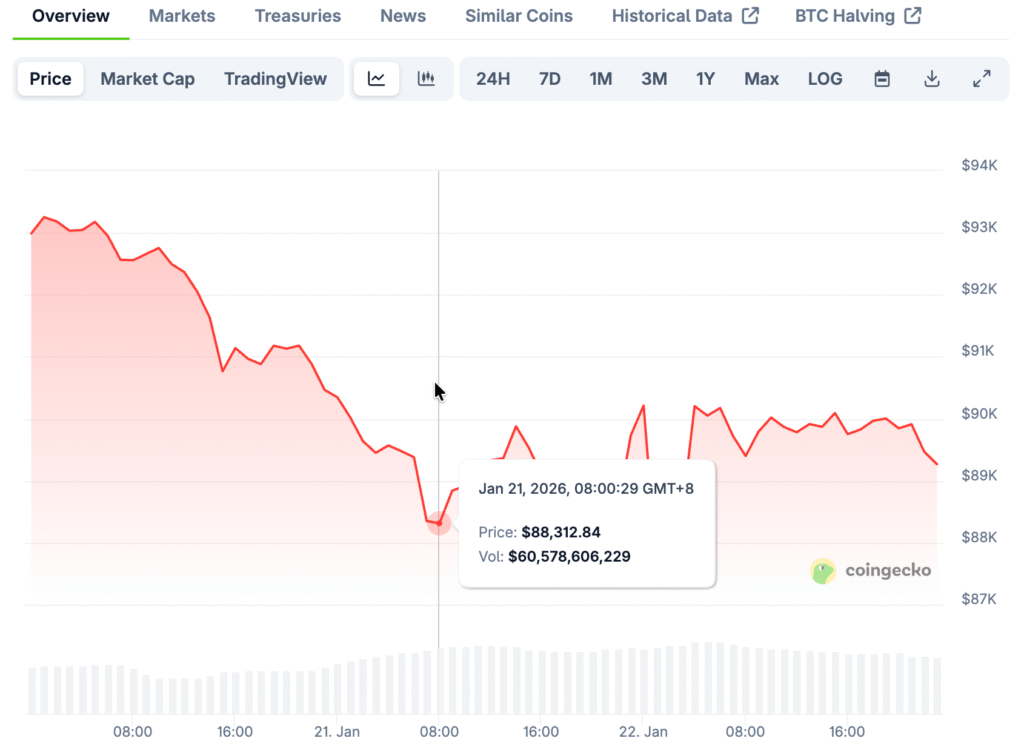

Bitcoin Drops Back After Brief Rise Toward $90,000

Bitcoin got close to $90,000 for a short time before falling back to around $88,000 as traders took a second look at the market’s momentum and liquidity. Selling pressure came back quickly as the larger crypto markets got weaker and leveraged positions started to unwind. The reversal showed that confidence was still shaky after recent market swings and buyers not following through as promised.

Even though prices went down, they were still closely tied to political and macroeconomic news that shaped expectations. Instead of building on the short rally, traders were more interested in technical resistance. This behavior made the current situation worse, where upward moves have a hard time keeping their momentum.

Trump Comments Spark Short-Lived Optimism

Donald Trump wants the United States to stay the world’s center for cryptocurrency innovation. He also said that Congress is working on a law about the structure of the crypto market that he hopes to sign soon. At first, those comments made people feel better about major digital assets.

Traders’ hopes faded as they thought about recent problems with the stalled regulatory proposal. Political talk alone wasn’t enough to get past technical resistance and cautious positioning. Because of this, excitement quickly faded after the first reaction.

Regulatory Uncertainty Is Back in the Spotlight

The proposed market structure bill lost support after Coinbase pulled out before an important markup session. Coinbase said that changes could limit stablecoin rewards and make competition less dynamic. Those worries brought back fears that laws could hurt industry growth instead of helping it.

Prediction markets showed the change in expectations by lowering the odds of passage by a lot. Polymarket showed that the chances of approval were much lower in 2026 than they were in early January. This drop made people even more doubtful that regulatory catalysts could keep bitcoin rallies going.

Recommended Article: Coinbase Withdraws Support for US Crypto Structure Bill

Analysts Urge Caution on Chasing Rallies

Several analysts said that bitcoin’s pullback signals weak short-term momentum instead of consolidation. Ed Engel, an analyst at Compass Point, stressed the importance of getting back to short-term holder cost bases close to $98,000. He said to be careful about chasing upside moves until those levels come back.

This point of view fits with other worries about liquidity sensitivity and positioning risks. When resistance isn’t resolved, markets often punish aggressive buying. Because of this, traders are still on the defensive, even though there are some positive headlines.

Prices Don’t Go Up When Institutions Buy

Sean Farrell of Fundstrat said that big purchases of bitcoin did not keep prices high. Strategy bought about $2.13 billion worth of bitcoin, but it didn’t make any lasting gains. Farrell said that this pattern often means that prices are about to go down when big flows can’t push them higher.

This kind of behavior makes it seem like there is still plenty of supply, even though there is a lot of institutional demand. After big purchases of government bonds, markets usually expect more activity. The lack of a response made people even more careful in digital asset markets.

Diverging Views Persist Among Researchers

Even though things have been weak and losing momentum lately, some analysts still had a positive outlook. 10X Research said that the pullback might be a chance to buy during a larger attempt to bounce back. For now, their positions are still leaning toward the long side.

But that hope comes with strict limits on how far it can go. A long-term drop below $87,000 would make the bullish scenario impossible. This kind of move could cause a bigger pullback and more volatility.

Market Sentiment Is Still Weak

After a tough late-2025 period, Bitcoin has lost a lot of its gains from the beginning of the year. Traders are becoming more sensitive to political uncertainty, signals of liquidity, and technical resistance. Until more clear reasons for change show up, the market is likely to be cautious.