Ethereum Price Holds Strong Within a Narrow Trading Corridor

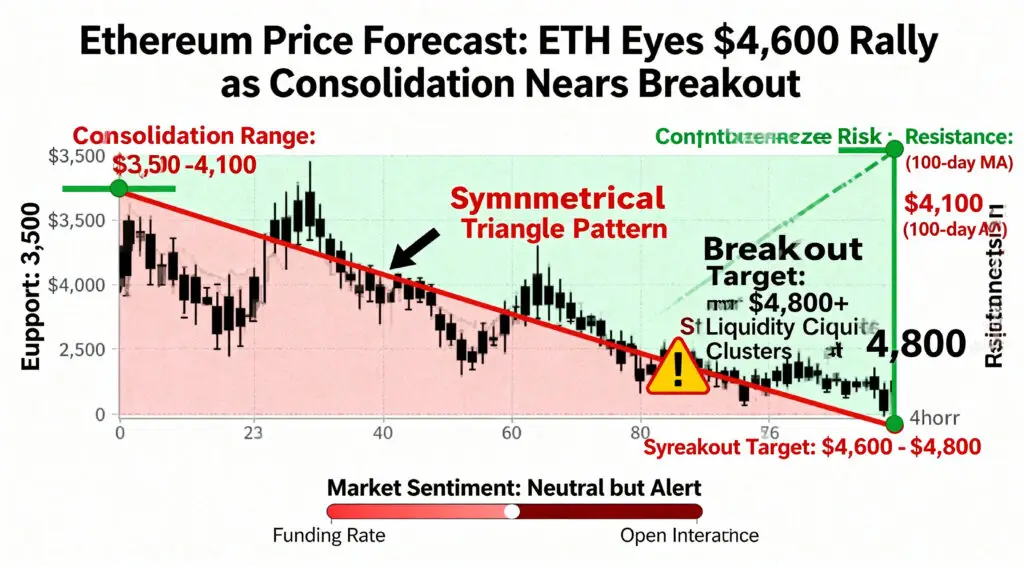

Ethereum’s price action remains confined within a narrow range, reflecting a tug-of-war between buyers and sellers. The digital asset has maintained strong support near $3,500, while facing consistent resistance close to $4,100, creating a period of extended sideways movement.

This ongoing consolidation reflects declining volatility as traders hesitate to commit before a breakout. Historically, similar compression phases have preceded high-magnitude moves, keeping market participants on edge. Until a breakout confirmation arrives, Ethereum is expected to hover within this defined corridor.

Critical Resistance Levels Cap Upward Momentum

Ethereum’s daily chart highlights the persistence of its flag pattern, which continues to act as a containment zone. The 100-day moving average, positioned near $4,100, reinforces this resistance region that has repeatedly rejected bullish advances.

On the flip side, $3,500 remains the key defense level where buyers absorb sell-side pressure. Sustained price action above $4,100 could unlock new momentum, potentially igniting a push toward $4,600–$4,800. This level will be critical in determining whether Ethereum can regain bullish dominance and challenge its previous all-time highs.

Symmetrical Triangle Patterns Indicate Market Indecision

On the four-hour timeframe, Ethereum is trapped inside a symmetrical triangle pattern, signaling uncertainty among traders. The current trading zone around $4,000 showcases equilibrium between bullish and bearish forces, with shrinking price swings hinting at a buildup in volatility. Such compression typically precedes explosive movement in either direction.

If buyers secure a close above $4,100, analysts expect an upward expansion toward $4,600, while a drop below $3,700 could expose the $3,400 level. The narrowing structure reinforces the view that Ethereum is nearing a high-impact decision point.

Recommended Article: Ethereum Gains Momentum as JPMorgan OKs Crypto Collateral

Investor Sentiment Stays Neutral but Alert

Market sentiment data reveals that investors remain cautious, awaiting confirmation before taking directional positions. Funding rates have fallen, and open interest remains stable, underscoring the neutral stance across major exchanges. Many traders interpret this as a prelude to renewed volatility once liquidity conditions shift.

Institutional participation has also slowed, suggesting that larger players may be waiting for macroeconomic cues or a confirmed breakout signal before re-entering the market. Overall, sentiment tilts slightly bullish, but conviction remains weak until key resistance levels are breached.

Liquidity Clusters Highlight Potential Breakout Targets

Recent liquidation heatmaps show concentrated liquidity pockets forming above $4,800, where clusters of short positions are awaiting liquidation. This area could act as a magnet once Ethereum surpasses the $4,100–$4,300 range, potentially triggering a short squeeze. Below current levels, liquidity density is thinner around $3,500, reflecting that much of the downside volume has already cleared. Analysts interpret this imbalance as favoring an upward breakout if momentum accelerates. These liquidity dynamics indicate that Ethereum may target higher zones once it escapes its current holding pattern.

Consolidation Builds the Foundation for Volatility Expansion

Periods of extended consolidation like Ethereum’s current setup often precede sharp directional movements. The decline in volatility, coupled with increasing liquidity concentration, suggests a pending volatility expansion phase.

Price compression between the $3,500 and $4,100 levels has created significant tension that could soon resolve into a powerful breakout. Technical models indicate that the initial move following this consolidation could define the next medium-term trend, shaping Ethereum’s path into late 2025 and early 2026.

Outlook: Ethereum Gears Up for a Potential Breakout Phase

Ethereum’s technical landscape points toward a breakout scenario forming in the coming weeks. Traders are watching the $4,100 resistance for signs of confirmation, while protecting positions near the $3,500 support zone.

A bullish breakout may propel ETH toward $4,600–$4,800, but failure to sustain momentum could trigger a retest of $3,400. With sentiment balancing and volatility compressed, the market appears poised for decisive movement. As Ethereum nears this critical juncture, traders anticipate a major trend reversal that could redefine its trajectory into the next cycle.