Bitcoin and Ethereum Surge on Renewed Market Optimism

Bitcoin and other major cryptocurrencies gained sharply Monday, lifted by optimism surrounding a potential U.S.-China trade breakthrough and growing expectations that the Federal Reserve will cut interest rates. Bitcoin rose 2.6% over the past 24 hours to trade near $115,144, recovering from last week’s dip as investor sentiment improved.

The rally followed progress in negotiations between Washington and Beijing, with reports indicating a possible framework deal to be finalized during President Donald Trump’s upcoming meeting with Chinese President Xi Jinping. The renewed diplomatic optimism helped ease investor anxiety after months of tariff threats and economic uncertainty.

Fed Rate Cut Expectations Add to the Crypto Momentum

Markets are now pricing in a near-certain quarter-point rate cut from the Federal Reserve this week, especially after Friday’s delayed inflation report showed U.S. consumer prices rising 3% in September. Analysts believe the Fed’s dovish stance could further support risk assets, including cryptocurrencies.

Lower interest rates generally weaken the U.S. dollar and make speculative assets more attractive compared to traditional interest-bearing investments like bonds. The anticipation of cheaper borrowing conditions has reinvigorated risk appetite, contributing to Bitcoin’s rebound.

Altcoins Follow Bitcoin’s Upside Momentum

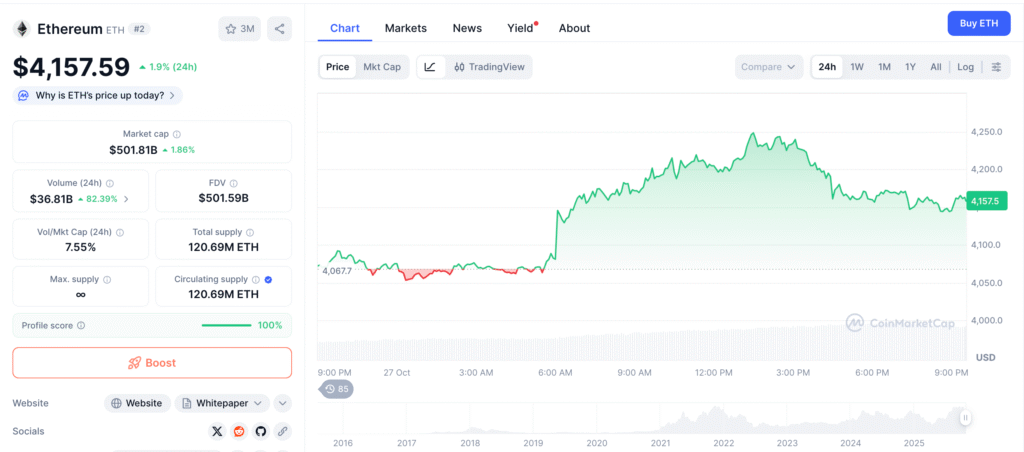

Ethereum led gains among top altcoins, rising 4.7% to trade near $4,200. Solana added 2.9%, while Dogecoin climbed 2%. The broader crypto market capitalization now stands at approximately $3.9 trillion, reflecting the sector’s growing strength after weeks of macro-driven volatility.

Ethereum’s upward momentum is being supported by strong developer activity and rising staking participation, while Solana’s consistent network upgrades continue to attract institutional inflows. Meme tokens like Dogecoin also benefited from the improved sentiment, regaining traction after recent profit-taking cycles.

Recommended Article: Ethereum Price Forecast: ETH Eyes $4,600 Rally as Consolidation Nears Breakout

Crypto-Exposed Stocks Gain as Risk Appetite Returns

Traditional equities tied to the crypto sector also rallied in tandem. MicroStrategy (now Strategy Corp.), the world’s largest corporate Bitcoin holder, rose 4.2%, while Coinbase Global advanced 2.9% during pre-market trading. The recovery in crypto-linked stocks highlights renewed confidence in digital assets as macro headwinds begin to fade.

Analysts at several investment firms noted that crypto’s correlation with tech and growth equities remains elevated, meaning both sectors could benefit from lower borrowing costs and improved geopolitical stability.

Market Outlook: Fed Policy and Trade Progress Set the Tone

The upcoming Fed meeting and Trump-Xi summit are expected to be pivotal for the next phase of crypto market direction. A dovish policy announcement paired with tangible trade progress could extend the current rally toward Bitcoin’s recent high above $124,000.

However, traders remain cautious about potential volatility, particularly if negotiations falter or inflation surprises resurface. For now, easing trade tensions and the prospect of monetary stimulus have provided the right mix for crypto markets to recover momentum, signaling a bullish tone heading into November.