Bitcoin’s Position Questioned Amid Regulatory Shifts

A new era for digital assets in the UK has arrived following the lifting of the crypto ETN ban. Yet, the nation’s largest retail investment platform, Hargreaves Lansdown, remains unconvinced about Bitcoin’s role in portfolios. The firm firmly believes Bitcoin is not an asset class suitable for long-term growth or income generation. This stance comes despite the surge in optimism among retail investors anticipating a broader crypto market rebound.

Hargreaves Lansdown’s assessment aligns with a cautious perspective toward crypto’s volatility and unpredictable price cycles. According to the platform, the inability to evaluate performance assumptions makes cryptocurrencies fundamentally unreliable. Without intrinsic value or consistent returns, they argue, Bitcoin cannot serve as a dependable tool for achieving financial goals. This skepticism contrasts sharply with government efforts to promote innovation in digital finance.

ETN Ban Lifted as UK Pushes for Market Competitiveness

The decision to lift the ban on crypto exchange-traded notes (ETNs) has drawn mixed reactions across financial circles. ETNs are structured debt instruments linked to specific assets, offering investors exposure without direct ownership. The UK government argues that reopening access will strengthen its position as a global crypto hub. However, Hargreaves Lansdown warns that accessibility does not equal safety.

While the change supports regulated exposure, it may also attract speculative behavior among inexperienced investors. Regulators aim to balance innovation with investor protection, but Hargreaves Lansdown insists risk awareness must remain paramount. The firm highlights the extreme volatility that once erased trillions from the market during the 2022 crypto winter. Caution, it suggests, should outweigh excitement in this newly liberalized environment.

Recommended Article: Bitcoin Blasts Past $125K as Exchange Balances Hit Six-Year Low

Bitcoin’s Volatility and Investor Risk Remain High

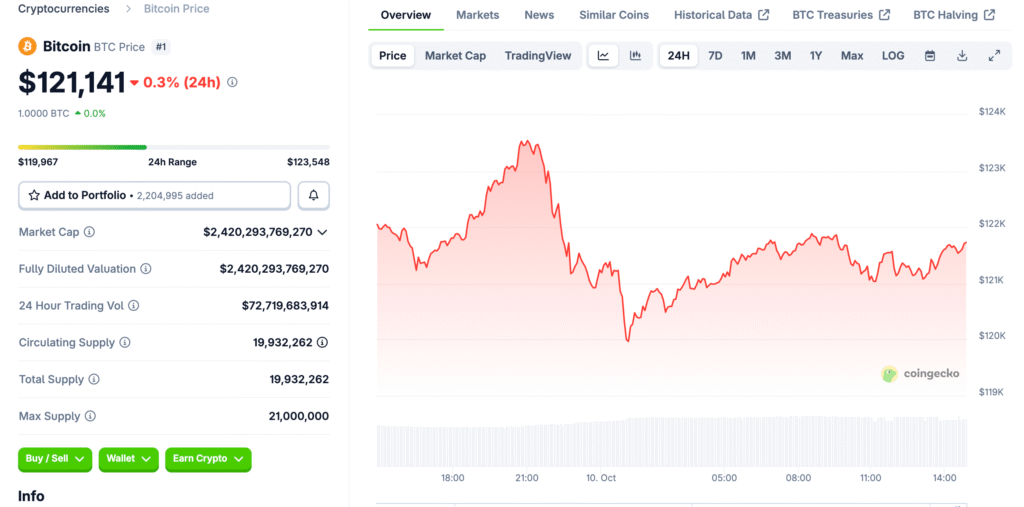

Bitcoin’s historical performance paints a story of both remarkable gains and devastating losses. Early adopters enjoyed life-changing profits, but many retail traders faced steep drawdowns during market downturns. As of October 2025, Bitcoin trades around $121,500, yet its price remains highly unstable. Even small market shifts can trigger large value fluctuations, underscoring its speculative nature.

Hargreaves Lansdown emphasizes that while Bitcoin has posted positive long-term returns, its erratic movements make it far riskier than traditional assets. The company urges investors to assess whether they can endure such volatility without jeopardizing broader financial plans. Unlike bonds or equities, cryptocurrencies lack cash flow or dividends to offset downside risks. This makes them better suited for speculation than structured wealth-building.

Institutional Players Divide on Crypto’s Role

The debate over Bitcoin’s legitimacy extends into institutional finance, where opinions diverge sharply. Banks like Morgan Stanley and JPMorgan are cautiously embracing crypto services to meet client demand. Morgan Stanley plans to expand retail access, while JPMorgan explores stablecoin ventures despite vocal skepticism from its leadership. This institutional involvement adds both credibility and complexity to Bitcoin’s evolving reputation.

Meanwhile, legendary investors such as Warren Buffett continue to denounce digital assets, calling them speculative and unproductive. Yet, some financial strategists argue that Bitcoin offers diversification benefits when balanced against traditional portfolios. These opposing views highlight the ongoing struggle between innovation and risk aversion in global investment circles. The broader market continues to wrestle with defining crypto’s true purpose.

Analysts Debate Bitcoin’s Correlation and Utility

According to Chris Mellor of Invesco, Bitcoin functions as a form of “digital gold” in modern portfolios. He observes that Bitcoin often shows minimal correlation with assets like U.S. Treasuries or equities, potentially serving as a hedge. However, Mellor warns that these correlations can shift rapidly during market stress. Investors, therefore, must treat Bitcoin’s diversification benefits as conditional, not guaranteed.

Nigel Green, CEO of DeVere Group, takes a more optimistic view, calling Bitcoin’s growth a sign of structural maturity. He believes institutional holders are now more disciplined and long-term oriented. This stability, he suggests, marks a transition from speculative hype toward mainstream financial integration. Green emphasizes that short-term volatility is natural in markets undergoing rapid transformation.

The Case for Strategic Exposure Versus Speculation

Despite warnings, some investors continue to view Bitcoin as a strategic allocation rather than a gamble. For them, crypto represents technological innovation and monetary independence rather than a short-term trade. These proponents argue that ignoring digital assets could mean missing the next wave of financial evolution. Bitcoin’s scarcity and decentralized nature remain its most compelling long-term attributes.

Nevertheless, Hargreaves Lansdown maintains that crypto exposure must be handled with extreme caution. The firm recognizes that speculative interest will persist, especially among risk-tolerant traders. However, it insists that only sophisticated investors with high-risk capacity should approach the crypto ETN market. For most, traditional assets remain the safer and more predictable choice.

Outlook: A Divided Future for Bitcoin Investors

As the UK embraces regulated crypto access, the divide between enthusiasts and skeptics continues to widen. Institutional adoption may lend Bitcoin legitimacy, but volatility remains its defining characteristic. Hargreaves Lansdown’s cautious stance reflects the tension between opportunity and uncertainty shaping global crypto discourse. Whether Bitcoin evolves into a lasting asset class or fades as a speculative phase remains unresolved.

For now, the message from traditional finance is clear: excitement should never replace prudence. Investors must evaluate risk with clarity before entering markets built on emotion and momentum. Bitcoin’s long-term potential may be undeniable, but its unpredictability demands discipline, patience, and a clear strategy. As regulation expands and sentiment evolves, the debate over Bitcoin’s true value will persist well into the future.