BitMine Expands Ethereum Treasury Holdings

BitMine Immersion recently bought more than $1.1 billion worth of Ethereum, bringing its total to 2.42 million ETH. The company listed on the Nasdaq now owns more than 2% of the total ETH supply, making it the largest Ethereum treasury among public companies around the world. This big change shows that BitMine is moving away from Bitcoin mining as part of its strategy.

The company’s balance sheet is now over $11 billion, mostly because of its strategy of buying up Ethereum. BitMine owns Ethereum worth more than $10 billion, 192 Bitcoin worth $21.6 million, and a lot of cash. This makes the company a key institutional player in the long-term use of Ethereum and the integration of its treasury.

Share Sale Causes Stock Price to Drop

BitMine’s stock fell almost 10% on Monday, closing at $55.30 per share, even though the company bought Ethereum. The drop came after the company said it would sell $365.2 million worth of stock to an unnamed institutional investor. Shares fell sharply, but BMNR stock is still up more than 3% in the past month, which shows that investors are unsure.

BitMine has gotten money for its Ethereum acquisition program by selling stocks and bonds. The most recent sale of shares shows how aggressively the company is trying to grow its ETH reserves, even though the market is under short-term pressure. This dual approach has gotten mixed reactions from investors, with some being hopeful about Ethereum and others worried about stock dilution.

Tom Lee Supports the ETH Strategy

Tom Lee, the chairman of BitMine and managing partner at Fundstrat Global Advisors, talked about how Ethereum could be useful in the long run. Lee said that Ethereum would be one of the biggest macro trades over the next ten years because it is being used by institutions. He said again that the company’s goal is to control 5% of the total supply of Ethereum.

Lee had said before that Ethereum could compete with Bitcoin as institutional investors put more money into ETH and its network. He thinks that Ethereum is a key part of digital finance because it can be used in decentralized apps and for settling stablecoins. His positive outlook is still guiding BitMine’s strategy for building up its treasury.

Recommended Article: Ethereum Whales Shake Market as $72M Sale Tests Support

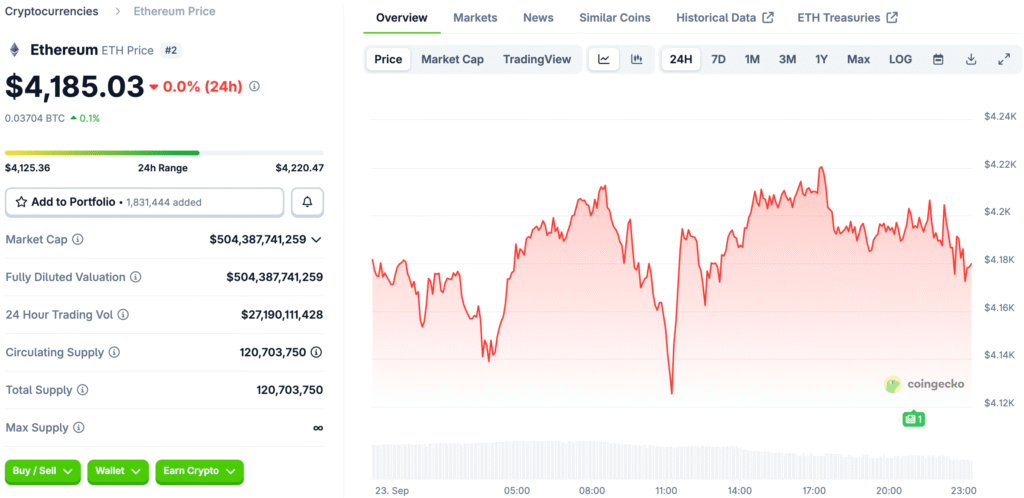

Ethereum Price Trends and Market Impact

Ethereum was trading at about $4,181 after a 12% drop in value over the course of a day. This shows that it is volatile even though it has strong fundamentals and is becoming more popular. Analysts say that Ethereum’s role as a decentralized network for stablecoins and decentralized finance makes its long-term case stronger. BitMine’s aggressive buying could affect the liquidity of ETH and the overall mood of investors.

Because of recent drops and ongoing volatility, people who watch the market are still cautious about Ethereum’s short-term price movement. But institutional interest, such as corporate treasuries and regulatory progress in the U.S., keeps making the case for investing in Ethereum stronger. This means that it will still be relevant even if daily trading activity changes.

BitMine’s Balance Sheet and Diversification

BitMine said it had $345 million in cash that wasn’t tied up and a $175 million stake in Eightco, along with Ethereum. The company also owns 192 Bitcoin, which are worth more than $21 million, adding variety to its crypto portfolio. These assets add up to $11.4 billion on its balance sheet, making it one of the biggest holders of digital assets.

This diverse treasury makes BitMine better able to handle short-term changes while still having long-term exposure to Ethereum. The company’s strategy is multi-layered because it has cash reserves, Bitcoin, and investments in other companies. This keeps Ethereum at the center of its growth and accumulation plan while also making it more resilient.

Regulatory Developments Influence Strategy

BitMine’s plan fits in with bigger changes in the law, like the GENIUS Act that President Trump signed in July. This law sets up a way for stablecoins to be issued in the U.S., which makes Ethereum a more important settlement network. The rules have made it more likely that big companies and banks will issue stablecoins, which makes Ethereum more important.

Tom Lee thinks that these changes prove that Ethereum will be a long-term player in global finance. BitMine’s aggressive strategy for buying Ethereum is more likely to work because of clear rules, businesses using it, and investors’ interest. This situation could speed up the process of adding ETH to corporate treasuries and institutional portfolios around the world.

BitMine Expands Its Ethereum Treasury Model Beyond Bitcoin’s Strategy

BitMine’s goal of getting 5% of the ETH supply shows how crypto is becoming more important in corporate treasuries. Like Bitcoin-focused companies like Strategy, this one uses the same model, but it applies it to Ethereum’s decentralized finance ecosystem. This method makes BitMine a leader in managing Ethereum-focused treasuries.

There are short-term risks, like stock price swings and ETH price swings, but the long-term outlook is still positive. BitMine’s position could give it big strategic and financial benefits if more people start using Ethereum. The way the company is going about it is a big bet on Ethereum’s future in global digital finance.