XRP Breaks Above $3 Amid Renewed Optimism

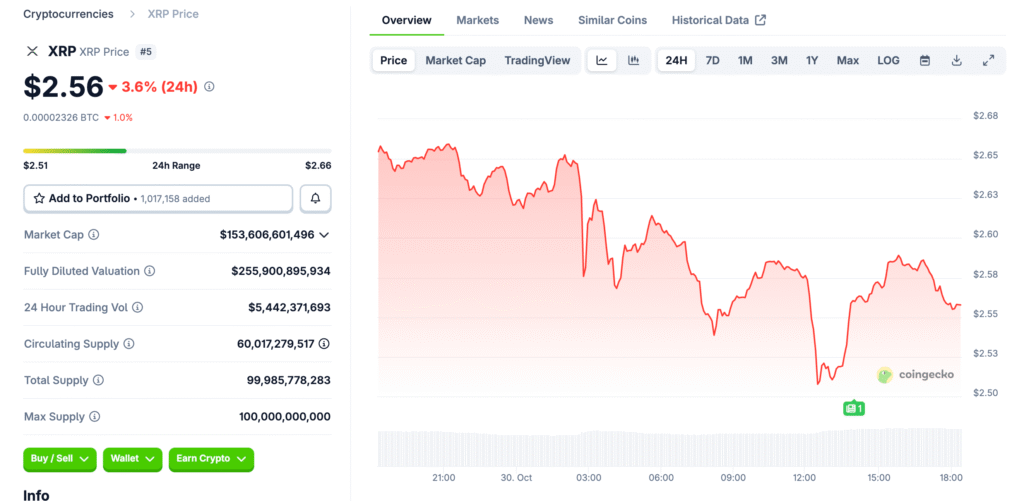

XRP surged 4.5% in 24 hours, crossing the $3 mark for the first time in over a week. The rally comes as speculation mounts that the SEC may soon dismiss its long-running case against Ripple. Investors view the potential resolution as a pivotal moment that could restore confidence in XRP’s regulatory standing. The token’s sharp move higher reflects renewed optimism across the broader crypto market.

Legal Background: A Five-Year Battle Nears Its End

The SEC first filed its case against Ripple in December 2020, alleging the sale of unregistered securities worth $1.3 billion. Over nearly five years, the dispute has defined XRP’s legal status in the United States. Judge Analisa Torres ruled in 2023 that XRP’s retail sales were not securities, setting an important precedent. A final dismissal would officially end one of crypto’s most significant regulatory battles.

Conditional Settlement Paved Way for Resolution

Earlier in 2024, Ripple and the SEC signed a conditional settlement agreement that failed to meet all terms. Now, both parties appear closer to reaching a joint conclusion before the August 15 court report deadline. Legal expert Bill Morgan predicts that the SEC may withdraw its appeal rather than risk another defeat in higher courts. Such a dismissal would clear the way for XRP’s broader institutional adoption.

Recommended Article: Ripple’s $1B XRP Buyback Signals a Structural Shift in Crypto Liquidity

Market Reaction and Investor Sentiment

Traders quickly responded to the news, pushing XRP volume up 60% across major exchanges. Social sentiment data from LunarCrush shows a surge in positive mentions tied to case resolution hopes. Institutional investors also began reopening positions in anticipation of legal clarity. This renewed momentum suggests confidence that XRP will soon operate free from regulatory overhang.

Ripple’s Continued Growth Despite Legal Uncertainty

Throughout the lawsuit, Ripple has continued expanding its global payment partnerships and liquidity services. The company strengthened ties with banks in Asia, the Middle East, and Africa to drive cross-border efficiency. These initiatives demonstrate resilience and highlight Ripple’s ability to separate operational growth from litigation risks. As legal uncertainty fades, Ripple’s business model stands poised for acceleration.

Analysts Expect Institutional Inflows if Case Ends

Market strategists forecast significant capital inflows into XRP should the case conclude favorably. ETFs, payment providers, and fintech firms could reintroduce XRP exposure once compliance risks are resolved. Analysts believe this could propel prices beyond $4 in the short term, extending the token’s bullish breakout. The anticipated dismissal may also encourage U.S. exchanges to relist XRP, expanding liquidity access.

Technical Indicators Support Bullish Continuation

XRP’s technical setup reflects strengthening momentum, with price trading above major moving averages. RSI remains within the bullish range, confirming sustained buying interest. If XRP maintains support above $2.80, analysts see potential for another 20% rally. Volume patterns suggest institutional buyers are gradually accumulating ahead of official case updates.

Outlook: Case Dismissal Could Redefine XRP’s Future

If the SEC formally drops its appeal, Ripple could finally move beyond years of regulatory scrutiny. This event may establish a blueprint for future crypto compliance cases, especially regarding token classifications. A favorable outcome would reaffirm Ripple’s leadership in blockchain payments and cement XRP’s legitimacy in global finance. For investors, the long wait for clarity may soon transform into one of crypto’s most anticipated rebounds.