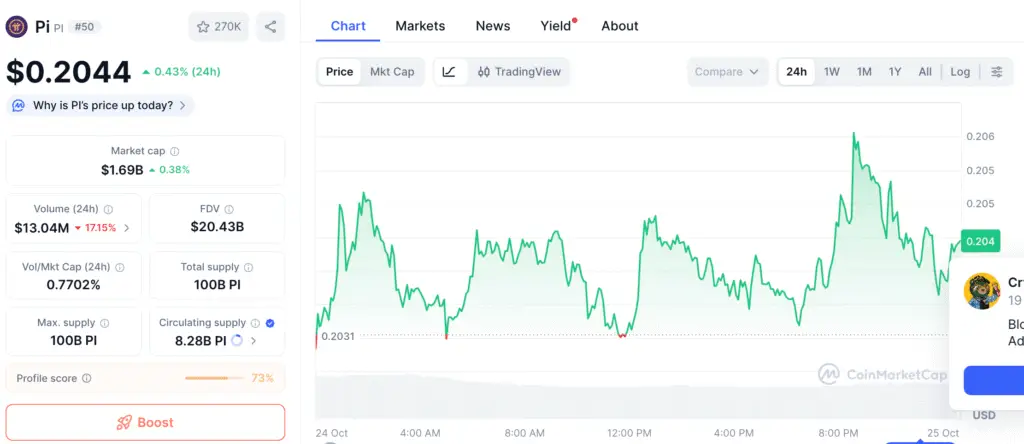

Pi Network Price Stabilizes Near $0.20 Support Zone

After weeks of selling pressure, Pi Network (PI) is starting to stabilize, staying between $0.20 and $0.21. The token’s drop from $0.36 to $0.166 seems to have calmed down, and dealers say that buyers and sellers are again back in balance.

The four-hour chart shows that a possible accumulation base is emerging at $0.20, which is an important level that has worked as a support zone in several sessions. Analysts say that keeping this range might mean that Pi’s corrective phase is finished and that a slow rebound is beginning.

Technical Outlook: Key Resistance Levels in Focus

The 0.236 Fibonacci retracement level is where Pi’s immediate resistance is at $0.2128. If the price closes above this range, it might continue toward $0.2415 and $0.2646, where the 50-EMA and 100-EMA cross each other. These are the next big technical hurdles.

As long as PI is below the $0.217 level, though, the mood of the market is expected to continue neutral to slightly negative. If prices stay above $0.22 for a long time, it would confirm a bullish reversal pattern and might push prices toward the $0.26–$0.28 zone in the short term.

Pi Network’s Low Volatility Signals Possible Bottom Formation Near $0.20

Even while the momentum is low, on-chain activity suggests that smaller holders and long-term investors are slowly building up their holdings. Trading volumes have gone down, but volatility is still low. These are things that commonly happen near the end of a slump.

If buyers keep defending the $0.20 floor, the consolidation might turn into a base-building period before a possible breakout in Q4. Conversely, a collapse below $0.18 would expose Pi to additional falls toward $0.166, its September low and final significant structural support.

Recommended Article: Pi Network Sells Off After App Studio Update as Fundamentals Face Scrutiny

KYC Milestone Boosts Network Integrity and Trust

Pi Network’s Know Your Customer (KYC) improvement is a big reason why people are feeling more hopeful again, in addition to technical issues. The project just reported that over 3.36 million Pioneers have successfully completed full KYC verification. This is a big step toward making the ecosystem more open and mature.

The verification method uses AI to check for liveness and evaluate documents to get rid of fake accounts, which makes the network more trustworthy. This big verification milestone not only proves that users are who they say they are, but it also makes the project more appealing to potential partners and exchanges.

Pi Network Advances Toward Mainnet With 2.69M Verified User Transfers

Pi Network’s Mainnet transition is still going strong, and almost 2.69 million verified users have now moved to the blockchain. Once their liveness checks are confirmed, the following 3 million tentative KYC accounts will be verified.

This relocation is a big step toward true decentralization. It also shows that Pi can enroll a lot of people at once, which is an important step in changing its environment from mobile mining to practical Mainnet adoption with genuine usefulness.

Technical Levels to Watch Heading Into Q4

Traders should keep an eye on $0.2128, $0.2415, and $0.2646 on the upside and $0.20 and $0.18 on the downside. The 200-EMA at $0.244 is still a key resistance level that bulls need to break over in order to change the momentum to a clear positive.

Analysts think that volatility will increase whenever Pi breaks out of its present tight structure, especially if the price goes above $0.217 or below $0.18. Both of these actions might lead to more trading activity and set the next trend in the market.

Pi Network’s Future Hinges on $0.20 Support and Expanding KYC Adoption

The short-term future of Pi Network depends on keeping support over $0.20 and building on the confidence of more users through bulk KYC verification. The rise in verified accounts makes the project’s ecosystem seem more real, which might lead to further debates about listing and more liquidity in the future.

If accumulation keeps on as the ecosystem grows, Pi might have the momentum it needs to turn back to $0.26. But if it can’t hold on to its present base, consolidation might go on longer, leaving traders waiting for a clearer breakout signal until late 2025.