Avalanche Stabilizes Near Key Support

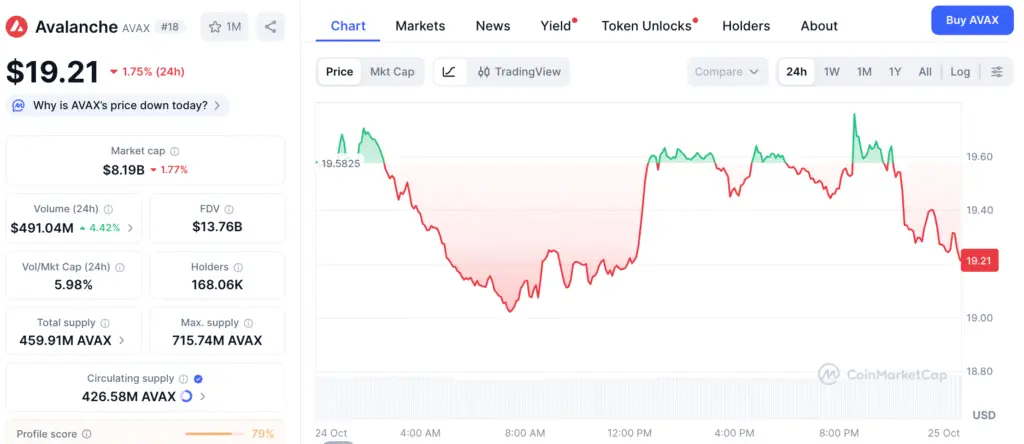

Avalanche (AVAX) is getting more attention in the market again as it stabilized at a significant support zone between 18 and 20 dollars, which has historically led to many rallies. The token’s ability to stay stable throughout recent price swings shows that purchasers are protecting the base channel and discreetly building up their holdings again.

Analyst VexeCrypto called this range a super discount zone and said that every big Avalanche rally in the past started from this area. If the price goes back over 24 dollars, it might mean that the market is about to turn around in the short term and start a longer-term expansion phase.

Growing Optimism Fuels Avalanche’s Return

The Avalanche ecosystem is starting to gain momentum again, with social analytics suggesting more engagement and institutional confidence coming back. Community experts point out that developers are getting more involved in developer channels and that the derivatives markets are feeling good about themselves again.

ExcelBaller said that institutional liquidity might shift back to high-efficiency Layer-1 networks like Avalanche as the crypto market’s demand for scalable chains grows in the last three months of 2025.

Avalanche Forms Symmetrical Triangle Pattern Hinting at Major Breakout

From a big picture point of view, Avalanche is making a symmetrical triangular shape, getting smaller between long-term resistance and horizontal support. This pattern, which is common before big breakouts, shows that a strong rise over 40–45 dollars might push the price up to 70–90 dollars.

Pure8’s research shows that volatility is going down and price compression is going higher. These are both early signals that a high-timeframe breakout may be coming soon when upper resistance is broken.

Recommended Article: Avalanche Price Weakens as AVAX Struggles Despite Backing

Momentum Indicators Show Recovery Signs

On-chain and technical indicators both point to Avalanche being bullish. The RSI is flattening down at its bottom range, and the MACD is losing negative momentum. This means that selling pressure is easing.

The same support range of 19 to 20 dollars that helped Avalanche stabilize in August 2024 is still holding, just like it did at the commencement of prior recovery periods. In the past, similar indicator configurations have typically come before big price jumps in AVAX cycles.

Avalanche Sees Largest Monthly Token Burn Since 2024, Fueling Optimism

Tokenomics are now in line with the technological configuration. Joeycannoli9’s data shows that October was Avalanche’s worst monthly token burn in almost a year, with more than 59,000 AVAX, around 1.1 million dollars, permanently taken out of circulation.

This burn rate backs up the idea that on-chain activity is growing and strengthens the network’s deflationary mechanisms. In the past, every time the burn volume went higher, it led to a long-term rise in prices, which was caused by more people using the service and more transactions happening.

Key Resistance and Price Targets to Watch

Traders who only want to make money quickly see 20.80 dollars as the first level of resistance. If the price moves over this resistance level, it might go up to 23.50 dollars, and then it could try a higher level near 28 dollars. Analysts think that getting past this area might start the next wave of positive momentum that will take prices above 40 dollars and higher.

On the other hand, if AVAX breaks below 18.50 dollars, the bullish setup will no longer work, and AVAX will go back to a neutral consolidation phase. But for now, the market is leaning toward buyers, with both volume and momentum starting to go higher.

AVAX Prepares for Year-End Expansion

Avalanche’s ability to hold its long-term base around 19 dollars shows that the network is solid and the market is very supportive. The conditions for a Q4 breakout look better and better as on-chain data shows accumulation, token burns speed up, and momentum indicators get better.

If AVAX stays above 20 dollars and breaks above 24 dollars with confidence, it might rise to 45–55 dollars in the next few months. This makes Avalanche one of the most important cryptocurrencies to monitor as we go into 2026.