Bitcoin Regains Ground After Market Shock

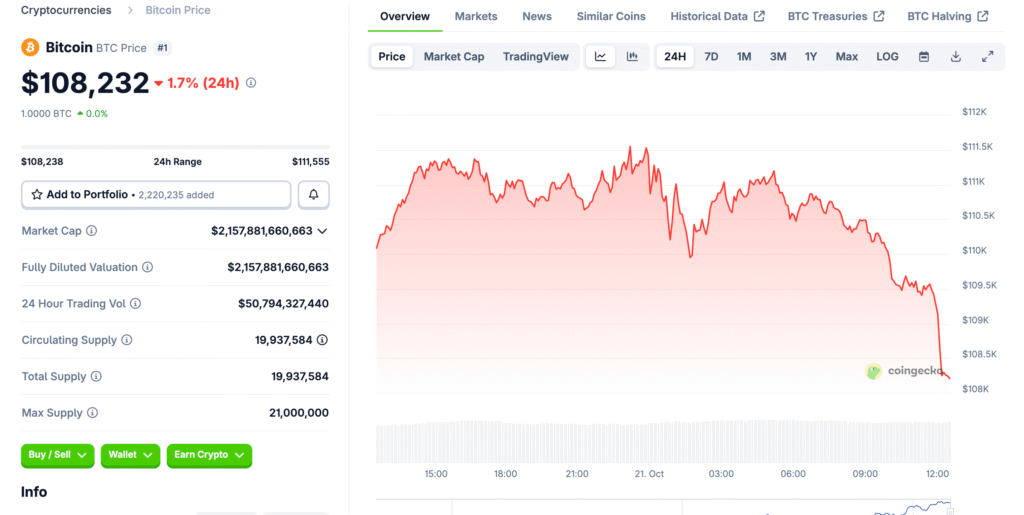

Bitcoin has climbed back above the $110,000 threshold, signaling renewed optimism among crypto investors. This rebound follows a major liquidation event that shook the market and coincided with lingering U.S.-China trade tensions. The cryptocurrency’s recovery highlights renewed buyer confidence and steady accumulation among long-term holders.

Technical Indicators Suggest Price Stabilization

Bitcoin’s price recovery aligns with buying interest near a confluence of technical support zones. The lower boundary of its three-month trading range and the rising 200-day moving average provided a solid floor for bulls. Meanwhile, the Relative Strength Index (RSI) remains slightly below neutral, indicating subdued momentum but growing accumulation interest.

Support Levels to Watch Closely

Investors should monitor the $100,000 mark, which acts as a psychological and technical support level. A breakdown below this zone could trigger a sharper decline toward $93,000, an area linked to previous trading activity between November and April. Historically, these levels have attracted renewed buying pressure from institutional traders.

Recommended Article: Billionaire Predicts Bitcoin to Soar 14x and Reach $1.5 Million

Resistance Barriers Ahead for Bitcoin

If Bitcoin maintains its current momentum, traders will watch the $117,000 resistance zone. This level coincides with the 50-day moving average and previous September highs. A breakout beyond this area could propel prices toward $123,000, the upper boundary of Bitcoin’s three-month trading channel.

Market Sentiment Remains Divided

Despite the rebound, investor sentiment remains mixed. Some traders interpret the recovery as a short-term relief rally, while others believe it marks the start of a sustained bullish reversal. The balance between macroeconomic data, central bank policy expectations, and crypto-specific news will dictate Bitcoin’s near-term trajectory.

Trade Developments Influence Price Direction

Bitcoin’s resurgence came after U.S. President Donald Trump adopted a softer tone toward China, calming investor nerves. His statements followed steep tariffs on Chinese imports that had previously wiped out billions from leveraged crypto positions. Any progress in trade negotiations could bolster broader market confidence and extend Bitcoin’s rally.

Interest Rate Expectations Impact Outlook

The trajectory of U.S. interest rates and crypto regulation remains pivotal for Bitcoin. Lower borrowing costs tend to encourage speculative investment, while regulatory clarity could unlock more institutional participation. Traders will closely monitor Federal Reserve updates for cues on liquidity conditions and risk appetite.

Long-Term Outlook for Bitcoin

Despite persistent volatility, Bitcoin’s fundamentals remain strong. Its limited supply, institutional adoption, and maturing global infrastructure continue to make it a store of value asset. Sustaining momentum above $110,000 could lay the groundwork for a retest of its $126,000 all-time high in the coming weeks.