The Macroeconomic Shift Fueling a Crypto Rally

The cryptocurrency market has recently demonstrated its increasing sensitivity to traditional macroeconomic data, and this week was no exception. Following the release of the U.S. consumer price index (CPI) for July, which showed a notable cooling in inflation, Bitcoin and Ethereum prices, along with the broader crypto market, experienced an immediate upward bounce. This reaction signals a new era where crypto traders are closely watching macroeconomic indicators, particularly those that influence the Federal Reserve’s monetary policy.

The softer headline inflation reading has boosted optimism for a “friendlier macro path,” as a cooler economy could pave the way for the central bank to ease its restrictive policies. This positive sentiment, driven by data that suggests inflation may finally be under control, has served as a powerful catalyst for a market-wide rally, moving crypto assets from a period of consolidation into a new phase of potential growth.

Inflation Data Analysis: Headline Versus Core

A closer look at the data from the Labour Department reveals a nuanced picture. The headline CPI, which measures the average change over time in the prices paid by urban consumers for a basket of consumer goods and services, increased by a year-over-year rate of 2.7% in July. This figure was a touch cooler than what market analysts had forecasted, and it was this specific metric that caught the attention of traders.

However, the core CPI, which strips out the more volatile food and energy components, told a slightly different story, accelerating to 3.1%, a reading just above expectations. While the Federal Reserve, under the leadership of Chair Jerome Powell, has emphasised its focus on the 12-month inflation trend, traders appeared to prioritise the softer headline reading. This selective focus on the more favourable data point underscores a collective desire for a change in monetary policy and a return to an environment of easier credit, which is traditionally seen as a bullish signal for risk assets like cryptocurrency.

The FedWatch Tool and Rate Cut Expectations

The immediate market response was most clearly visible in the firming of rate-cut bets. The CME FedWatch tool, which tracks the probability of Federal Reserve policy changes, showed a dramatic shift in sentiment. The probability of a September rate cut surged to over 93% in the hour after the data was released, up from roughly the low 80s before the print. This jump reflects a strong consensus among traders that the new inflation data provides the Fed with the justification it needs to begin lowering interest rates. However, a dovish pivot is far from a certainty.

Fed Chair Jerome Powell and other central bank officials have repeatedly stressed that they will not rush to cut rates and are focused on a sustained, long-term trend of cooling inflation. The persistence of a slightly higher-than-expected core inflation number is a potential concern that may temper these optimistic expectations and inject a degree of caution into the Federal Reserve’s upcoming communications.

Bitcoin and Ethereum’s Immediate Price Bounce

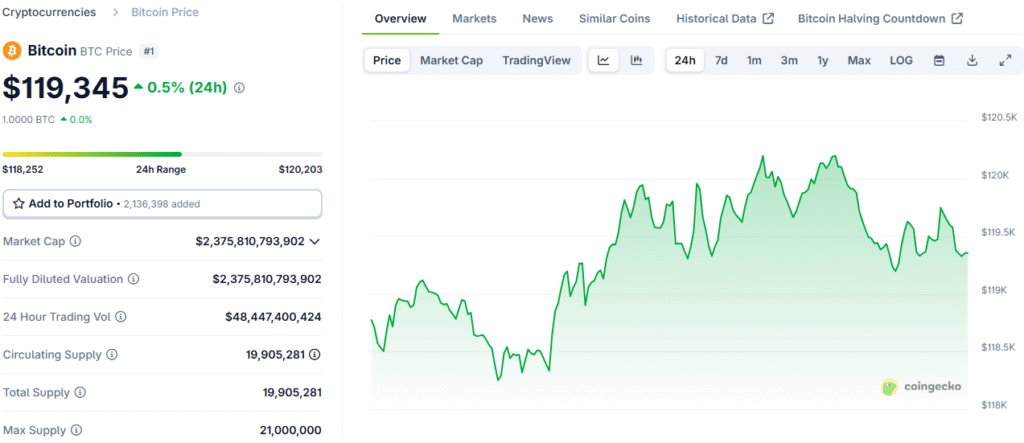

Following the data release, the cryptocurrency market’s two largest assets, Bitcoin and Ethereum, responded with a notable price bounce. Bitcoin, which had been trading closer to the crucial $120,000 level, edged higher as traders interpreted the softer headline inflation reading and firmer odds of a near-term easing of monetary policy as a bullish signal.

Ethereum also saw a significant gain, rising over 2% to trade above $4,400, a clear sign of renewed investor interest and confidence. This post-print pop in prices demonstrates the strong correlation between cryptocurrency markets and the broader macroeconomic climate. When the path to easier policy becomes clearer, traders tend to rotate capital back into riskier assets, and this week’s price action was a textbook example of that dynamic playing out in real-time.

Analyst Perspectives on Market Trends

The price movements following the inflation report were anticipated by a number of market analysts. Analysts from Bitfinex noted the “close relationship between ETF flows and macro outcomes” this cycle, suggesting that a clean print could help Bitcoin “break above range highs towards new all-time highs.” They also highlighted that structural demand from corporate treasuries and passive buyers continues to underpin the market, providing a stable foundation even amidst short-term volatility.

Jake Kennis, a senior research analyst at Nansen, added that persistent inflation would keep policy risks in play and could inject volatility for both BTC and ETH, which were trading just below recent peaks. He pointed out that “smart money” flows had been rotating into stablecoins over the past month, a move consistent with positioning for data-driven swings. These insights provide a more nuanced view of the market, suggesting that while the immediate reaction was bullish, a healthy degree of caution and strategic positioning still exists among sophisticated investors.

The Path to a September Cut

The market’s focus will now shift to a number of upcoming events and data points that could either confirm or complicate the path to a September rate cut. Investors will be closely watching the producer-price figures later this week, as they often provide an early look at inflation in the supply chain. More importantly, market participants will be scrutinising future Federal Reserve communications for any clues on whether July’s mixed data (cooler headline, hotter core) has meaningfully altered the central bank’s stance.

While the odds of a September cut have firmed significantly, a dovish pivot from the Fed is not yet a foregone conclusion. A key indicator of sustained market strength will be whether improving macro odds can translate into sustained spot ETF inflows rather than just a fleeting post-print pop. Long-term, consistent capital flowing into these funds would signal a more profound shift in institutional and retail sentiment.

Bitcoin and Ethereum Await Macro Alignment for Highs

Ultimately, the market’s response to the inflation data provides valuable insight into the current state of cryptocurrency. The fact that the market is so tightly coupled with traditional macroeconomic indicators demonstrates a new level of maturity and integration into the global financial system. The demand from corporate treasuries and the presence of passive buyers through ETFs provide a robust, structural foundation that can withstand short-term volatility.

While the market will continue to react to every data point and every central bank communication, this underlying strength suggests that the rallies are not just based on speculation but are underpinned by genuine interest and capital. The road to a potential new all-time high for Bitcoin and Ethereum may be subject to twists and turns, but the recent price bounce is a clear sign that the market is ready to move forward when the macroeconomic conditions align.

Read More: Strategy Expands Bitcoin Holdings, Solidifying Its Market Position