Bitcoin Whale Starts Selling Again After Huge Four Billion Dollar Swap

A Bitcoin whale who sold 36,000 BTC for Ether in August started trading again on Sunday, putting in more than 1,000 BTC. This wallet, which had been inactive for eight years, sent 1,176 BTC worth $136 million to Hyperliquid, which is a sign that liquidation pressures are back on the rise.

Whale activity often affects how traders feel. For example, big sales can make traders worry about downward pressure in already volatile cryptocurrency markets around the world. These kinds of moves are closely watched because they show shifts in smart money and possible trend reversals in Bitcoin’s ongoing price consolidation phase.

Ethereum Swap Leaves Whale Facing Possible Paper Losses Right Now

The tracked whale traded Bitcoin for Ether when BTC was worth more, which could mean paper losses if the assets are converted back now. Based on current ETH to BTC conversion rates, Lookonchain says that whale would lose about 460 BTC, which is worth more than $53 million.

The ETH to BTC ratio went up six percent recently, even though it is still well below its all-time high. This keeps downward pressure on the market as a whole. This suggests that a whale strategy may involve positioning for the long term rather than making money right away, even though the market impact in the short term is still bad.

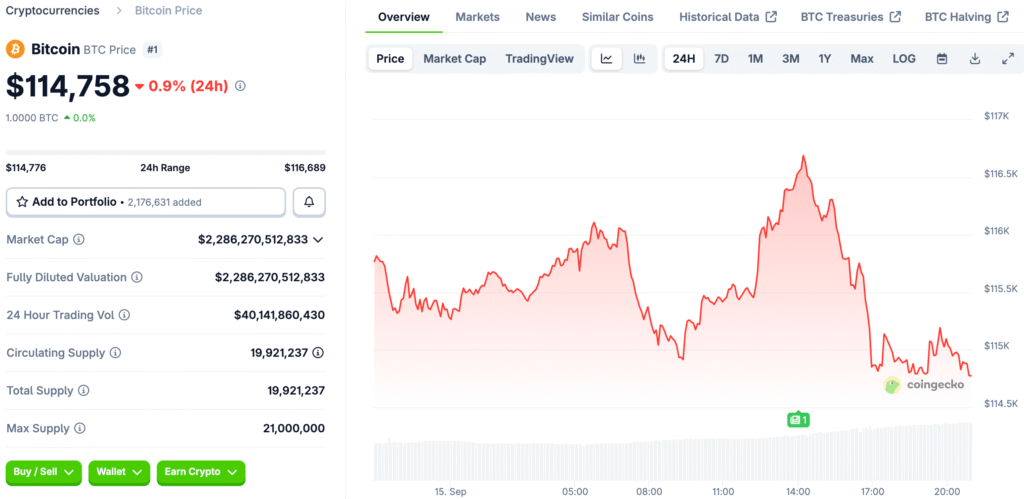

Bitcoin Price Struggles To Break Resistance Around 116000 Level

Bitcoin stayed close to the $116,000 resistance level and couldn’t keep going up after briefly reaching $116,182 before falling back below $115,000. Current levels show sideways trading, which is frustrating for bullish traders who were hoping for breakouts above resistance that was last tested in late August.

Prices for BTC are still down seven percent from their highs in August, when they were above $124,000. This shows how hard it is to keep up with global economic headwinds. Traders are still being careful, weighing the selling pressures from whales against the seasonal optimism for possible year-end rallies in the broader cryptocurrency markets.

Recommended Article: Bitcoin Price Prediction With All-Time Highs Approaching

Historic Dormant Wallets Add to Market Volatility Signals Recently

Bitcoin whale wallets have reactivated after years of dormancy, sparking speculation about high-value transfers. One wallet, which had been inactive for 13 years, sent 445 BTC to Kraken, causing concern about increased selling pressure on other exchanges.

Another wallet, inactive since 2012, made a transaction with 480 BTC, but the activity appeared more like internal transfers than sales. These sudden wallet reactivations indicate uncertainty and may prompt older holders to reconsider their strategies due to current market conditions.

Whale Selling Sparks Debate Over Market Impact and Investor Psychology

When whales sell a lot of Bitcoin, it makes people worry about too much supply, which lowers confidence because retail traders see liquidations as bad news for Bitcoin. Psychological effects often make the market more volatile, and analysts keep a close eye on whale movements to see if they can find clues about possible changes in direction.

These kinds of sales don’t always cause immediate crashes, but they do put pressure on sentiment, which makes investors who want stability in volatile markets more cautious. As a result, traders who want to successfully navigate Bitcoin’s unpredictable price cycles must keep an eye on whale behavior.

Analysts Highlight Long-Term Context Behind Recent Whale Movements

Market analysts say that whale sales shouldn’t be taken too seriously because long-term holders sell their shares from time to time without losing all faith in the market. Historical data shows that whales may rebalance their portfolios or spread out their investments. These are not necessarily signs of a broader collapse in Bitcoin’s price.

Still, the fact that whales are timing their trades with key resistance levels makes bearish concerns stronger, which makes technical analysis harder for cautious traders right now. So, analysts say that to get a good overall view of the market, you should balance whale tracking with fundamental and macroeconomic indicators.

Bitcoin’s Bullish Direction Depends on Breaking $116K

Future BTC direction depends on breaking above $116,000 with strong volume, which would mean overcoming whale-driven selling pressures that are making it hard for the current bullish momentum to continue. If the price doesn’t break through resistance, it could make downside risks stronger. Traders are looking at $112,000 support as a possible fallback in case the market stays volatile.

On the other hand, sustained breakouts could boost confidence, counteract whale influence, and support Bitcoin’s long-term upward trend toward previous record highs. In the end, whale actions and macroeconomic signals will decide whether Bitcoin stays stable or starts bullish rallies again soon.