Ethereum Recovery Begins With Strong Support Levels

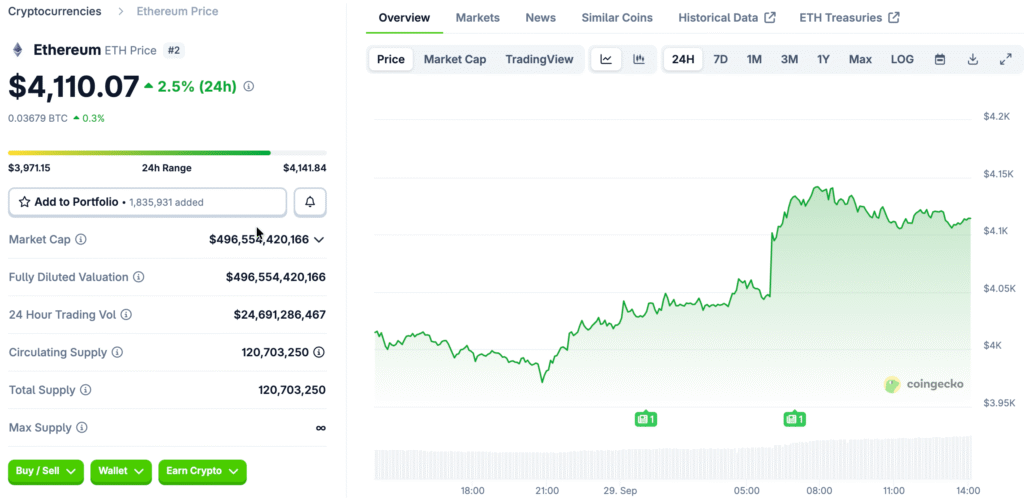

Ethereum started to rise again above $4,050 after staying stable around $3,820 during the last downturn. Buyers strongly defended important support levels, which made people feel better about Ethereum’s short-term price potential and possible upward momentum in the future.

The cryptocurrency broke through some important resistance levels, which suggests that the market is slowly becoming more bullish. Traders saw more people interested in buying, which could mean that Ethereum is getting ready for another big push against resistance.

Breaking Key Resistance Triggers Bullish Momentum

Ethereum broke above a bearish trend line at $4,000, which sent prices up and got a lot of traders excited about the bull market. This big breakout got the attention of both short-term traders who were looking to make a quick profit and long-term strategic investors.

The price went above the 50% Fibonacci retracement level, which is between $4,275 and $3,826. This was a big technical milestone for bullish traders. Momentum indicators now show that Ethereum’s rise could continue if prices stay stable above the $4,170 resistance level.

Resistance Levels Could Decide Rally Strength

Resistance levels close to $4,150 and $4,170 will decide where Ethereum goes in the short term as it tries to recover. Traders see these levels as important signs of whether this rally is real or not.

If Ethereum breaks out above $4,200, it could go up to $4,250 and then $4,350 in a bullish continuation. If these important resistance levels aren’t broken, the market could go back into consolidation or bearish reversals, which would test its conviction.

Recommended Article: Ethereum Co Founder Jeffrey Wilcke Fuels ETH Speculation

Possible Price Targets for Ethereum Bulls

Analysts say that if Ethereum breaks through the $4,200 resistance level, it could rise to between $4,250 and $4,350 in the next few sessions. These targets are in line with previous swing highs and Fibonacci retracement extensions, which makes active traders more likely to think the market will go up.

Traders who want to make quick money and directional confirmation signals might be interested in a breakout like this. It could also boost the overall mood of the market, which would bring in more money to Ethereum and help it keep going up.

Downside Risks Remain Despite Bounce

Ethereum still has some big downside risks if it can’t keep support levels above $4,050 during times of high volatility. If the price breaks below this level, it could speed up selling and completely change the bullish structure that is forming right now.

If prices drop below $4,000 again, they could go down to $3,920 or even $3,820 before they start to rise again. Bears are still in a strong position near resistance levels, ready to take advantage of any weaknesses that show up and turn the market’s momentum downward.

Technical Indicators Provide Mixed Signals

The hourly MACD shows that bullish momentum is fading, which could mean that the rally is running out of steam without more trading. Traders are still being careful because technical signals haven’t yet confirmed that the market will keep going up.

At the same time, RSI readings are just above 50, which means that the overall mood is neutral to bullish. Before taking bigger directional positions with confidence, people in the market are waiting for confirmation signals like big volume surges or decisive breaks of resistance.

Ethereum Recovery Faces Key Tests as Market Sentiment Stays Cautious

Market sentiment is still cautiously optimistic as Ethereum tries to stay in its recovery phase above important technical levels. Traders are keeping an eye on ETF updates and macroeconomic factors, hoping that these will soon affect how people feel about crypto in general.

Overall, institutional interest is still strong, but retail investors are still a little hesitant because of past patterns of volatility. Ethereum’s ability to turn this recovery into a long-term rally depends a lot on technical follow-through and new outside factors.