Chainlink Shows Bearish Breakdown Amid Market Volatility

Chainlink (LINK) is showing renewed weakness after confirming a Head and Shoulders breakdown on the daily timeframe. The move signals a shift from bullish to bearish sentiment, with traders now eyeing $14 as the next critical support level. LINK currently trades around $16.70, reflecting broader market caution and fading upward momentum. Analysts believe a sustained breakdown could lead to deeper corrections before any rebound occurs.

Head And Shoulders Pattern Confirms Trend Reversal

Technical analysts confirm that Chainlink’s pattern breach indicates the completion of a classic reversal formation. Alpha Crypto Signal noted that rising sell volume supports the bearish confirmation following weeks of consolidation. The neckline break, combined with LINK’s position below the 9-day exponential moving average (EMA), reinforces the short-term bearish bias. As long as LINK remains below $18.25, sellers appear to control market direction.

Moving Averages Reinforce Downward Momentum

Chainlink trades below its 50-day simple moving average (SMA), currently near $21.88, further validating the bearish setup. Analysts emphasize that regaining this level would be key to reversing sentiment. Until that happens, traders should expect limited upside movement and possible retests of lower support zones. Price rejection near short-term averages underscores the lack of strong buying conviction among market participants.

Recommended Article: Cardano and Chainlink Poised for Breakouts, But Layer Brett Could Lead Q4

Key Support Zone Emerges Between $13 And $14

The next major support cluster lies between $13 and $14, aligning with both horizontal and ascending trendline supports. This confluence zone could serve as a short-term accumulation area if bearish momentum eases. Historically, Chainlink has shown strong recoveries from this range during prior correction phases. Market observers suggest patient accumulation within this zone could position traders for a potential medium-term rebound.

Analyst Identifies $14 As Strategic Accumulation Point

Market analyst Ali believes the $14 level could become a critical buy zone for long-term investors. His analysis highlights that LINK remains within a multi-year ascending channel, with the current decline nearing its lower boundary. If the price stabilizes here, LINK may start building momentum for a gradual recovery toward $50. Ali’s projection assumes that the token can reclaim resistances at $22 and $28 before targeting the upper channel near $45–$50.

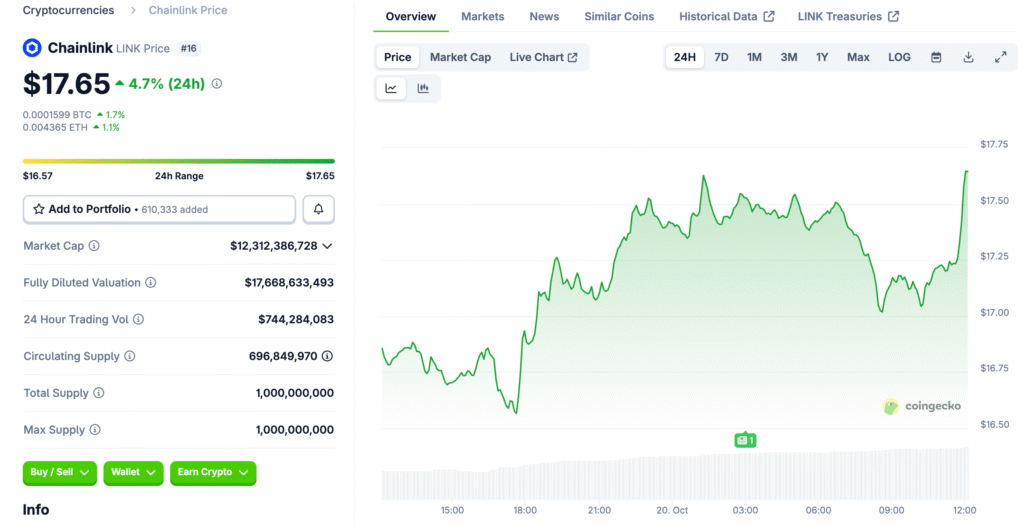

Short-Term Market Performance Reflects Ongoing Caution

At press time, LINK’s price sits at $16.71, marking a 4.33% drop in twenty-four hours with daily volume reaching $1.32 billion. The market capitalization stands at $11.63 billion, maintaining Chainlink’s position among the top altcoins. Intraday fluctuations reveal hesitation as traders await clearer signals from technical indicators. The price action reflects both profit-taking and defensive positioning amid uncertain market sentiment.

Intraday Levels Define Near-Term Outlook

Immediate resistance lies near $17.20, where a breakout could revive short-term bullish sentiment and test the $18 mark. Conversely, a decline below $16.30 could open the door to a retest of $16.00 or even $14.50. Consolidation between $16.60 and $16.80 suggests traders are monitoring these levels for potential reversals. Momentum indicators hint at possible relief if volume re-enters the market during dips.

Broader Market Context And Investor Sentiment

Chainlink’s current decline mirrors the broader correction seen across altcoins following Bitcoin’s recent volatility. While LINK remains technically weak in the short term, its long-term fundamentals continue to attract attention from strategic investors. The network’s growing oracle adoption and DeFi integrations maintain a supportive backdrop for future recovery. For now, traders are advised to monitor $14 closely as the level that could determine the next phase of LINK’s trajectory.

Outlook: Chainlink Faces Crucial Support Test Ahead

As LINK trades below major moving averages, its fate hinges on holding the $14–$15 support region. Failure to defend this level could trigger further downside toward $12, while successful defense may initiate a slow rebound. The next few sessions will likely define whether Chainlink resumes its long-term uptrend or extends its corrective cycle. For now, market participants remain cautious but alert for signs of accumulation and reversal.