HYPE Rises 20% as Market Defies Exchange Absence

The native token of Hyperliquid, HYPE, is going up. In the previous week, it has gone up more than 20%, bringing its market worth to $12.6 billion. The surge is even more impressive because the coin is not listed on either Binance or Coinbase, which are two of the biggest centralized exchanges in the world.

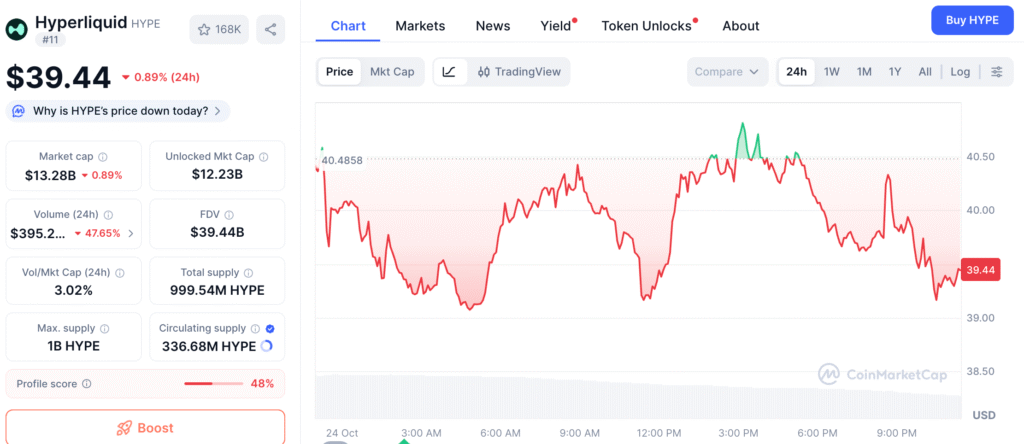

Data from CoinMarketCap shows that HYPE is currently the 11th biggest cryptocurrency, beating the market by four times. This performance shows that people are more and more excited about decentralized perpetual futures markets, which are changing the way people trade.

Hyperliquid Expansion Sparks Investor Optimism

The most recent wave of positive energy comes after news that Hyperliquid is getting ready to raise $1 billion in additional money. A recent filing with the government showed that some of the money would be used to purchase back tokens, while the remainder will be used to hire more people and grow the business.

The move shows that Hyperliquid’s staff is sure of themselves as they speed up expansion in a DeFi sector that is getting more and more competitive. Hyperliquid is one of the best decentralized perpetual futures platforms. It has seen a rise in demand for on-chain trading solutions since regulators put pressure on centralized exchanges.

Perp DEX Volume Surges Past $1 Trillion in October

DeFiLlama says that decentralized perpetual futures markets saw a record-breaking trading volume of over $1 trillion in October. This rapid increase points to a larger move toward trading settings that don’t need trust, as both institutional and ordinary investors look for more open options.

HYPE’s rapid rise fits with this trend, as investors want to become involved with tokens that are connected to actual trading and making money. A lot of traders think that Hyperliquid’s steady performance shows that decentralized exchanges may have the same level of liquidity as regular CEXs.

Recommended Article: Ethereum, HYPE, and MAGACOIN Lead 2025 Watchlist as Momentum Builds

Why HYPE Isn’t Listed on Binance Yet

Binance has not listed HYPE, despite its rapid growth, possibly due to its close relationship with Aster, a competitor in the decentralized futures market. Binance founder Changpeng Zhao believes listing selections are based on business strategy and competition, rather than demand.

He believes that market size and liquidity eventually outweigh competition. As HYPE approaches being one of the top 10 cryptocurrencies, Binance may feel pressure to change its decision, especially if user demand continues to grow.

Coinbase Listing Odds Drop Despite Market Buzz

Coinbase, on the other hand, has likewise refused to list HYPE, even though there is more and more discussion about it. In July, a prediction market contract on Polymarket that tracked whether Coinbase will list the coin by the end of the year indicated an 85% chance. Since then, those chances have dropped to 35%.

Analysts think that Coinbase’s reticence may be because it might have to compete with Hyperliquid’s own USDC exchanges, which are now the largest in the world for trading stablecoins. If Coinbase lists HYPE-USDC, it might compete directly with Hyperliquid.

Strategic Decisions or Missed Opportunities?

HYPE’s performance hasn’t suffered from not having large listings; in fact, it’s made it more appealing as a decentralized success story. Traders think that the token’s rise is proof that real use and good fundamentals can keep growth going even if it isn’t listed on a CEX.

Analysts still think that the price of HYPE might go up sharply again when either Binance or Coinbase registers it, since new money will come in. It is yet unclear when these listings will happen, although they may happen around the same time as the platform’s next big capital round.

HYPE Poised for Continued Growth

The fact that Hyperliquid can grow without help from a centralized exchange shows how the structure of the crypto sector has changed. HYPE seems like it might go much higher because it is worth $12.6 billion, has a daily volume that is going up, and is about to start a $1 billion fundraising campaign.

If the trend keeps going, analysts say that short-term objectives will be between $16 and $20 and that the value might go up much more when a significant listing happens. HYPE’s continuous rise shows that decentralized platforms no longer need centralized clearance to dominate the market. This is a rising fact in crypto.