ASTER Price Rallies on Renewed Market Confidence

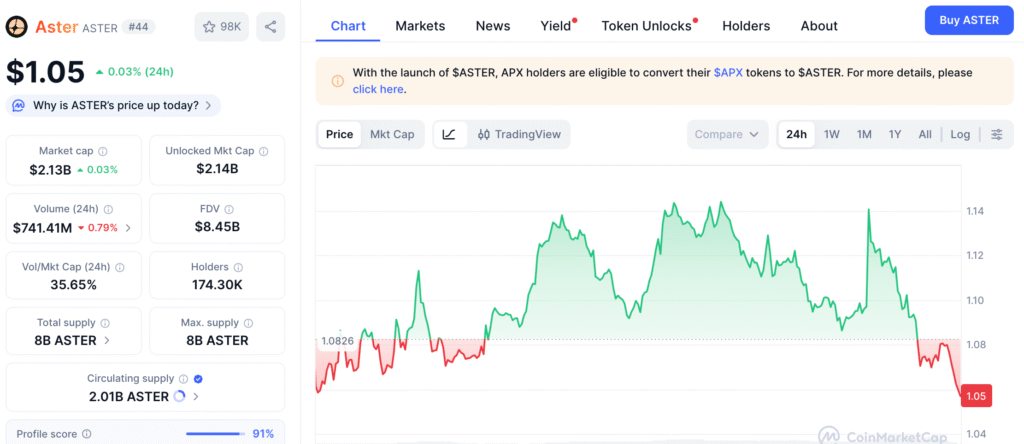

The ASTER token went up more than 11–16% in 24 hours, reaching about $1.12–$1.14. This was because investors were more confident and there was a lot of activity on the blockchain. This rise in momentum comes after the launch of ASTER’s Rocket Launch campaign, which is a big incentive program meant to get more people involved and increase liquidity.

The surge is more than just short-term speculation; both retail and institutional investors are buying more, which is driving up volumes. Analysts think that this synchronized market action shows that trust in the ecosystem is building. This means that ASTER might keep its current gains if momentum keeps going.

Rocket Launch Campaign Sparks Community Participation

The Rocket Launch campaign gives users ASTER and partner tokens for trading, listing early, and being involved in the ecosystem. This has caused both spot and decentralized exchange volumes to go up, which shows that the initiative has a real effect on the market.

Analysts say that these kinds of marketing create genuine activity instead of hype, which builds confidence in the community and brings in fresh money. If participation stays high, ASTER might get more price support if ordinary investors and institutions keep buying during the campaign window.

Whale Accumulation Accelerates ASTER’s Breakout

Whale behavior has been a big part of the current rise. On-chain data reveals that the top 100 addresses added a total of 11.7 million ASTER to their portfolios. This brought the total number of tokens held by whales to 7.82 billion. Smaller whale groups also added 2.3% to their investments, which shows that big investors are becoming more sure of themselves.

This accumulation phase lowers the amount of circulating supply, which pushes prices higher. The synchronized behavior signals long-term positioning, with whales wagering on ASTER’s continued development and ecosystem expansion after its most recent utility-focused projects.

Recommended Article: Can RWA Crypto Like ONDO Challenge Meme Coin Dominance in 2025

Derivatives Market Shows Rising Bullish Sentiment

The futures market has helped ASTER’s price keep going up. Futures open interest has gone up by more than 13% in the previous day, which shows that leveraged traders are becoming more confident. Funding rates are still somewhat positive, which means that people in the market expect prices to keep going higher.

But economists warn that more indebtedness might potentially make things more volatile in the near term. Still, ASTER is in a good position to benefit from investors’ growing willingness to take risks, thanks to the rise in Bitcoin and key altcoins.

ASTER Breaks Falling Wedge as Bulls Target Key $1.35–$1.40 Resistance Zone

From a technical frame of view, ASTER has broken above a falling wedge formation, which might mean that it is about to turn around from recent lows. The coin is presently trading between $1.10 and $1.14, with $1.27 acting as the next important breakthrough level.

If bulls can keep the price above support around $1.10, experts think it might go up to $1.35–$1.40 in the immediate future. But if the present levels don’t hold, there might be a short pullback that tests regions below $1.00 before bouncing back up to higher resistance areas.

On-Chain Data Suggests Accumulation Zone Formation

Technical measurements and volume analysis show that a new accumulation zone is forming. The Relative Strength Index has gone slightly negative, which means that things are cooling off a bit. However, on-chain volumes are still stable. This pattern generally comes before a second rise when selling pressure is gone.

Market experts think that there will be a short-term consolidation in the present range before another upward move, thanks to continued whale inflows and campaign-driven liquidity. People are nonetheless cautiously enthusiastic about ASTER’s on-chain expansion.

ASTER Combines Retail Hype and Institutional Interest in New Bullish Phase

The Rocket Launch campaign has become a major factor in ASTER’s most recent surge, combining participation based on incentives with smart investor involvement. The program shows that the token may combine community incentives with institutional appeal, which makes it more credible and liquid.

If the campaign keeps going and trade volumes are steady, ASTER might set up a fresh mid-term support base above $1.10. Analysts think that this combination of whale activity, retail excitement, and better market mood might lead to a continuing breakout toward higher price zones in the next several weeks.