Dollar Debasement Becomes Central Driver Of Bitcoin Valuation

As fiscal dominance weakens trust in traditional fiat monetary systems around the world, dollar debasement has a bigger and bigger effect on Bitcoin’s value. Long-term investments lose faith in a currency when the government spends too much and politicians put pressure on central banks. Historically, these kinds of conditions have supported rare digital assets that are meant to stop governments from expanding their money supply at will.

Bitcoin benefits from this situation because there are limits on how much of it can be made, which is very different from how easy it is to make sovereign currencies. Bitcoin issuance, on the other hand, follows a fixed, clear schedule that has nothing to do with politics. Gold mining output, on the other hand, does. This structural scarcity supports long-term demand during long periods of fiscal dominance around the world today.

Federal Reserve Independence Concerns Reshape Investor Expectations

People are worried about the Federal Reserve’s credibility and its ability to control inflation in the future because of political pressure. More and more, investors are wondering if central banks can stop governments from spending too much money without being independent. These doubts make people want assets that they think are safe from political interference even more.

As faith in traditional policy frameworks declines, Bitcoin becomes more appealing as a different way to protect your money. People in the market see institutional stress as a sign that the value of the currency will go down over time. This view makes Bitcoin’s role in diversified macro-oriented portfolios stronger.

Trump Policies Intensify Fiscal Dominance Narrative

Donald Trump’s actions and words make people think that there will be aggressive fiscal expansion and political pressure on the people in charge of money. Big deficit spending plans make it harder for the central bank to change its policies and make it easier to borrow money. Economists say that this interaction is an example of fiscal dominance affecting future inflation.

Fiscal dominance makes it harder for traditional tools like interest rates to stabilize currencies. In these kinds of governments, monetary policy is more about meeting the needs of the government for money than keeping inflation in check. Historically, this macro backdrop has been good for non-sovereign stores of value like Bitcoin.

Recommended Article: CrunchUpdates Expands Digital Newsroom Covering Cryptos AIX

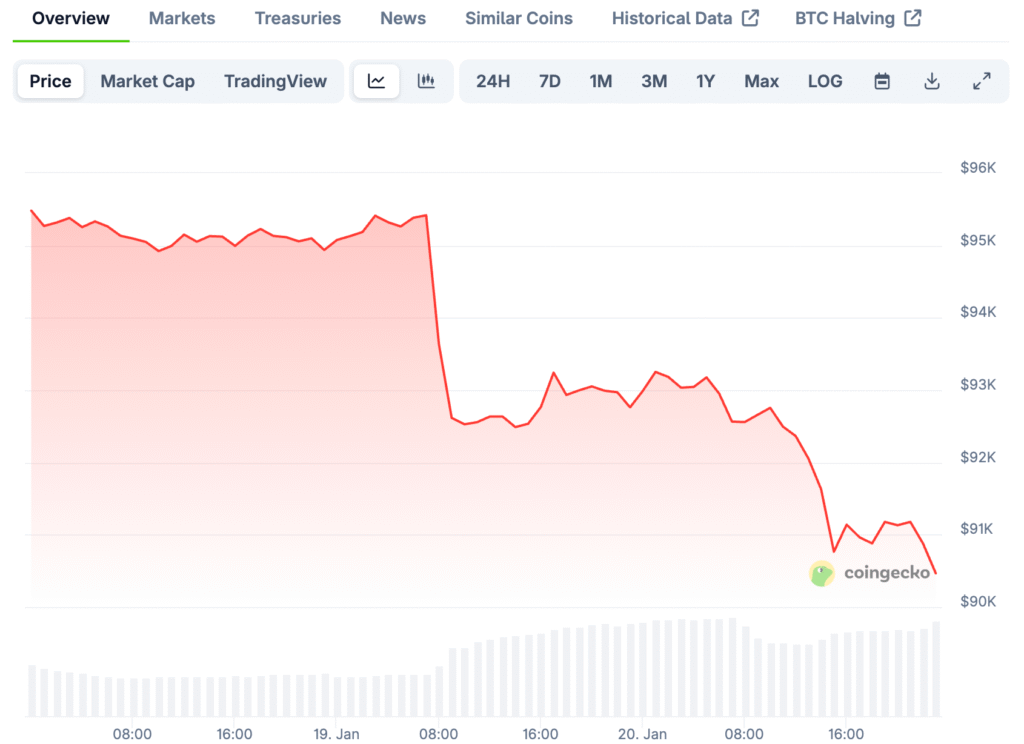

Short Term Volatility Masks Long Term Upward Price Drift

The price of Bitcoin often moves like a random walk because of changes in people’s feelings and short-term stories. Daily political news and macroeconomic data often temporarily drown out structural valuation signals. This noise makes it harder to make short-term predictions and time the market.

But over longer periods, structural forces cause prices to rise, which supports higher valuations. Expectations of monetary debasement build up slowly over time, rather than in response to one event. Long-term investors pay more attention to these cumulative forces than to short-term changes.

Greenland Geopolitics Play Secondary Supporting Role

Concerns about Greenland’s place in the world make headlines, but they are not the main factors that affect the value of Bitcoin. Markets may react quickly to geopolitical shocks, but they may not keep moving in the same direction. These kinds of things make prices go up and down, but they don’t set long-term trends.

The most important macro force is still the credibility of the currency, not small geopolitical conflicts. Investors know the difference between short-term political risks and long-term changes in the monetary system. Bitcoin reacts more strongly to the second one over longer periods of time.

Bitcoin As A Way To Protect Against The Loss Of Value Of Money

Bitcoin doesn’t work well as a hedge against short-term inflation spikes or political instability. Its strength comes from protecting buying power during long periods of currency debasement. This difference makes it clear why traders who only look at headlines are often let down by short-term reactions.

As fiscal dominance continues, Bitcoin looks more and more like a monetary hedge than a speculative technology asset. Its clear supply rules are different from discretionary monetary expansion, which is not clear. This property draws in investors who want to protect themselves from currency depreciation that happens all the time.

Long Term Valuation Scenarios Support Million Dollar Outcomes

Evaluating Bitcoin’s value via prospective global monetary share yields illustrative long-term scenarios. Even a small amount of use as a reserve option means that there is a lot of room for growth from where we are now. These kinds of frameworks help explain predictions like $1.6 million per Bitcoin.

These scenarios aren’t short-term price goals; they’re ways to measure structural potential in fiat regimes that have lost value. Adoption would happen slowly as institutions rethink their strategies for diversifying their reserves. Long-term optimism exists alongside enduring short-term volatility risk.