Post‑Crash Reality and Market Backdrop

The October flash crash exposed how exchange congestion can cascade into mass liquidations. More than a million traders faced forced exits as liquidity thinned and volatility spiked. Such events dent confidence, especially among leveraged participants who depend on execution. Even robust platforms can struggle under stress, reminding markets that operational risk is real.

Binance’s Compensation Moves and User Trust

Binance announced targeted compensation for assets impacted by temporary de‑pegs and service interruptions. Ex‑gratia payments and airdrops can soften immediate losses, but they rarely restore full trust. Transparent incident reports and control improvements matter more for long‑term credibility. Traders look for systemic fixes—redundancy, throttling logic, and clearer safeguards—before sizing up risk again.

Recommended Article: BNB Joins Polymarket Increasing Access for 2.2M Active Users

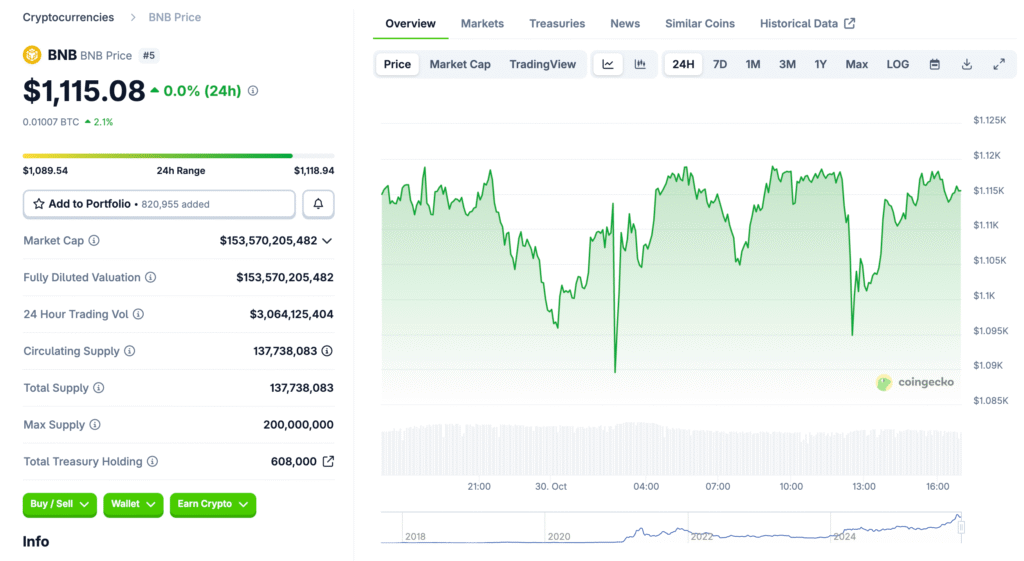

Price Structure: Supports, Resistances, and Trend Signals

BNB now trades below key intraday moving averages, signaling sellers remain active. Reclaiming $1,100 would neutralize the immediate downtrend and invite momentum buyers. Failure to retest that zone risks a drift toward $1,030 and then $950. If weakness persists, the high‑beta path to $900 becomes a tactical bear target.

Liquidity, Leverage, and the Liquidation Feedback Loop

Elevated open interest paired with thin spot liquidity can amplify downside moves. As price slips, cascading liquidations can force additional selling from margined accounts. Conversely, short squeezes are possible if price reclaims resistance into crowded shorts. Managing position size and collateral buffers is essential in these fragile conditions.

Macro Overhangs and Policy Wild Cards

Rate‑cut timing, dollar strength, and headlines about U.S.–China trade tensions color crypto risk appetite. A hawkish surprise from the Fed could compress multiples across risk assets. Conversely, a dovish pivot or easing geopolitical rhetoric can re‑ignite flows. BNB’s path often mirrors that broader tide, magnified by exchange‑specific catalysts.

Legal Risk and Institutional Sentiment

Large‑ticket losses during outages can attract litigation, even if exchange policies limit liability. Prolonged uncertainty curbs institutional participation that prioritizes clear rules and recourse. Concrete governance disclosures and third‑party audits can ease those concerns. Without them, risk premia stay elevated, suppressing multiples during drawdowns.

What Would Flip the Narrative Constructively

A decisive close back above $1,100 followed by higher lows would rebuild technical confidence. Documented infra upgrades and post‑mortems could underpin a sentiment turn. Sustained spot demand and healthier breadth across majors would lessen tail risk. In that setup, BNB could base, reclaim $1,200, and unwind the $900 scenario.