Quarterly Candle Turns Red, Bulls See Historical Echoes

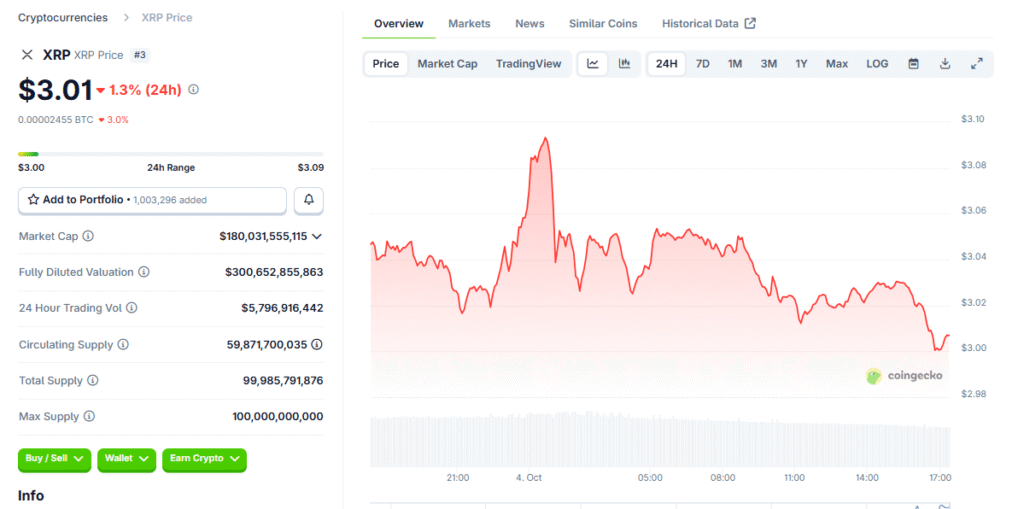

At 7:00 AM on October 2, XRP’s quarterly chart flipped from green to red for the first time since 2017. Some analysts interpret similar shifts as precursors to strong upside acceleration in subsequent quarters.

Following a 28% three‑month surge, momentum watchers view recent softness as a potential final shakeout. Attention is shifting to catalysts that might extend XRP’s longer‑term uptrend.

New Contracts Unlock Passive Income For XRP Holders

Solcravo introduced XRP contracts that allow participants to activate earnings using existing deposits. Users keep their XRP while engaging contracts, avoiding taxable sales and preserving exposure.

Daily wallet payouts simplify cash‑flow planning. The model replaces hardware commitments with a software‑first approach tailored for flexible participation.

Recommended Article: XRP Regulatory Clarity Fuels New Financial Strategies And Payroll Growth

Simple Onboarding And Flexible Options

Getting started involves creating an account, selecting a contract, and activating with XRP balances. A $15 sign‑up bonus sweetens onboarding for first‑time users exploring the platform.

Contract tiers range from Starter and Entry‑Level to Basic and Premium, plus Prime and Quantum for higher‑capacity participants. Durations and thresholds vary to match different risk profiles and time horizons.

Compliance, Transparency, And Multi‑Asset Support

Solcravo highlights a UK headquarters, claiming adherence to local and international standards. Transactions and fund flows are designed to be traceable, emphasizing transparent operations.

Security measures include Cloudflare protection, EV SSL encryption, and multi‑factor authentication. Beyond XRP, supported deposits include USDT, BTC, ETH, BNB, LTC, and SOL.

Who Might These Contracts Suit?

XRP holders seeking yield without selling principal may find the structure appealing. The approach suits users preferring hands‑off participation versus running equipment or complex strategies.

Investors should still assess counterparty risk, contract terms, and jurisdictional rules. Due diligence remains essential when evaluating third‑party platforms promising daily returns.

Market Context: Momentum And Uncertainty

XRP’s growing attention reflects renewed interest in payment‑focused crypto infrastructure. Yet price volatility and regulatory variability remain perennial considerations for treasury planning.

Yield products can complement holdings but are not substitutes for risk management. Position sizing and diversification help align returns with tolerance and objectives.

Bottom Line: Utility‑Driven Yield With Caveats

Solcravo’s contracts add an option for XRP holders to monetize idle balances. Friction‑light onboarding and tiered products broaden accessibility across experience levels.

As with any yield program, transparency and compliance are paramount. Thorough evaluation helps participants align potential income with prudent safeguards.