem. Analysts attribute this stability to Binance’s proactive measures to restore confidence after market disruptions.

Binance Launches $400 Million Compensation Fund

In response to recent flash crashes and trader losses, Binance announced a $400 million compensation fund. The initiative aims to support users impacted by liquidations triggered during last week’s extreme volatility. The program includes partial reimbursements and targeted BNB airdrops for affected traders. This decisive move helped stabilize market sentiment and reaffirm Binance’s reputation as a reliable platform during turbulent conditions.

BNB Defends Key Support Levels Amid Bearish Pressure

From a technical standpoint, BNB remains within a descending channel but continues to defend critical support between $1,100 and $1,120. The token’s rebound from a $1,040 intraday low indicates strong accumulation at these levels. Analysts note that maintaining this support range could provide the foundation for a broader recovery. Momentum indicators, however, remain mixed, suggesting cautious optimism among traders.

Recommended Article: The Crypto Rally: Ethereum and BNB Lead a Market Rebound

Technical Indicators Highlight Resistance Challenges Ahead

The 50-day exponential moving average (EMA) remains below the 100-day EMA, signaling continued short-term bearish momentum. BNB must close above $1,138 to invalidate the current descending pattern and restore upward bias. Resistance zones near $1,192 and $1,251 represent potential breakout targets if buying strength accelerates. Failure to hold above $1,020, however, could expose BNB to additional declines toward $978 or $928.

Analyst Notes Long-Term Bullish Framework Still Intact

Analyst BATMAN observed that BNB’s long-term trend remains anchored to a rising trendline extending from the $600 region. This structure suggests that the overall bullish framework could remain intact if price stability persists above $1,100. The ability of BNB to hold these critical zones has reinforced its reputation as one of the market’s more stable large-cap assets. Sustained institutional interest and continued exchange activity further support its long-term growth outlook.

Broader Altcoin Market Begins Showing Recovery Signs

BNB’s rebound has also triggered renewed optimism across the altcoin market, which has suffered from weeks of volatility. Several leading assets, including Ethereum and Solana, have shown modest recoveries alongside Binance Coin. Analysts believe BNB’s performance could act as a bellwether for broader altcoin sentiment heading into late October. If momentum holds, a sector-wide recovery may follow as investor confidence gradually rebuilds.

Bitcoin Hyper Introduces Solana-Powered BTC Layer 2 Solution

Adding to the week’s developments, Bitcoin Hyper ($HYPER) has entered the spotlight with a unique Layer 2 model. Built on the Solana Virtual Machine, it combines Bitcoin’s security with Solana’s transaction speed. This integration allows smart contracts, decentralized applications, and token creation within the Bitcoin ecosystem. With over $23.9 million raised in presale, Bitcoin Hyper represents the next phase of Bitcoin scalability and innovation.

Key Technical Takeaways For Traders

BNB currently faces resistance near $1,138 and $1,192, while key support remains at $1,020 and $978. The RSI indicator sits at 40, reflecting weak but stabilizing momentum after recent sell-offs. A confirmed breakout above the $1,150 mark could accelerate recovery toward $1,200 in the coming sessions. Conversely, a failure to sustain above $1,100 might trigger renewed short-term pressure.

Outlook: BNB Poised To Lead Next Altcoin Rebound

As Binance continues to enhance investor protection and market confidence, BNB remains positioned as a potential leader in the next altcoin uptrend. The combination of strong fundamentals, strategic interventions, and resilient price action supports its bullish medium-term trajectory. If the broader market stabilizes, BNB could pave the way for renewed investor participation across the sector. Traders now watch closely to see if Binance Coin can maintain its momentum above $1,100 and extend its gains into the final quarter of 2025.