Technical Breakdown Flashes Familiar Warning

Ethereum’s weekly MACD has triggered a bearish crossover, echoing patterns that preceded major corrections in 2024 and early 2025. Analysts at Cointelegraph note that similar signals historically led to 46–60% pullbacks within weeks. The development highlights renewed downside pressure just as macro volatility resurfaces. Traders are now focusing on whether $4,000 can act as a stabilizing floor.

Historical Precedent Suggests Larger Correction Risk

The last comparable MACD cross in mid‑2024 saw Ethereum drop more than 46% over a two‑month span. Earlier this year, the same configuration resulted in a 60% decline before recovery resumed. While past performance doesn’t guarantee repetition, the pattern raises caution among momentum traders. The probability of renewed selling increases if macro headwinds persist alongside technical deterioration.

Macro Environment Amplifies Bearish Technical Setup

Macroeconomic uncertainty has added weight to the bearish scenario. With global equities volatile and Fed guidance less dovish, liquidity conditions are tightening again. Such an environment typically limits speculative capital inflows into risk assets like ETH. Analysts warn that a convergence of weaker charts and tightening liquidity could trigger accelerated drawdowns.

Recommended Article: Ethereum Gains Momentum as JPMorgan OKs Crypto Collateral

$4,000 Level Emerges as Line of Defense for Bulls

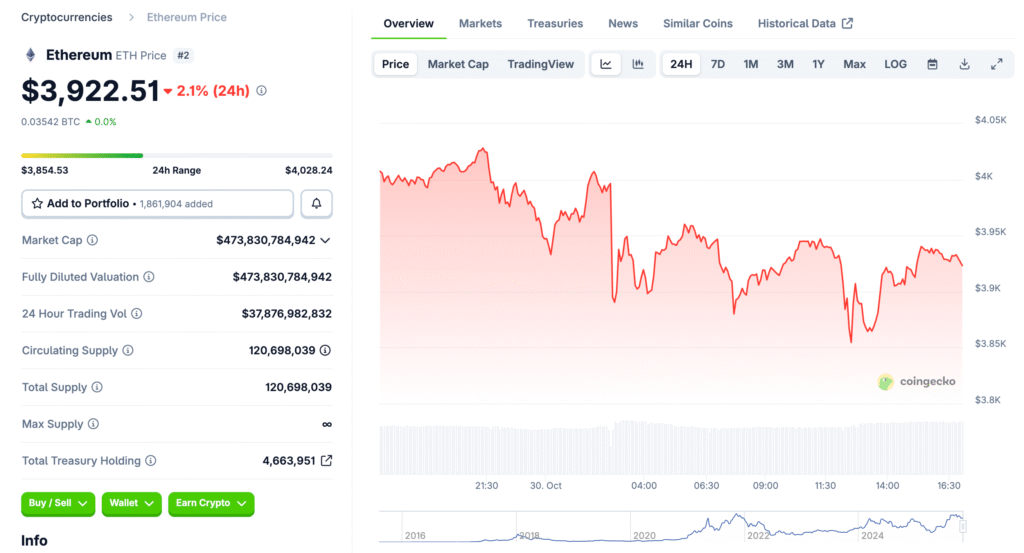

Ethereum has repeatedly bounced from the $3,800–$4,000 range over the past quarter. This support coincides with dense trading volume and previous breakout zones. Holding this region would preserve the ascending structure from early 2025. A decisive break below $3,800, however, could open downside targets at $3,400 and $3,000.

Market Sentiment Reflects Cautious Positioning

Despite the bearish crossover, traders have not capitulated. Open interest remains moderate, and funding rates show no excessive short exposure. This implies that bearish pressure stems more from cautious repositioning than panic. A positive macro surprise could quickly invalidate the signal if buyers defend key zones.

Short‑Term Action Shows Controlled Selling

As of publication, ETH trades near $3,950, down less than 1% in 24 hours. The measured pace of decline suggests rotation rather than mass liquidation. Shorter‑timeframe indicators show RSI near neutral levels, hinting at a potential bounce attempt. Traders are watching for confirmation via reclaim of $4,100 to negate immediate downside risk.

Strategic View: Wait for Confirmation Before Positioning

For swing traders, patience is warranted until Ethereum either confirms support or reclaims the breakdown point. Long entries near $3,800 with tight stops may attract value buyers seeking early positioning. Conservative investors, however, may prefer waiting for renewed MACD strength on higher timeframes. The next few sessions will determine whether this setup becomes a deeper correction or a routine reset.

Outlook: Maintaining $4,000 Keeps Bull Cycle Viable

As long as Ethereum holds above its $4,000 base, its broader uptrend remains structurally intact. The MACD signal may prove a short‑term shakeout rather than a full reversal. With DeFi and L2 activity still rising, fundamental demand continues to underpin price stability. Traders agree that defending this level could set the stage for renewed bullish momentum into year‑end.