Kaspa Starts the Week with a Quiet Market

Kaspa started the new trading week showing quiet but strong strength after days of steady downward pressure. Traders saw new buying interest forming around support levels, which could mean that bullish momentum is about to pick up.

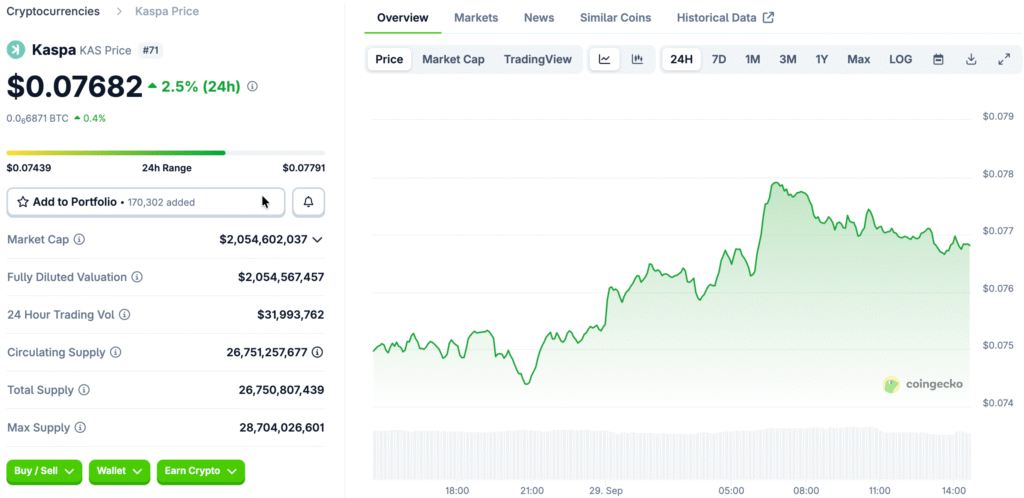

The price of the token went up a little and settled around $0.077 while traders looked for possible breakout opportunities. Buyers are still defending important areas, showing that they are determined to stabilize price action before making a big move up.

Important Parts of Chart Structure: Important Price Levels

Kaspa’s 4-hour chart shows a slow downward trend that has been going on since early September, with consistently lower highs over several sessions. The price has dropped from highs near $0.096 and is slowly moving toward a key support level.

A floor near $0.0727 has been a key defense zone, drawing in buyers who step in to take on selling pressure. These reactions show how important this support level is for keeping things stable and stopping bigger drops.

Momentum Builds Around Critical Support Zone

Recent candles show a small recovery from $0.073, which means that the market is starting to stabilize as people’s feelings about it change. Kaspa’s price is now just below a short-term resistance level between $0.080 and $0.082, which is an important level for breaking out.

If bulls can keep going up and challenge this ceiling, momentum could quickly pick up and push prices into the mid-$0.08 range. On the other hand, if $0.075 support doesn’t hold, there could be more selling pressure and weakness in the short term.

Recommended Article: Kaspa Emerges as Fastest Proof of Work Blockchain in 2025

Market Indicators Show Neutral to Bullish Signals

Momentum indicators like the RSI are rising from oversold levels and are now between 46 and 58, which shows that sentiment is getting better. If prices go up again, it could mean that bullish momentum is getting stronger and lead to more aggressive buying.

Open interest stays steady at about $520 million, which shows that people are still trading derivatives without taking on too much risk. This stability makes it less likely that there will be sudden liquidations and helps a controlled price recovery scenario if buyers gain ground.

Shorts and Longs Reflect Balanced Market Positioning

Net shorts are about $358 million and net longs are about $270 million, which means there is no clear directional bias. This balanced positioning suggests that traders are waiting for confirmation before putting a lot of money into the market.

This kind of balance often happens before big market moves, when volatility goes down and traders get ready for breakout opportunities. Keeping a close eye on these levels can give you useful information about where prices might go in the short term.

Short-Term Outlook Targets $0.084 Resistance Range

Kaspa’s short-term goal is to keep support between $0.075 and $0.077 during today’s session. If prices break out above $0.080, they could move toward the $0.084–$0.086 range that was hit earlier this month.

If $0.072 isn’t defended, it will probably make people feel bearish, which will open up lower ranges near $0.070 and signal that prices will keep going down. Traders are still on the lookout as prices stay close to important levels and technical indicators become more and more positive.

Kaspa Traders Watch Resistance Breakout to Confirm Bullish Momentum

Market sentiment is cautiously positive, thanks to rising RSI values, strong open interest, and a stable support base. These things together suggest that buyers may slowly start to take back control after weeks of selling pressure.

A clean breakout above resistance could confirm bullish expectations and change the short-term momentum in a big way. Kaspa is still stuck in a range, and both bulls and bears are carefully watching the price structure for signs of confirmation.