Bitcoin’s Path to Record Highs Comes With Volatility

Analysts say that Bitcoin’s path to record highs is unlikely to be smooth and that there will be many sharp corrections along the way. Jordi Visser says that volatility is still a part of the market, just like it has been in the past with other high-performing assets.

Visser talks about how Bitcoin fits into bigger stories about technology, like AI. This growing connection makes people more interested in speculation, but it also makes the market less stable, which can lead to big pullbacks during bullish cycles.

Nvidia’s Example Offers Key Insights for Bitcoin Traders

Jordi Visser compares Bitcoin’s rise to Nvidia’s meteoric rise over the past few years, using past price movements as evidence. Nvidia’s stock price dropped by 20% five times, but it still went up by an incredible 1,000% after ChatGPT was released.

Bitcoin’s possible path may look a lot like this, with big rallies followed by sharp drops. Traders should be ready for these changes and know that corrections don’t always mean that bullish trends are over.

Historical Data Shows Bitcoin’s Corrections Are Normal

Bitcoin has had a lot of double-digit corrections in previous bull markets before reaching new highs. These times often shake out weak hands, stabilize the market structure, and fix leverage imbalances, all of which set the stage for long-term growth.

Investors can better manage their expectations if they know how Bitcoin cycles have worked in the past. Corrections, even though they are unpleasant, are not just bad things that happen; they are part of Bitcoin’s long-term bullish trends.

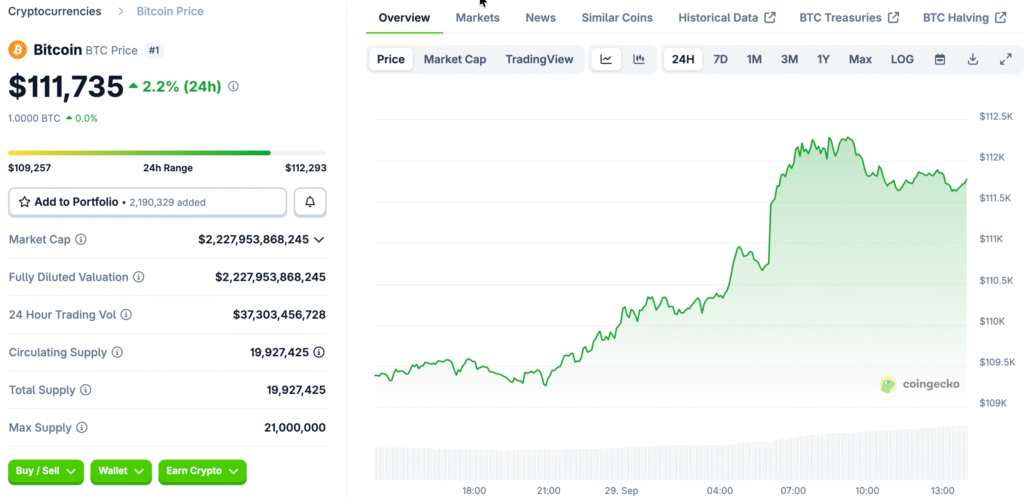

Recommended Article: Bitcoin Price Holds $111K As Bears Dominate Market Sentiment

AI Adoption Strengthens Bitcoin’s Macro Investment Case

Visser says that the quick rise of artificial intelligence makes Bitcoin a better digital store of value. Bitcoin is a way to protect yourself against changes in the economy as automation changes industries and breaks down traditional company structures.

This big story links Bitcoin to big changes in technology that have led to huge amounts of money moving around in the past. In a world economy that is changing quickly, institutional investors may see Bitcoin as a strategic asset more and more.

Regulatory and Policy Factors Shape Market Trajectory

During times of high volatility, Bitcoin’s price behavior is greatly affected by government policies and regulatory decisions. Analysts have said that the lack of a strategic Bitcoin reserve in the US has slowed down bullish momentum.

Changes in policy in the future, like national accumulation strategies or better regulatory frameworks, could cause prices to go up. On the other hand, restrictive measures may lengthen consolidation phases, which would slow down Bitcoin’s rise to new all-time highs.

Investors Debate Timing of Bitcoin’s Next Breakout

People in the market are still split on whether Bitcoin will reach new highs in the fourth quarter or stay in a long period of consolidation. Some predictions say prices will rise to $140,000, while others say they will fall back to $60,000 first.

This difference shows how uncertain Bitcoin’s short-term path is, even though its long-term fundamentals are strong. A lot will depend on macroeconomic changes, clear regulations, and changes in market sentiment when it comes to how investors position themselves.

Strategic Patience and Risk Management Are Essential

Experts say that investors should stick to their plans and expect prices to go up and down without giving in when they do. Historically, accumulating positions during corrections has led to good risk-reward outcomes for long-term investors.

Tools for managing risk, like stop-losses, diversifying your portfolio, and staged entries, are still very important. Bitcoin’s rise to new highs will likely test people’s emotional strength, and those who stick to their strategic beliefs during times of market turmoil will be rewarded.