Bitcoin Bancorp Leading the Digital Asset Space Amid Favourable Regulation

In a strategic move to capitalise on the rapidly growing cryptocurrency market, Bullet Blockchain Inc. has officially rebranded to Bitcoin Bancorp. This name change reflects the company’s renewed commitment to leading the digital asset space through its nationwide Bitcoin ATM network, exclusive patents, and innovative fintech solutions. The rebrand is perfectly aligned with a favourable regulatory landscape under the Trump administration, which has recently implemented a series of pro-crypto policies.

On March 6, 2025, President Donald Trump signed Executive Order 14233, which established a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile. This executive order, now codified into law, aims to position the United States as a global leader in the digital asset landscape. These new policies, coupled with the personal involvement of the Trump family in cryptocurrency ventures, underscore the growing mainstream acceptance and momentum in the crypto sector, aligning perfectly with Bitcoin Bancorp’s mission to drive innovation and accessibility.

The Strategic Bitcoin Reserve and Digital Asset Stockpile

The new U.S. policy framework is centred on two distinct custodial accounts. The Strategic Bitcoin Reserve is designed to treat Bitcoin as a strategic national asset, or a “digital Fort Knox.” It is capitalised with nearly 200,000 BTC, valued at roughly $17 billion as of early March 2025, primarily accumulated through criminal and civil forfeiture proceedings. The policy’s purpose is to retain these assets as a long-term store of value, prohibiting their sale except in specific, legally defined circumstances.

The order directs the Treasury to establish an office to administer and maintain the reserve, and federal agencies must review their authority to transfer seized BTC to this reserve. The second account, the U.S. Digital Asset Stockpile, encompasses all other digital assets forfeited to the Treasury. Unlike the Bitcoin Reserve, the Stockpile allows for the liquidation of assets and does not authorise the acquisition of additional non-BTC digital assets. This distinction highlights Bitcoin’s unique status as a strategic national asset.

Driving Cryptocurrency Adoption and Growth

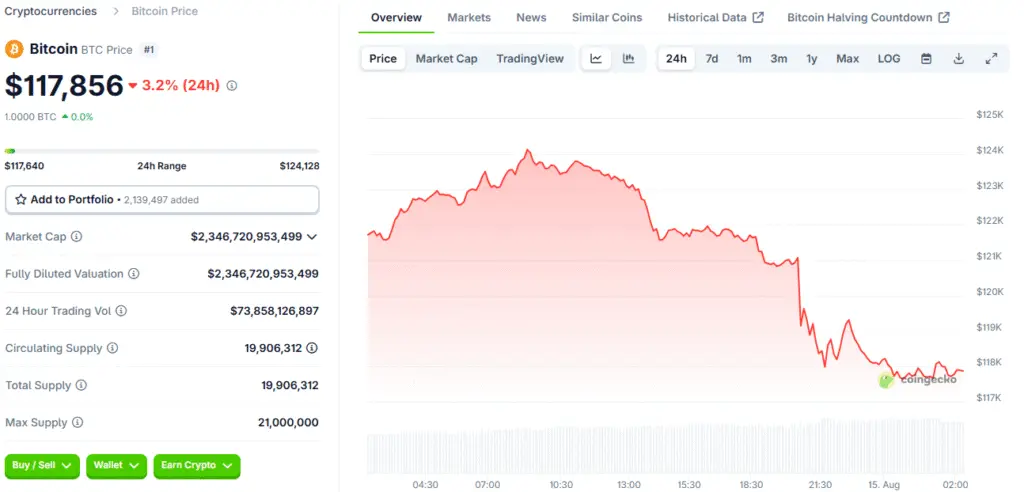

The global cryptocurrency market, valued at $4.25 trillion, is projected to continue its rapid growth. With Bitcoin’s market cap at $2.45 trillion, ranking it as the world’s fifth-largest asset, the demand for accessible crypto solutions is immense. Bitcoin Bancorp is perfectly positioned to capitalise on this growth by expanding its Bitcoin ATM network and introducing AI-driven financial products.

According to Eric Noveshen, Interim CFO of Bitcoin Bancorp, the rebrand “better reflects our strategic vision to shape the future of Bitcoin-powered services.” With an estimated 650 million worldwide crypto users and the Bitcoin payment ecosystem expected to reach $3.79 trillion by 2031, the company is building the infrastructure to make Bitcoin accessible to everyone. The rebrand aligns with the company’s mission to become a leader in Bitcoin ATMs and crypto financial education in the U.S. and beyond.

The Unique Advantages of Bitcoin Bancorp

Bitcoin Bancorp’s competitive edge is built on a number of key initiatives. The company is focused on network expansion, scaling its proprietary and patented Bitcoin ATMs. It also holds two foundational patents for Bitcoin ATMs, a critical piece of intellectual property that gives it exclusive rights to the operation of these devices across North America. The company plans to monetize these patents, a strategy that will help it to maintain market leadership.

Bitcoin Bancorp is also innovating with new crypto fintech solutions, including stablecoin withdrawals, digital wallets, and bill pay services. It is also committed to crypto education, producing resources to drive adoption. A new partnership with Tangem to enhance secure crypto storage further strengthens the company’s ecosystem. These initiatives, combined with its robust financial strategy and leadership in Bitcoin ATM technology, position Bitcoin Bancorp as a premier public company at the intersection of Bitcoin, fintech, and infrastructure.

A Robust Financial Strategy and Future-Ready Solutions

To support its growth, Bitcoin Bancorp is introducing a robust financial strategy that includes a number of innovative revenue models. The company is offering an ATM-as-a-Service model, which provides revenue-sharing opportunities for retail partners. It is also developing subscription services for ATM hosts and exchange providers, as well as high-margin add-ons such as Bitcoin-based debit products and tax reporting tools.

As Bitcoin continues to hit all-time highs, the company is creating accessible entry points for new users through self-service kiosks in retail, travel, and hospitality sectors. Future plans include the integration of biometric security, a Bitcoin rewards ecosystem, and a potential exploration of ATM-linked DeFi lending products. This future-ready approach is designed to ensure that the company can continue to innovate and meet the demands of a rapidly evolving market.

Bitcoin ATM Technology and Market Leadership

Bitcoin Bancorp holds two foundational patents, US9135787B1 and US10332205B1, which are critical to the operation of Bitcoin ATMs across North America. This intellectual property gives the company a significant advantage over its competitors. As one of only three publicly traded Bitcoin ATM network owner/operators in the U.S., Bitcoin Bancorp is expanding its licenced network, with a recent acquisition establishing its presence in multiple states.

The company’s ATM network of over 200 machines and growing enables users to seamlessly purchase and sell cryptocurrencies using cash, debit, or credit cards, providing a vital bridge between fiat and digital currencies. This leadership in technology and infrastructure is a key reason why the company is confident in its ability to capture significant market share in the global crypto ATM market, which is expected to surpass $10 billion by 2030.

Bitcoin Bancorp Stock: An Opportunity to Invest in the Bitcoin Ecosystem

The rebrand to Bitcoin Bancorp signals a new strategic direction for the company and a clear commitment to its core mission. For investors, the company’s stock, which is publicly traded on the OTC Markets under the symbol BULT, offers a way to gain exposure to the growth of the Bitcoin ecosystem. The company is actively building the infrastructure needed to shape the future of digital and blockchain-related platforms.

With a focus on rapid growth and increasing shareholder value, Bitcoin Bancorp is positioning itself as a leader in the intersection of Bitcoin, fintech, and infrastructure. The company’s transparent communication and its commitment to driving innovation make it an attractive opportunity for investors who believe in the long-term potential of the cryptocurrency market.

Read More: Bitcoin and Ethereum Prices Rally as US Inflation Cools