Dogecoin Momentum Could Build Further If Support Holds at Low RSI Levels

Dogecoin’s monthly RSI shows clear phases of accumulation, holding, and selling that happened before big price rises in the past. Analysts look closely at these patterns to find possible breakout points that are like those in past cycles.

In the past, the accumulation phase happened during quiet trading times and low RSI levels, which set the stage for future rallies. The RSI is still below the selling zone, which means that upward momentum may continue if support holds.

Historical Data Signals Strong Momentum Potential

Historical data shows that the RSI pattern has always predicted big price changes during past bull cycles. Traders use these insights to guess when the next rally will happen by looking at how similar structures have behaved in the past.

The RSI for DOGE is steadily rising, but it hasn’t yet reached the very high levels seen during previous rallies. If the mood in the market improves, this could open up a chance for more growth.

Breakout Pattern Resembles 2015–2017 Cycle

The way DOGE’s price has changed is similar to how it did from 2015 to 2017, when it built a base before breaking through important resistance levels. Analysts think this is a strong bullish sign that something similar could happen in the future.

The current breakout pattern looks like past resistance zones and consolidation patterns that came before long-term uptrends. Traders think that doing this setup again could start another huge rally.

Recommended Article: Dogecoin Rally Without Retail Investors May Be Bullish for Growth

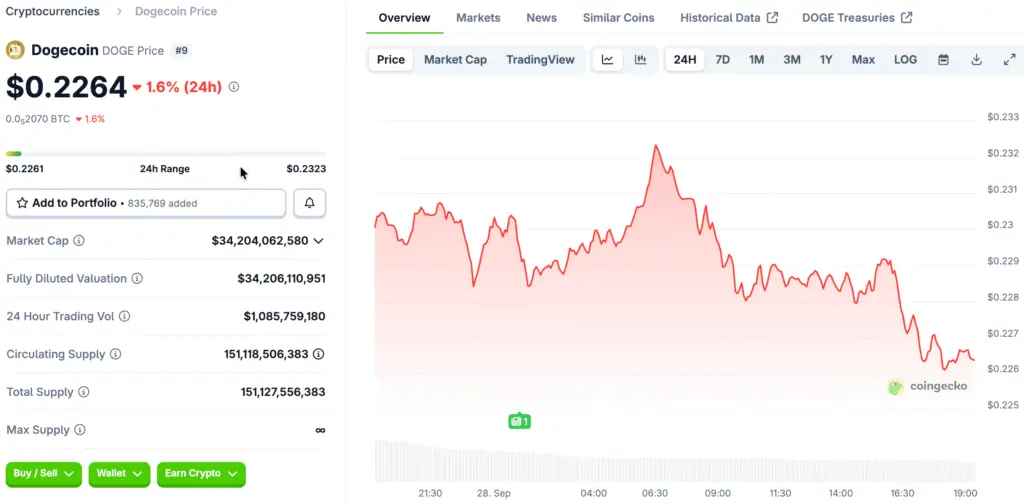

The Key $0.22 Support Level Holds Strategic Importance

The $0.22 support level is in line with important Fibonacci retracement levels and the lower boundaries of triangle patterns. To keep the bullish structure and stop bearish reversals, this support must be kept.

If DOGE stays above $0.22, it might stay there for a while before moving up to higher resistance levels. If this zone breaks down, losses could last longer and go down to $0.20 or lower.

Analysts Stress the Importance of Consolidation Before the Next Move

Analysts say that DOGE could stay in its current rising triangle for a while before trying to break out again. Traders can use this time to figure out how strong support is and get ready for moves in a certain direction.

Consolidation phases often come before big increases in volatility, which gives traders a chance to build up their positions. It is very important to keep the structure stable during this phase in order to keep the bullish momentum going.

Technical Indicators Support Gradual Uptrend

DOGE is trading above both the 200-day EMA and the 200-day MA, which means that the underlying trend is strong. Analysts say that this technical alignment is good for prices in the medium term.

Higher lows since April 2025 support the uptrend, even though there have been some recent dips. For DOGE to keep its momentum going and get more people to buy, it will be important to keep these levels.

Dogecoin Traders Track Whale Activity and Market Trends for Breakouts

If RSI keeps going up and support stays strong, Dogecoin may see even more bullish sentiment. This could cause a sharp rise, like what happened during previous breakout phases.

Traders use changes in sentiment, patterns of whale accumulation, and general trends in the crypto market to figure out when to break out. These factors coming together could start a new bullish cycle for DOGE.